Featured

Debt To Income Ratio Fha

The debt to income ratio is a calculation your lender is required to make by taking your verifiable income compared to your total monthly financial obligations. Which Is Higher Proper Now.

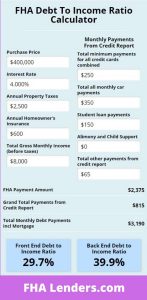

2021 Fha Debt To Income Ratio Requirements Calculator Fha Lenders

2021 Fha Debt To Income Ratio Requirements Calculator Fha Lenders

The maximum front end debt to income ratio cap on FHA borrowers with at least a 620 credit score is 469 DTI.

Debt to income ratio fha. Using this data the bank and the FHA calculate the borrowers debt-to-income ratio. Your monthly debt payments would be as follows. How much can that ratio be.

PNC Financial institution Mortgage Opinions Scores Prime 10 Finest Mortgage Lenders of 2021 APY Calculator to Calculate Efficient Annual Price 5 Benefits of Making a Down Cost on a VA Mortgage Flagstar Bancorp Beats. FHA Guidelines On Debt To Income Ratio Caps. These are the ratios required to get an approveeligible per Automated.

The debt-to-income ratio is calculated with and without your proposed mortgage payment-doing so is required by FHA loan rules to make sure a potential borrower can afford the new FHA mortgage loan payments. Lenders consider your debt-to-income ratio when evaluating your profile to give you the loan. The standard manual FHA debt to income ratio limit is 43.

The current 2019 limits for FHA debt-to-income ratios are 31 for housing-related debt and 43 for total debt. Department of Housing and Urban Development which runs the FHA. 1200 400 400 2000.

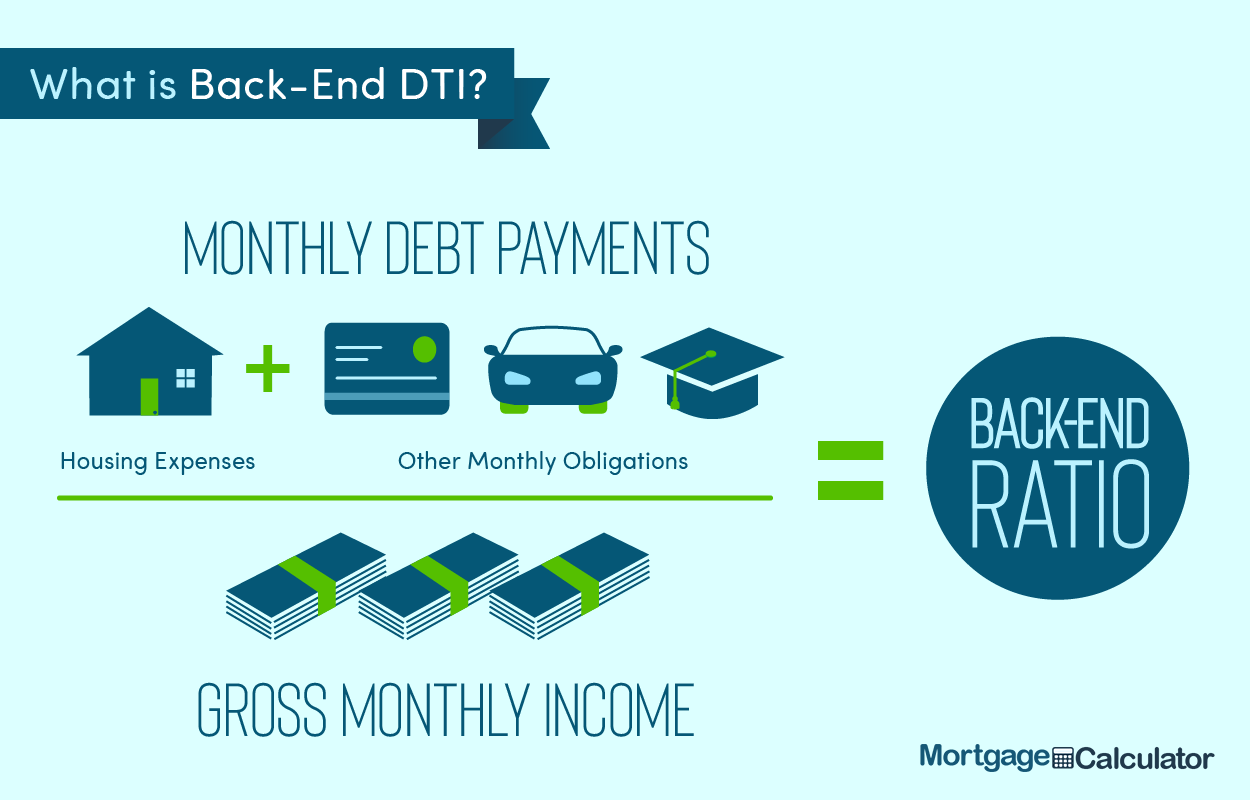

Your gross income is before taxes and deductions for items like health insurance and 401k contributions. The debt-to-income ratio refers to the minimum payment on all recurring debt such as your mortgage payment car loan credit cards and student loans compared with your monthly gross income. Manually underwritten FHA loans allow for a front-end maximum of 31 and back-end maximum of 43.

FHA will allow up to 569 back end maximum back end debt to income ratio cap for borrowers who have a credit score of at least 620 credit score. The maximum debt-to-income ratio for FHA loans is 55 when using an Automated Underwriting System AUS but may be higher in some cases. FHA loan limits are pegged to 115 of the median home price in a given area and theyre usually set according to county.

This is required when you are lent a. But there are exceptions to these general rules. This holds true even though FHA allows debt to income ratios up to 569 DTI for borrowers with credit scores of at least 620 or higher.

Debt-to-Revenue DTI Ratio Definition Company Reporting Season What to Count on. For 2021 FHA loan limits range from 356362 to 822375 for a single-family home and higher sometimes much higher for 2-4 unit homes. I is for Income.

Lenders can limit maximum debt to income ratio at a 55 DTI cap although FHA permits DTI up to 569 DTI. FHA has a maximum debt-to-income ratios of 3143 meaning the monthly housing payments should not exceed 31 of the borrowers gross income and the total debts should not exceed 43 of the gross income. Gross income is typically your annual salary plus bonuses.

The conventional loan requires you to maintain a debt to income rate of 43 which means your debt does not exceed more than 43 of your monthly gross income. An FHA Debt-to-Income DTI ratio is the percentage of the income of somebody that is used with an intention to cover his or her recurring debts. Some lenders will cap DTI at 45 up to a 680 credit score and may cap DTI to 55 over 680 Credit Scores.

So dont be discouraged if youre slightly above those numbers. FHA Debt-to-Income Ratio Requirement Debt-to-income ratio DTI is your monthly debt payments which can include student loans credit cards mortgages and other types of. This means the total monthly debt payments may not exceed 43 of the calculated income.

Monthly debt divided by monthly gross income results in your debt-to-income ratio. The FHA requires a debt-to-income ratio of 50 or less according to Brian Sullivan public affairs specialist for the US. According to the FHA official site The FHA allows you to use 31 of your income towards housing costs and 43 towards housing expenses and other long-term debt Those percentages should be examined side-by-side with the debt-to-income requirements of a conventional home loan.

However if you are considering getting the FHA loan you are eligible for the loan with a. If your gross income for the month is 6000 your debt-to-income ratio would be.

Fha Debt To Income Ratio For A Mortgage In 2020 Make Finance Simple

Fha Debt To Income Ratio For A Mortgage In 2020 Make Finance Simple

How Debt Burden Affects Fha Mortgage Repayment In Six Charts Urban Institute

How Debt Burden Affects Fha Mortgage Repayment In Six Charts Urban Institute

2021 Fha Debt To Income Ratio Requirements Calculator Fha Lenders

2021 Fha Debt To Income Ratio Requirements Calculator Fha Lenders

Fha Debt To Income Dti Ratio Requirements 2019

Fha Debt To Income Ratios Youtube

Fha Debt To Income Ratios Youtube

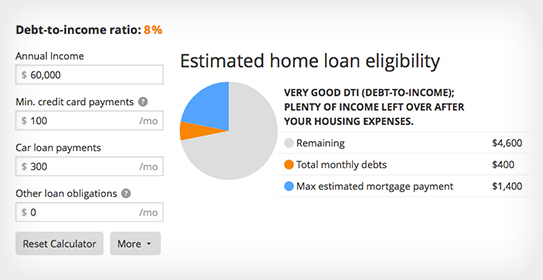

Debt To Income Ratio Calculator What Is My Dti Zillow

Debt To Income Ratio Calculator What Is My Dti Zillow

Debt To Income Ratio Dti Limits For 2014 Fha Conventional And Qm

Fha Debt Ratios Are Not Always Set In Stone Hbi Blog

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

What Is Debt To Income Ratio How Do I Calculate My Dti

What Is Debt To Income Ratio How Do I Calculate My Dti

Fha Debt To Income Calculator Debt To Income Ratio Fha Loans Real Estate Advice

Fha Debt To Income Calculator Debt To Income Ratio Fha Loans Real Estate Advice

Fha Debt To Income Ratio Requirements

Fha Debt To Income Ratio Requirements

Fha Vs Conventional Choosing Which Loan Is Best For You

Fha Vs Conventional Choosing Which Loan Is Best For You

Comments

Post a Comment