Featured

How Does Irs Audit Work

When the IRS detects an anomaly on a tax return it sends a notice to the taxpayer who must mail back documentation that supports her claim. If a tax return receives an unusually high score it may indicate that there is a problem with the return which will likely lead to an IRS audit unless the issue is promptly resolved.

What Is A Cp05 Letter From The Irs And What Should I Do

What Is A Cp05 Letter From The Irs And What Should I Do

An audit occurs when the Internal Revenue Service selects your income tax return for review.

How does irs audit work. We wont initiate an audit by telephone. The goal of an audit is to ensure that you have reported everything properly and paid the correct amount of tax. Since most audits occur after the IRS issues refunds you will.

Learn how the IRS audit works now on The List. One of the first things the IRS will request in an IRS audit is the receipts. This can happen at the IRS office the taxpayers business the office of the accountant of.

The IRS manages audits either by mail or through an in-person interview to review your records. How will the IRS conduct my audit. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features 2021 Google LLC.

These receipts need to back up the numbers you inputted into your personal or business tax return. Decisions to conduct audits are based on the financial information thats on or not on the tax return. Fraudsters will try and use an IRS audit to steal your personal information like your bank account details and your Social Security number.

The interview may be at an IRS office office audit or at the taxpayers home place of business or accountants office field audit. The IRS may want to interview you in person regarding specific items on your return. The field audit is what most taxpayers think of when they think of an IRS audit.

Through email or a phone call theyll claim to be an IRS representative. The IRS will provide all contact information and. The IRS will always inform you of an audit with a physical letter through the United States Postal Service USPS.

Prepare Your Business for Tax Time Reduce the risk and get the tools you need. The EITC is a refundable tax credit that increases with the number of child dependents you have. As the name suggests a correspondence audit is conducted through the mail.

Tax audits are a critical compliance tool to help ensure fairness in the tax system and the IRS works hard to ensure the agencys audit selection process is fair and impartial. The purpose of innocent spouse relief is to request that the IRS remove your liability for additional taxes penalties and interest owed on income your spouse did not report on your joint tax return taxes not paid to the IRS because of your spouses business or other activities that resulted in additional tax about which you were not aware. An IRS audit is a scrutiny of an individuals or organizations tax records and financial information to make sure that the tax amount and information reported is accurate.

An IRS audit aims to make sure financial information is reported correctly according to the current tax laws. Claiming the Earned Income Tax Credit is something of an automatic audit trigger but you probably wont even know that the IRS is reviewing your return. Typically the IRS wants to verify the amount of income and deductible expenses youve reported is accurate.

This is an audit where an IRS agent comes to your home your place of business if youre the owner or your. An agent typically conducts the audit using letters and phone calls to work with the officers or a representative of the organization where an entity is being audit or with a taxpayer directly. Remember you will be contacted initially by mail.

It also means low-income taxpayers are more likely to. Sometimes this audit can occur years after you filed your return however they are typically conducted within a few months of filing. The letter will have instructions for.

As is true of other types of audits a correspondence audit is generally initiated because the IRS or State of California needs to verify information that a taxpayer has supplied on his or her tax return. During the audit the IRS will analyze your return and supporting documentation to ensure that all entries are accurate. Poor taxpayers or those earning less than 25000 annually have an audit rate of 069 more than 50 higher than the overall audit rate.

As the IRS notes A correspondence audit is relatively limited in scope. There are income limits for qualifying as well. The IRS uses DIF computer scoring to evaluate all personal and some corporate tax returns according to Publication 556.

How Do IRS Audits Work. Theres an extensive set of checks and balances to ensure fairness with individual audits and there are important protections and appeals for. What is a correspondence audit.

An IRS audit is when the IRS reviews your finances to ensure that everything on your federal income tax return was correct. In the field audit the IRS reviews detailed financial transactions of the taxpayer. The IRS will never notify you of an audit through a phone call or email.

The IRS always issues an audit via mail. If she cant she must pay more tax or lose a tax credit.

What Is A Cp05 Letter From The Irs And What Should I Do

What Is A Cp05 Letter From The Irs And What Should I Do

Irs Audit Letter 4870 Sample 1

Irs Audit Letter Cp05 Sample 1

I M Being What What Does It Mean To Be Audited By The Irs Fidelity Tax Relief

I M Being What What Does It Mean To Be Audited By The Irs Fidelity Tax Relief

How Irs Audits Actually Work Scalefactor

How Irs Audits Actually Work Scalefactor

Tax Audit Types How Does An Irs Audit Work David W Klasing

Tax Audit Types How Does An Irs Audit Work David W Klasing

Avoid Mistakes On Tax Returns To Lower Risks Of An Irs Audit

Avoid Mistakes On Tax Returns To Lower Risks Of An Irs Audit

Irs Audit Letter 531 T Sample 1

Irs Audit Letter 3572 Sample 5

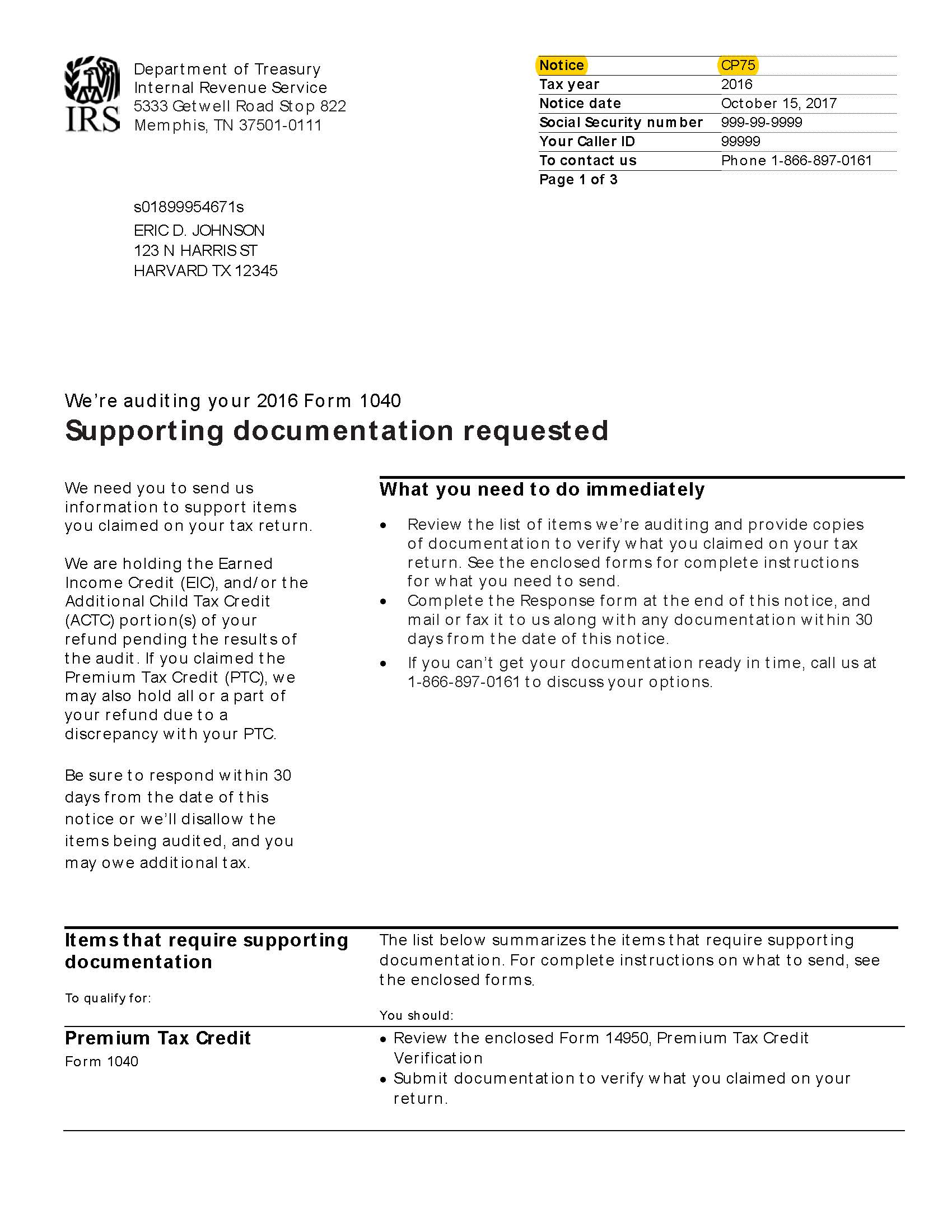

Audit Notice Cp75 Cp75a D Steps To Answer Respond

Audit Notice Cp75 Cp75a D Steps To Answer Respond

7 Reasons The Irs Will Audit You Nerdwallet

7 Reasons The Irs Will Audit You Nerdwallet

What Do You Do When An Irs Audit Letter Arrives

What Do You Do When An Irs Audit Letter Arrives

/GettyImages-1041512864-ea5f0f216e9f4f77850e4576541d2cdf.jpg)

Comments

Post a Comment