Featured

- Get link

- X

- Other Apps

What Percentage Of Income Tax Do I Pay

Your taxable income and filing status determine the tax bracket that you fall into. In 2017 the top 50 percent of all taxpayers paid 97 percent of all individual income taxes while the bottom 50 percent paid the remaining 3 percent.

Summary Of The Latest Federal Income Tax Data 2018 Update

Summary Of The Latest Federal Income Tax Data 2018 Update

The average income tax rate for all Americans was 146 in 2017 according to the Tax Foundations method of calculation.

What percentage of income tax do i pay. On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate. Taxable income is what matters. Income taxes in the US.

If you are filing for a previous year see the 2019 to 1985 tax rates. The maximum tax rate is 45 and only applies for incomes exceeding 250730 euros a year if you are unmarriednot in a civil partnership. The top 1 percent paid a greater share of individual income taxes 385 percent than the bottom 90 percent combined 299 percent.

Note that your personal allowance decreases by 1 for every 2 you earn over 100000. The total bill would be about 6800 about 14 of. Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10.

When do you need to pay income tax. Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more. 2 A small business owner with income this high whose company is a pass-through entity would be taxed at this rate.

The final 25000 of your income would be taxed at 30 or 7500. For couples who are married or in a civil partnership the maximum tax rate is of 45 only applies if you earn more than 501460 euros. Youll pay 40 Income Tax on earnings between 50271 to 150000.

In this scenario even though youre in the 30 bracket you would actually pay only about 207 of your income in taxes. In 2020 federal tax brackets range from 10 percent to 37 percent. Starting with the Feds you can expect to pay 153 in self-employment tax.

Most 2019 tax returns should be filed by April 30 2020. This deduction will come in handy when you pay income taxes because it lowers your total taxable income. For the 2018 tax year taxes due to be filed in 2019 individuals filing single will be taxed as follows.

Your total tax would be. Your marginal federal income tax rate remained at 2200. The amount of income tax you pay depends on how much money you earned in the past year minus any deductions and credits.

Depending on the type of income either you will pay monthly or how often you get paid and automatically as its discounted from the amount before it even reaches your bank account or you will pay annually taking into account the full. Find out your take-home pay - MSE. It sounds brand new but if youve had a job that provided you with a W-2 before youre not completely unfamiliar.

In the UK a tax year starts from April to April. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits. And then youd pay 22 on the rest because some of your 50000 of taxable income falls into the 22 tax bracket.

So why doesnt the same rule apply to profits from a home sale which feels a. According to the IRS 2020 tax rate tables taxpayers have to hand over anywhere from 10 to 37 of their taxable income. It could also be lower for example if you earn over.

Your income tax rate is based on a combination of federal and provincial tax rates. The 2021 tax tables show that the top federals income tax rate is 37 on 523601 of taxable income for individuals and heads of households and 628301 for married individuals filing jointly. Total Estimated 2020 Tax Burden.

Your effective federal income tax rate changed from 1000 to 981. After all the government makes no qualms about taxing peoples incomes. What Is the Corporate Tax Rate.

10 percent of the first 9525 in income 12 percent of all income between 9525 and 38700 22 percent of all income between 38700 and 82500. A financial advisor can help you understand how taxes fit into your overall financial goals. This assumes you have the standard Personal Allowance of 12570 which is the amount you can earn before paying tax.

The average single American contributed 298 of their earnings to three taxes in 2019income taxes Medicare and Social Security. The current tax year is from 6th April 2021 to the 5th April 2022. Between 50271 and 150000 youll pay at 40 known as the higher rate and above 150000 youll pay 45 the additional rate.

When you receive 1099 income you can expect to pay federal state and local tax the same as you would if you were working for an employer. If you earn 150001 and over you pay 45 tax. 2000 6000 7500 15500.

And so it goes through the various levels until the brackets top out at 37 518401 for single filers. The same goes for the next 30000 12. You can deduct 50 percent of your self-employment tax amount from your taxable income.

Your Personal Allowance might be higher for example if youve claimed certain allowances or if youve paid too much tax. Are calculated based on tax rates that range from 10 to 37. Your federal income taxes changed from 5693 to 5580.

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

Yes The Top 1 Pct Do Pay Their Fair Share In Income Taxes Mining Com

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

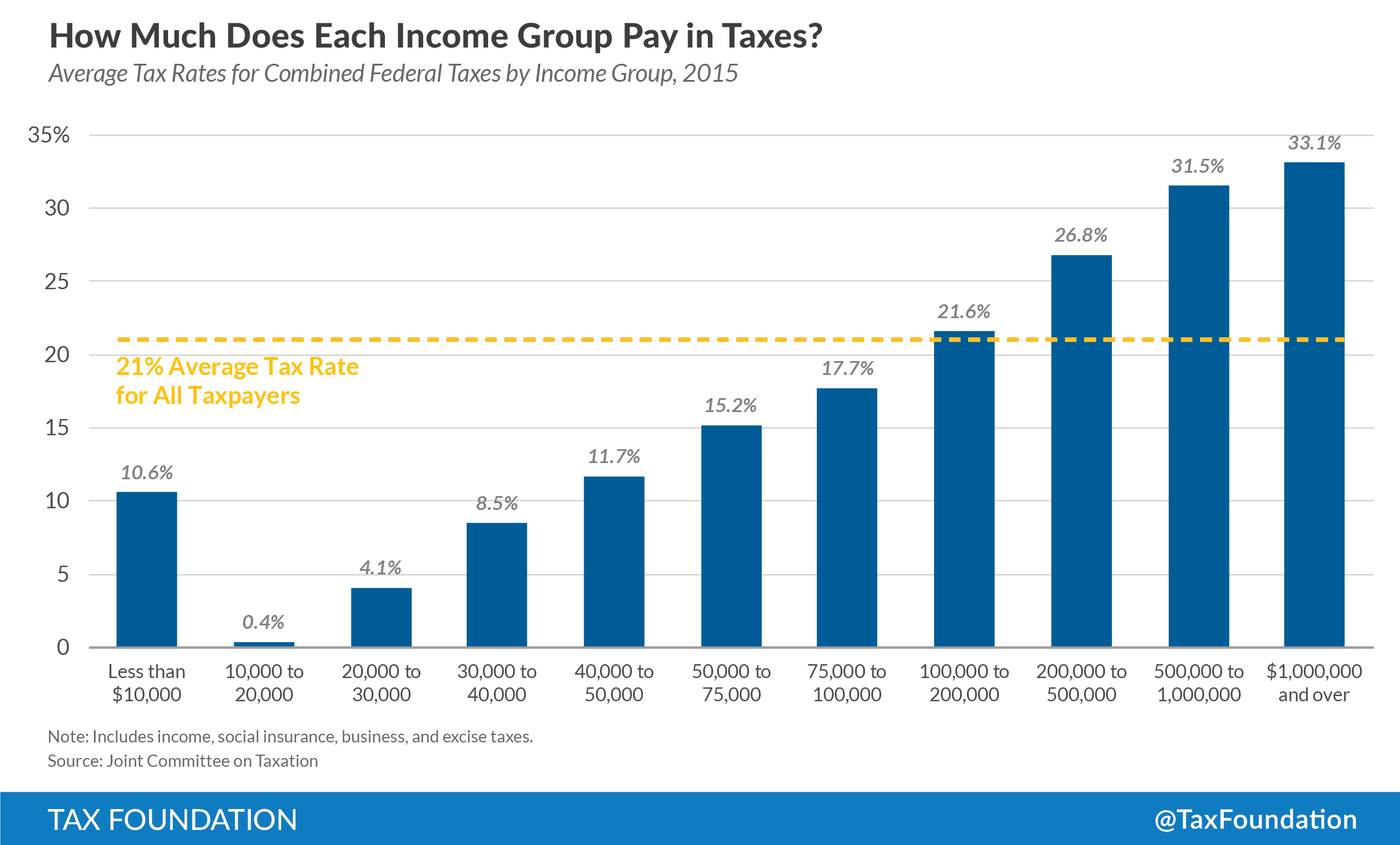

How Much Do People Pay In Taxes Tax Foundation

How Much Do People Pay In Taxes Tax Foundation

How Much Do The Top 1 Percent Pay Of All Taxes

Who Pays Income Taxes Foundation National Taxpayers Union

Who Pays Income Taxes Foundation National Taxpayers Union

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

Why Do Some People Pay No Federal Income Tax

Who Pays U S Income Tax And How Much Pew Research Center

Who Pays U S Income Tax And How Much Pew Research Center

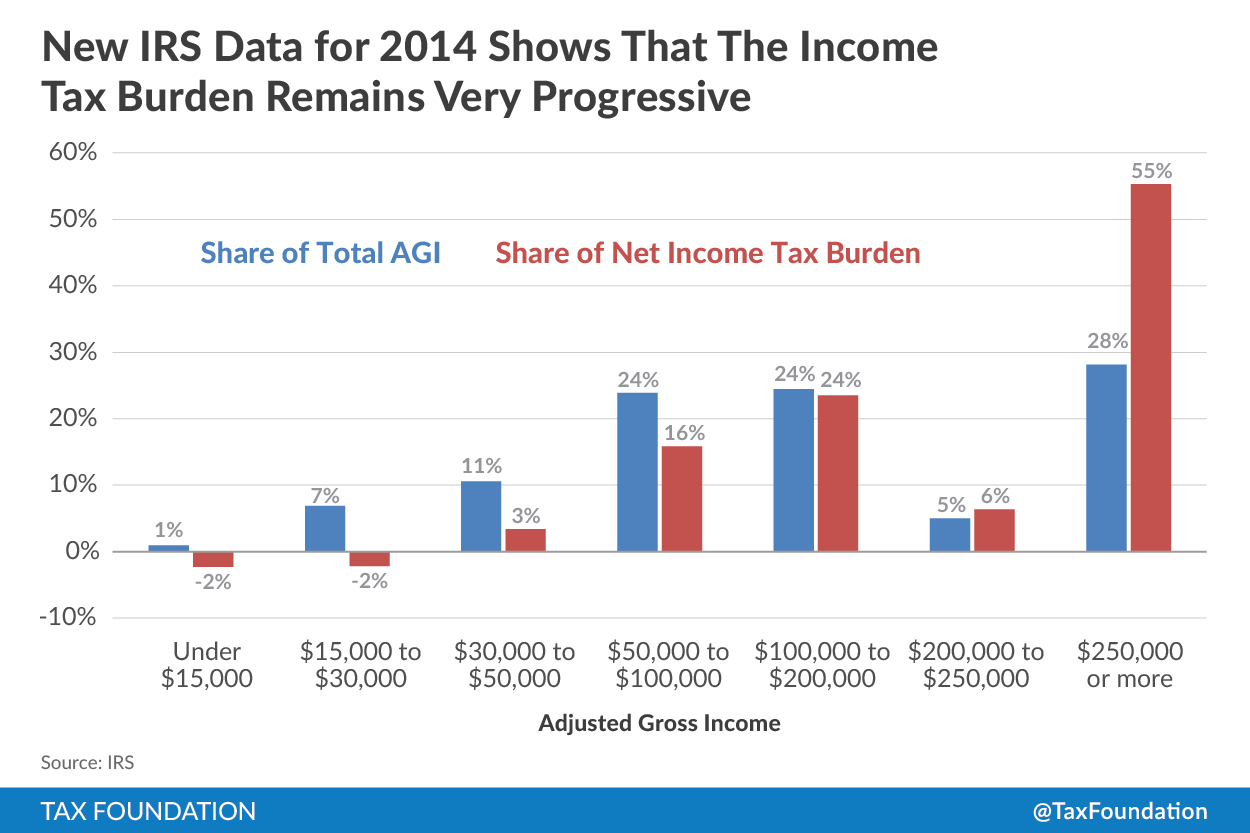

New Irs Data Wealthy Paid 55 Percent Of Income Taxes In 2014 Tax Foundation

New Irs Data Wealthy Paid 55 Percent Of Income Taxes In 2014 Tax Foundation

Income Tax In The United States Wikipedia

Income Tax In The United States Wikipedia

Comments

Post a Comment