Featured

New Tax Rates

You find that this amount of 2020 falls in the At least 2000 but less than 2025 range. Surcharge is levied on the amount of income-tax at following rates if total income of an assessee exceeds specified limits- Rate of Surcharge Assessment Year 2021-22 Assessment Year 2020-21.

Colorado Progressives Have A New Target In Their Pursuit Of A Tax Overhaul The Rich Here S Why

Colorado Progressives Have A New Target In Their Pursuit Of A Tax Overhaul The Rich Here S Why

If we approve your application well let you know what your tailored tax rate is.

New tax rates. Most taxpayers pay a maximum 15 rate but a 20 tax rate applies if your taxable income exceeds the thresholds set for the 37 ordinary tax rate. Express Web Desk. Jan 04 2021 Updates Web Admin.

Tax rate Taxable income Tax rate Taxable income Tax rate. In changes announced in Budget 2020 on 6 October 2020 the 1 July 2022 adjustments were brought forward to apply from 1. 19 for amounts over 18200.

The rates were modified rates to lift the 325 rate ceiling from 87000 to 90000 in the 4 years from 1 July 2018 to 30 June 2022 with further adjustments from 1 July 2022 and 2024. New KRA PAYE tax rates 2021. As amended by Finance Act 2020 Surcharge.

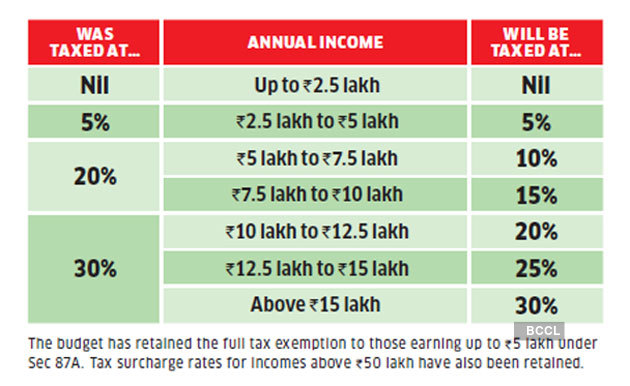

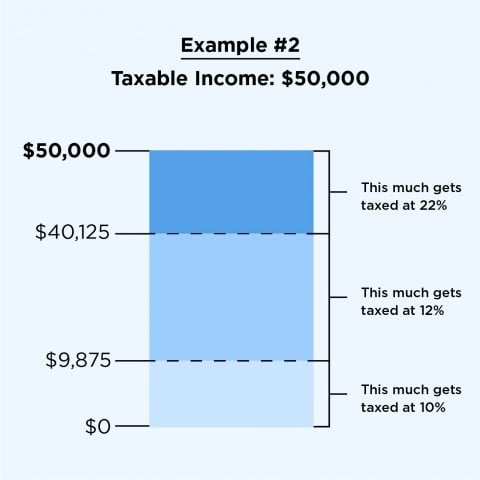

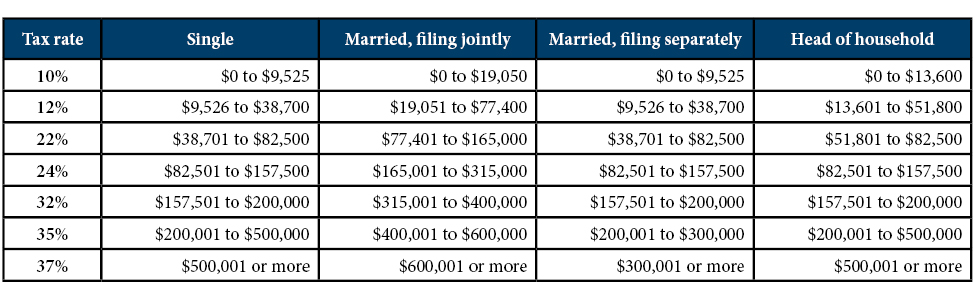

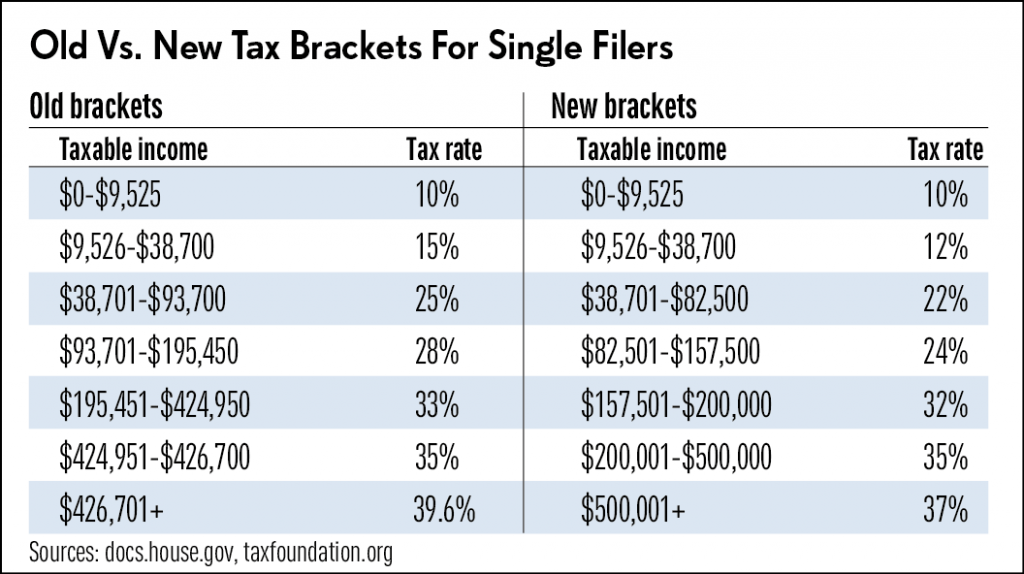

10 12 22 24 32 35 and 37. Under the new tax rates there will be 10 tax levied for incomes between 5-75 lakh per annum 15 for 75-10 lakh per annum bracket 20 for 10-125 lakh per annum 25 tax for income between 125 lakh to 15 lakh 30 tax for income above 15 lakh. There are seven federal tax brackets for the 2020 tax year.

Your tax bracket depends on your taxable income and. If the tax proposals are passed then these new tax slabs will be applicable from 1st April 2020 to 31st March 2021 and after Budget 2021 announcements from 1st April 2021 to 31st March 2022. Schedular payment tax rates.

19 for amounts over 18200. Tailored tax rates for salary wages and pensions. More from Smart Tax.

Now use the 2021 income tax withholding tables to find which bracket 2020 falls under for a single worker who is paid biweekly. Tax Law Amendment act No 2 of 2020 was published on Dec 24th 2020. Nil 250001 - 500000.

You need to apply for a tailored tax code first. Using the chart you find that the. Consequently there are changes to the monthly PAYE tax bands issued for COVID19 relief.

For the 202122 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to shrink once earnings hit 100000. Income Tax Slab Tax rates as per new regime Tax rates as per old regime 0 - 250000. Other vehicle tax rates Cars registered on or after 1 April 2017 You need to pay tax when the vehicle is first registered this covers the vehicle for 12 months.

19 for amounts over 18200. 3572 325 for amounts over 37000. Your bracket depends on your taxable income and.

Exceptions also apply for art collectibles and. 5 500001 - 750000 12500 10 of total income exceeding 500000 12500 20 of total income exceeding 500000 750001 - 1000000 37500 15 of total income exceeding 750000. For 2021 the top tax rate of 37 will apply to individual taxpayers with income over 523600 628300 for married filing jointly.

Click here for 2020s tax brackets. You can get a tailored tax rate for income you get from. There are seven tax brackets for most ordinary income.

24 pence for both tax and National Insurance purposes and for all business miles Cycle 20 pence for both tax and National Insurance purposes and for all business miles. Below are the new monthly tax bands effective January 2021. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

10 Surcharge applicable if income Rs 50 lac and 15 if income Rs 1 Cr.

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

Tax Season 2021 New Income Tax Rates Brackets And The Most Important Irs Forms

Tax Season 2021 New Income Tax Rates Brackets And The Most Important Irs Forms

Expat Tax Guide 2019 Global Times

New Income Tax Slabs Will You Gain By Switching To New Regime The Economic Times

New Income Tax Slabs Will You Gain By Switching To New Regime The Economic Times

Old Vs New Tax Regime Here S All You Need To Know The Hindu Businessline

State Income Tax Rates And Brackets 2021 Tax Foundation

State Income Tax Rates And Brackets 2021 Tax Foundation

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

The New Tax Law What You Need To Know Finemark Bank Finemark Bank

The New Tax Law What You Need To Know Finemark Bank Finemark Bank

Income Tax Slab 2020 New Lower Income Tax Rates Are Optional What It Means India Business News Times Of India

Income Tax Slab 2020 New Lower Income Tax Rates Are Optional What It Means India Business News Times Of India

4 Things To Know About The New U S Tax Law Stock Sector

2018 Tax Rates Do You Know Your New Tax Bracket Freidel Associates Llc

2018 Tax Rates Do You Know Your New Tax Bracket Freidel Associates Llc

How Much Do People Pay In Taxes Tax Foundation

How Much Do People Pay In Taxes Tax Foundation

Comments

Post a Comment