Featured

Conventional Mortgage Loan Limits

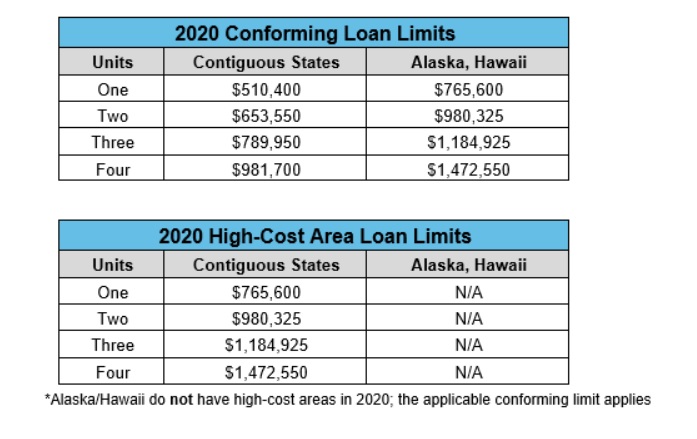

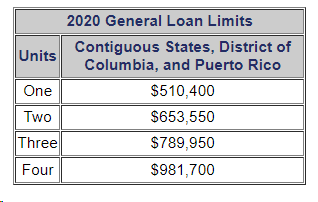

A qualifying refinance applicant can open a loan for at least this amount anywhere in the country. In 2020 the limit is 510400.

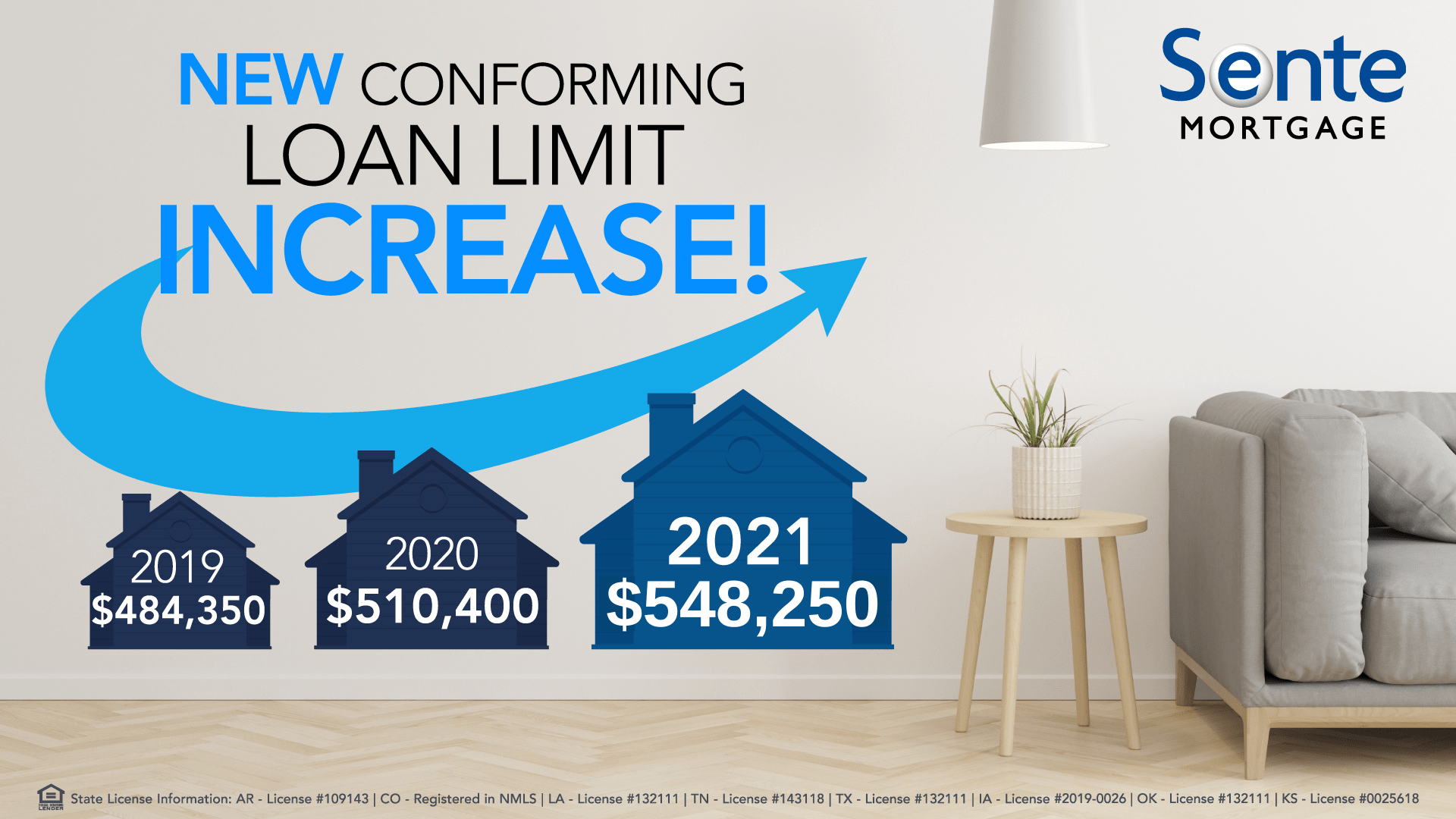

New Conforming Loan Limits Set At 548 250 For 2021 Sente Mortgage

New Conforming Loan Limits Set At 548 250 For 2021 Sente Mortgage

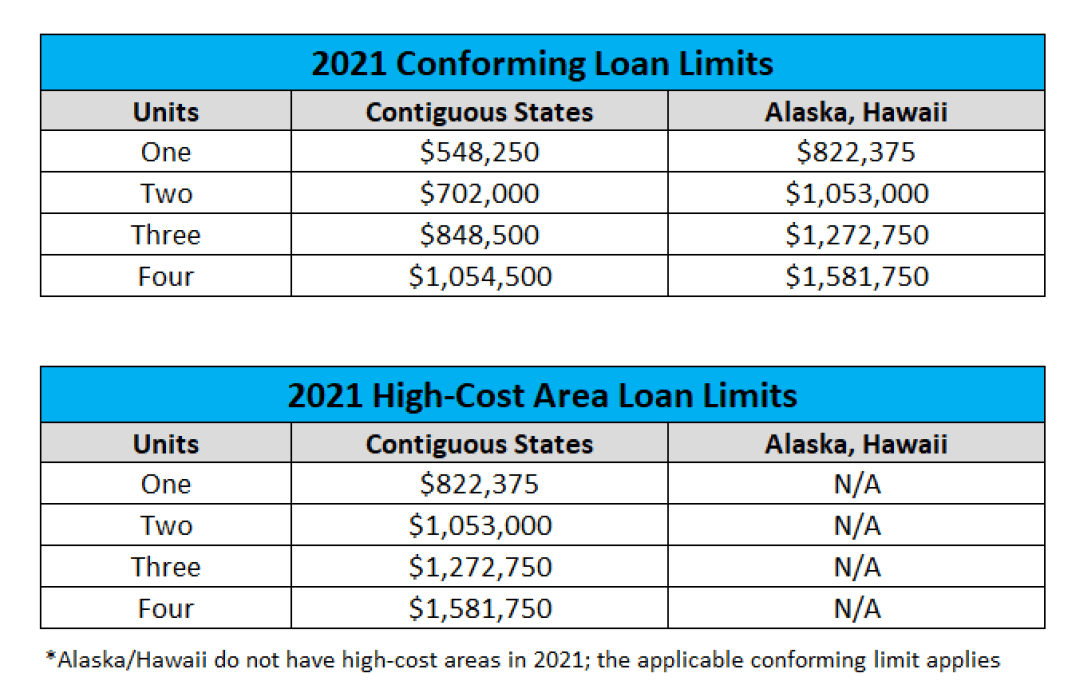

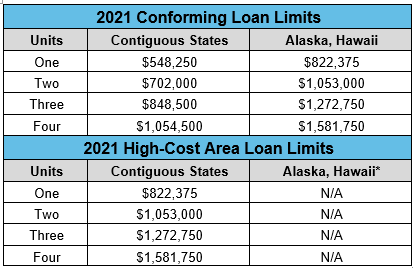

These include general and high-cost area loan limits.

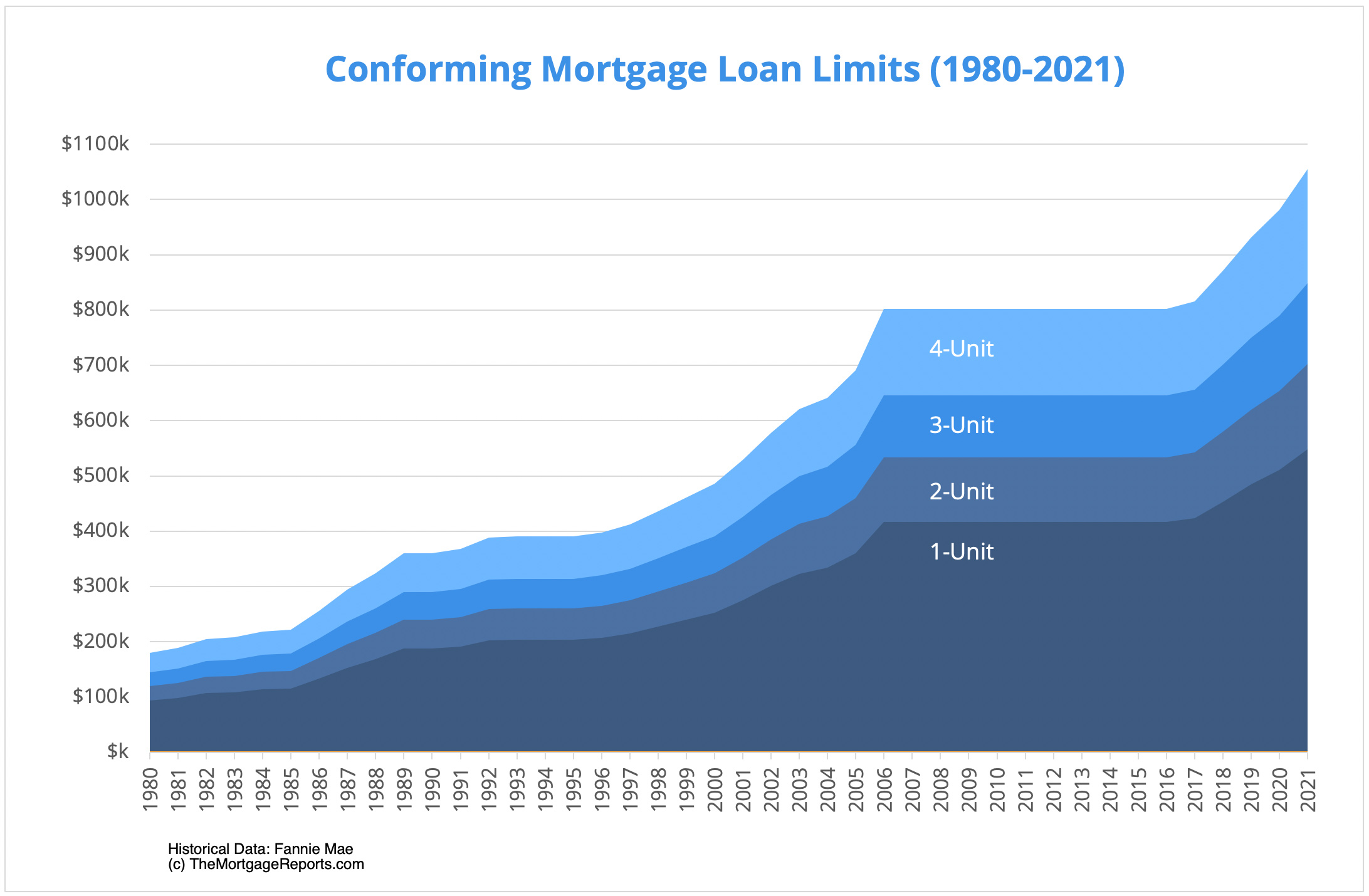

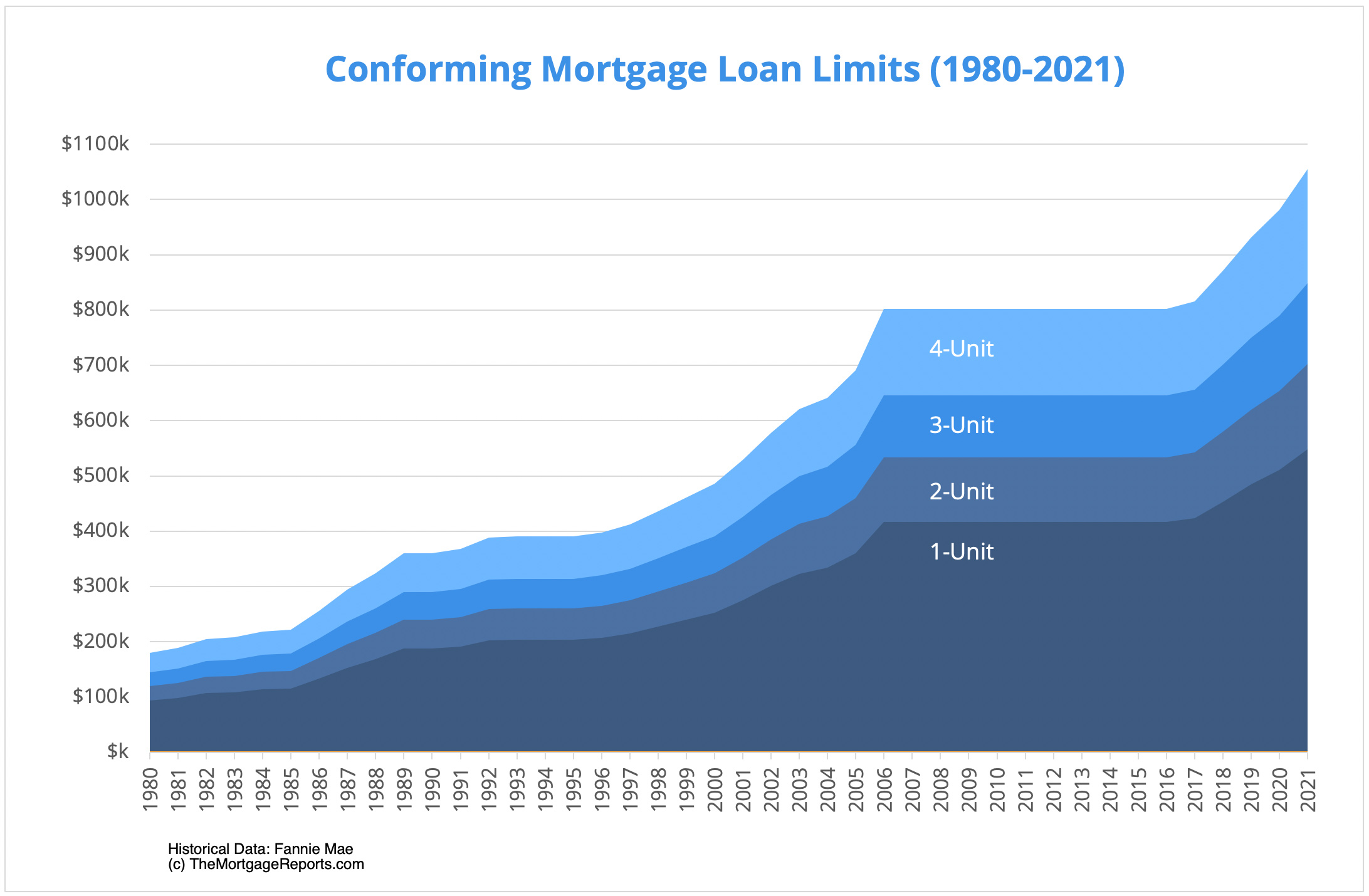

Conventional mortgage loan limits. These are called conventional loan limits or sometimes conforming loan limits In most parts of the country conventional loan limits top out at over 500000. On November 24 2020 the Federal Housing Finance Agency FHFA raised the 2021 conforming loan limit on single family homes from 510400 to 548250 - an increase of 37850 or 742. Will be 548250 an increase from the 2020 cap of 510400.

For a conforming conventional loan your loan must fall within the loan limits set by Fannie Mae and Freddie Mac. 2021 Conventional Loan Limits The standard conventional loan limit is 548250. General Loan Limits for 2021.

The Federal Housing Finance Agency FHFA publishes annual conforming loan limits that apply to all conventional mortgages delivered to Fannie Mae. Enter your zip code to see the loan. Youll notice that most counties within California have a 2021 conforming loan limit of 548250 for a single-family home.

Conventional home loans require the home buyer to invest between 3 and 20 of the sales price towards the down payment and closing costs. Conventional Loan Limits in Philadelphia County are 548250 for 1 living-unit homes to 1054500 for 4 living-units. More expensive markets such as New York City and San Francisco have conforming loan limits as high as 822375.

The Federal Housing Finance Agency FHFA publishes annual conforming loan limits that apply to all conventional mortgages varying by geographic location. The Federal Housing Finance Agency FHFA today announced the maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2021. So most home buyers will be well under the limit.

If the sales price is 100000 for example the mortgage applicant must invest at least 3000 20000 to meet conventional mortgage down payment requirements depending on the program. Anything above these maximum amounts would be considered a jumbo mortgage. Conventional loan limits can be.

The loan limit changes annually. 68 Zeilen Conventional minimum loan limits are set nationwide. Higher-priced areas like those in the San Francisco Bay Area have conventional limits of up to 822375 due to higher home values.

In 2021 the baseline loan limit for most counties across the US. In 2021 its 548250. High-cost areas vary by geographic location.

The 2021 Home Equity Conversion Mortgage HECM limits in Philadelphia County is 822375. Current Conforming Loan Limits. That rate is the baseline limit for areas of.

Other counties fall somewhere in between these floor and ceiling amounts. Most conventional mortgages come with caps on the possible loan amount. But Fannie and Freddie allow higher limits in some areas.

In most of the US the 2021 maximum conforming loan limit CLL for one-unit properties will be 548250 an increase from 510400 in 2020. HECM limit does not depend on the size of.

Conventional Loan Limits For 2020 Remn Wholesale A Division Of Homebridge Financial Services

Conventional Loan Limits For 2020 Remn Wholesale A Division Of Homebridge Financial Services

Conforming Loan Limits Conventional Loan Limits 2020

Conforming Loan Limits Conventional Loan Limits 2020

2020 Conforming Loan Limits Zoom Past 500k Infographic

2020 Conforming Loan Limits Zoom Past 500k Infographic

What Is A Conventional Loan 2021 Rates And Requirements

What Is A Conventional Loan 2021 Rates And Requirements

Higher Conforming Loan Limits In 2021 Good News For Buyers Owners

Higher Conforming Loan Limits In 2021 Good News For Buyers Owners

2019 Conforming Loan Limits For 1 2 3 And 4 Unit Properties Mortgage Blog

2019 Conforming Loan Limits For 1 2 3 And 4 Unit Properties Mortgage Blog

2020 Conforming Loan Limits For 1 2 3 And 4 Unit Properties Mortgage Blog

2020 Conforming Loan Limits For 1 2 3 And 4 Unit Properties Mortgage Blog

Maximum Conforming Loan Limits 8z Mortgage

Maximum Conforming Loan Limits 8z Mortgage

2021 Orange County Conforming Loan Limits Enjoy Oc

2021 Orange County Conforming Loan Limits Enjoy Oc

Conforming Loan Limits Jump By Nearly 30 000 Infographic Mecklenburg Mortgage

Conforming Loan Limits Jump By Nearly 30 000 Infographic Mecklenburg Mortgage

Conventional Loan Limits For 2021 Remn Wholesale A Division Of Homebridge Financial Services

Conventional Loan Limits For 2021 Remn Wholesale A Division Of Homebridge Financial Services

Conventional Loan Limit Increase 2020 Trulend Mortgage Trulend Mortgage

Conventional Loan Limit Increase 2020 Trulend Mortgage Trulend Mortgage

Conventional Loan Limits For 2021 Homebridge Wholesale

Conventional Loan Limits For 2021 Homebridge Wholesale

Comments

Post a Comment