Featured

- Get link

- X

- Other Apps

What Percentage Of Your Income Is Taxed

10 Your estimated tax bill would therefore be 3469. If your provisional income is above 25000 as a single filer or 32000 as a joint filer you may owe taxes.

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

Cormac is 66 years of age and is married.

What percentage of your income is taxed. And so it goes through the various levels until the brackets top out at 37 518401 for single filers. 2 A small business owner with income this high whose company is a. If your income exceeds the limits for low income exemption but is less than twice the amount of the limit then you can claim marginal relief.

Note that your personal allowance decreases by 1 for every 2 you earn over 100000. 10 12 22 24 32 35 and 37 percent. Is Social Security taxed.

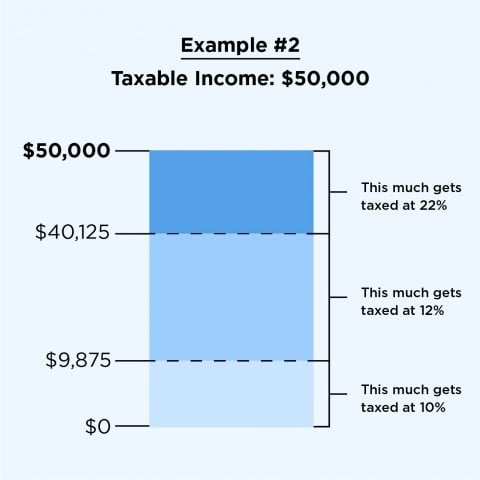

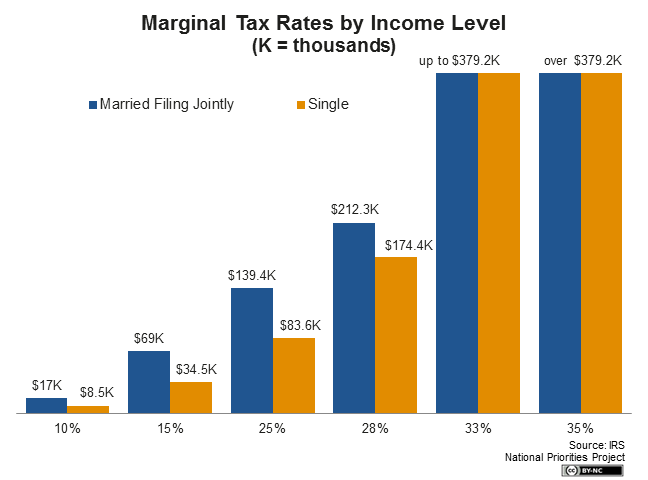

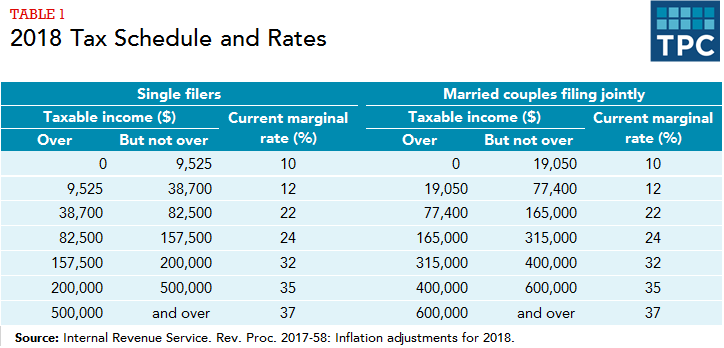

Based on this information you are taxed on 10 12 24 32 35 or 37 percent of wages exceeding the indicated amount. These are marginal rates meaning that each rate applies only to a specific slice of income rather than to your total income. Ordinary Income Tax Brackets.

The same goes for the next 30000 12. Up to 85 of your benefits may be. And just when you thought it was all over your take home pay is subject to still more taxes.

Youll pay 10 on the first 19750 of taxable income and 12 on the income that falls between 19750 and 80250. Your Federal Income Tax Rate Depends Upon Your Tax Bracket. You dont pay on other income such as dividends or interest.

Under marginal relief you are taxed only on the amount by which your income exceeds the limit but a special tax rate of 40 applies to this amount. Between 50271 and 150000 youll pay at 40 known as the higher rate and above 150000 youll pay 45 the additional rate. What Percentage of Income is Income Tax.

On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate. Wages are taxed based on your income level and whether you. As of the 2020 and 2021 tax year the capital gains tax rates are zero 15 and 20 depending on the level of your income.

Using the brackets above you can calculate the tax for a single person with a taxable income of 41049. That puts your estimated taxable income at 32200 placing you in the 12 tax bracket for your top dollars. However as taxable income increases you are subject to tax rates of 12 22 24 32 35 or 37 percent with the higher rates only applying to the higher portions of.

State Personal Income Tax of 101. Income in America is taxed by the federal government most state governments and many local governments. FICA Taxes are Separate from Income Taxes.

The 2021 tax tables show that the top federals income tax rate is 37 on 523601 of taxable income for individuals and heads of households and 628301 for married individuals filing jointly. Marginal tax rates range from 10 to 37. Your meal at Panera is taxed.

The rate that applies to the top slice of your income is your tax bracket. The first 9875 is taxed at 10 988 The next 30250 is taxed at 12 3630 The last 924 is taxed at 22 203. As of 2018 the marginal tax rates imposed by the IRS are as high as 37 percent for ordinary income and 20 percent for long-term capital gains but if youre a high earner you might have to pay additional taxes like the Net Investment Income Tax or Additional Medicare Tax.

For the most part interest income is taxed as your ordinary income tax rate the same rate you pay on your wages or self-employment earnings. The rates are applied to your gross wages in the amount of 42 percent for Social Security and 29 percent for Medicare as of 2012. Enter your financial details to calculate your taxes.

Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10. To determine the amount of allowance to subtract from your wages your employer multiplies your number of allowances by the amount the agency specifies per allowance which is based on your payroll frequency. Assuming you are an employee rather than self-employed you take the 130500 of your income that actually belongs to you and lets say you spend it.

Income was taxed at seven different rates. In addition to income tax you must also pay. In general there are seven tax brackets for ordinary income 10 12 22 24 32 35 and 37 with the bracket determined by filers taxable income.

The federal income tax system is progressive so the rate of taxation increases as income increases. In the 2020 tax year for example single people with a taxable income of 9875 or less pay federal income tax at the tax rate of 10 percent.

Taxes Are Surprisingly Similar In Texas And California Mother Jones

Taxes Are Surprisingly Similar In Texas And California Mother Jones

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

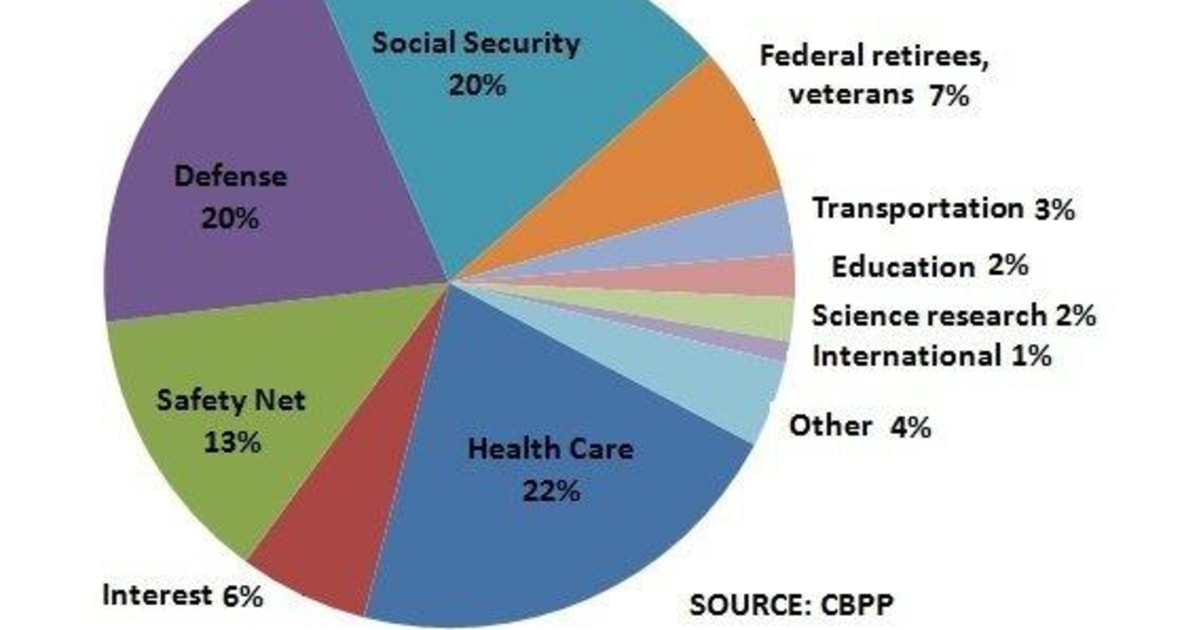

Here S Where Your Federal Income Tax Dollars Go

Here S Where Your Federal Income Tax Dollars Go

How Much Is Federal Income Tax How Much You Ll Pay Why Benzinga

How Much Is Federal Income Tax How Much You Ll Pay Why Benzinga

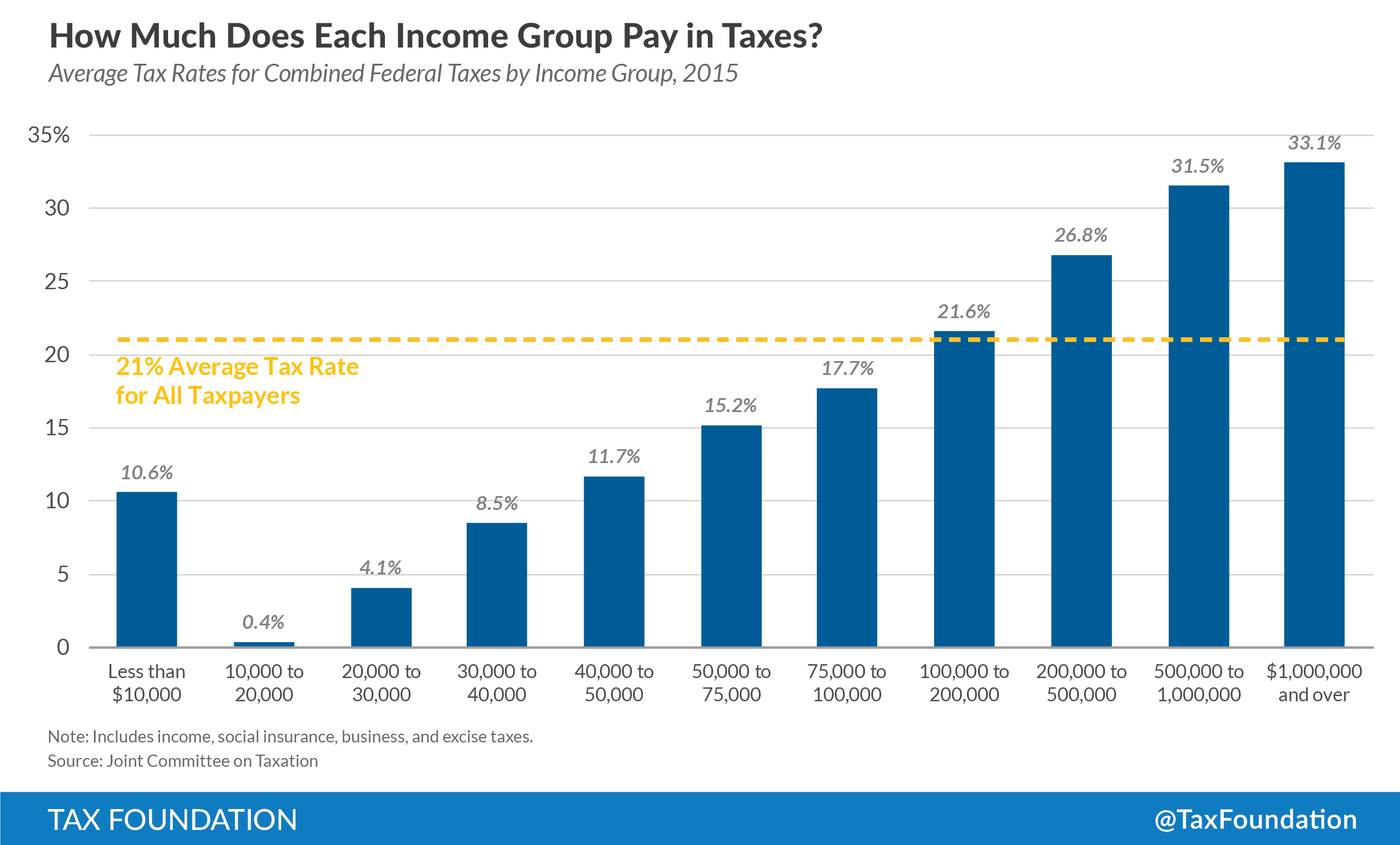

How Much Do People Pay In Taxes Tax Foundation

How Much Do People Pay In Taxes Tax Foundation

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

Summary Of The Latest Federal Income Tax Data 2018 Update

Summary Of The Latest Federal Income Tax Data 2018 Update

Income Tax In The United States Wikipedia

Income Tax In The United States Wikipedia

How Federal Income Tax Rates Work Full Report Tax Policy Center

How Federal Income Tax Rates Work Full Report Tax Policy Center

How Much Should You Budget For Taxes As A Freelancer

How Much Should You Budget For Taxes As A Freelancer

Comments

Post a Comment