Featured

- Get link

- X

- Other Apps

Social Security Tax Calculator 2020

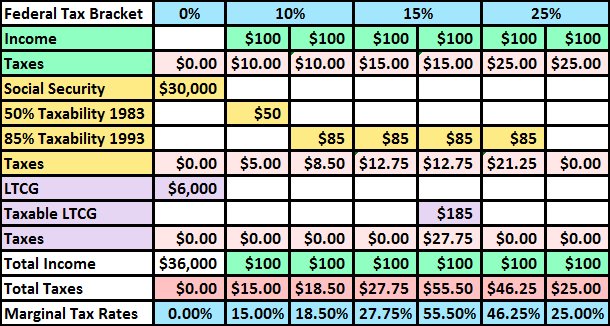

Lets look at an example report to run through the calculations for three years where the portion of Social Security subject to taxation varies from a low of 10 to a high of 85. For joint filers income higher than 32000 may force you to include as.

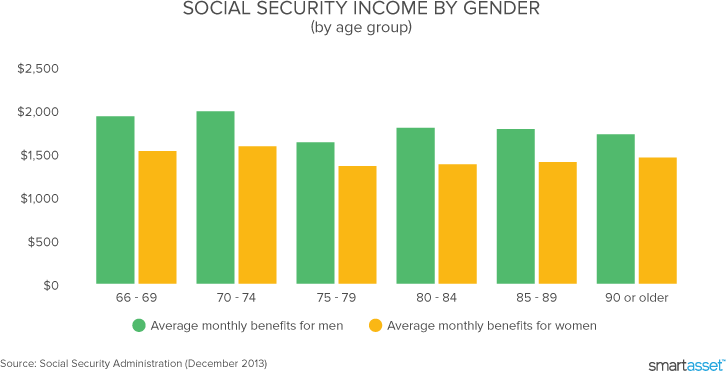

Is Social Security Taxable 2020 Update Smartasset

Is Social Security Taxable 2020 Update Smartasset

If you have clients who earn more than a certain amount from other sources.

Social security tax calculator 2020. Calculate Social Security Taxes. Did you know that up to 85 of your Social Security Benefits may be subject to income tax. The first step of properly paying your employees is determining how much they earned in a given pay cycle.

If this is the case you may want to consider repositioning some of your other income to minimize how much of your Social Security Benefit may be taxed and thereby maximize your retirement income sources. OASDI Old-Age Survivors and Disability Insurance and HI Medicares Hospital Insurance program. Calculate My Social Security Income.

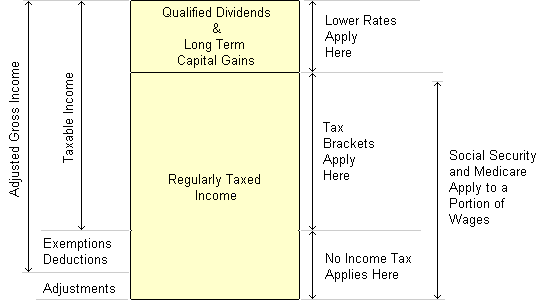

The portion of benefits that are taxable depends on the taxpayers income and filing status. What Is the Social Security Withholding for 2020. For the 2019 and 2020 tax years single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits.

Whether they receive wages or pension payments. Subtract the 50 taxation threshold for the individuals tax. For 2011 and 2012 only the employees half didnt equal the employers half for Social Security.

Benefit estimates depend on your date of birth and on your earnings history. Social Security benefits are paid for through a tax on workers and their companies. They dont include supplemental security income payments which arent taxable.

For age 6567 social security benefits total 50061 and the taxable portion is 19372 39. So in 2020 the Social Security withholding rate. Social Security Quick Calculator.

If your income is above that but is below 34000 up to half of your benefits may be taxable. For high salaries only the first 132900 of income is subject to the Social Security tax for 2019. Since 1990 the OASDI tax rateor the Social Security taxhas been 62.

Enter your expected earnings for 2021. Social security benefits you can check estimated social security benefit calculator include monthly retirement survivor and disability benefits. This is called provisional.

One tax employers are required to withhold from nearly all of their employees is Social Security tax. The threshold numbers at which taxes start to hit depend on your filing status. Youd calculate the amount theyd owe taxes on this way.

For 2017 there is a very large increase in the Social Security income limit from 118500 to 127200. This taxable benefit calculator makes it simple for you to show clients how much of their benefit is taxable. Tax Changes for 2013 - 2020.

Instead it will estimate your earnings based on information you provide. But note that social security tax is applied on maximum maxed 137700 for the tax year 2020 This was 132000 for 2019. Tax Tip 2020-76 June 25 2020 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits.

Divide their Social Security benefits 12000 in half to get 6000. The second step is calculating how much of that money needs to be withheld for payroll taxes. This information may help you analyze your financial.

For security the Quick Calculator does not access your earnings record. The new tool offers retirees as well as employees and self-employed individuals a more user-friendly way to check their withholding. Social Security benefits include monthly retirement survivor and disability benefits.

Social Security Taxes are based on employee wages. This money is deducted from employee paychecks and paid directly to the IRS on the employee. Note that not everyone pays taxes on benefits but clients who have other income in retirement beyond Social Security will likely pay taxes on their benefit.

There are two components of social security taxes. If you want to compute whether the amount of social security you received is taxable and if taxable how much then first step is to add Modified Adjusted Gross Income with 50 of the social security benefits. Tools or Tax ros exoo Social Security Taxable Benefits Worksheet 2020 Before filling out this worksheet.

And regardless of whether you think Social Securitys future is secure the fact remains that you shouldnt plan on living exclusively off your Social Security benefits. If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits. For 2013 both contribute 62.

So benefit estimates made by the Quick Calculator are rough. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator. If Married Filing Separately and taxpayer lived apart from his or her spouse for the.

For the purposes of taxation your combined income is defined as the total of your adjusted gross income plus half of your Social Security benefits plus nontaxable interest. Determine any write-in adjustments to be entered on the dotted line next to line 22 Schedule 1 Form 1040. They contributed 42 and 62 respectively.

The total self-employment tax rate is 153 comprising of 124 for Social Security and 29 for Medicare for both 2020 and 2019. After all Social Security wasnt designed to make up a retirees entire income. These days theres a lot of doom and gloom about Social Securitys solvency - or lack thereof.

For incomes of over 34000 up to 85 of your retirement benefits may be taxed. Employees and employers each pay 62 of wages. Self-employed people pay 124.

The tool has features specially tailored to the unique needs of retirees receiving pension payments and Social Security benefits.

/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png) Learn About Fica Social Security And Medicare Taxes

Learn About Fica Social Security And Medicare Taxes

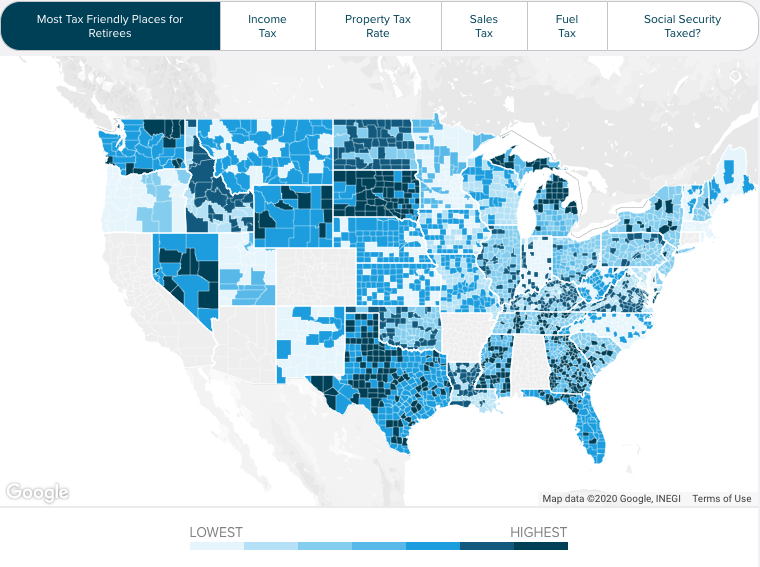

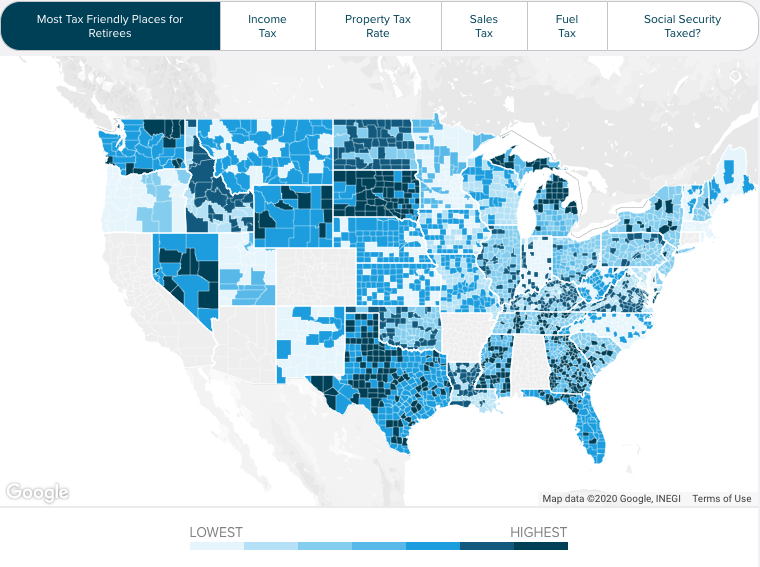

The Best States To Retire For Taxes Smartasset

The Best States To Retire For Taxes Smartasset

Employer Payroll Tax Calculator Gusto

Social Security Benefits Tax Calculator Internal Revenue Code Simplified

Social Security Benefits Tax Calculator Internal Revenue Code Simplified

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Social Security Calculator 2021 Update Estimate Your Benefits Smartasset

Social Security Calculator 2021 Update Estimate Your Benefits Smartasset

Social Security Tax Impact Calculator Bogleheads

Social Security Tax Impact Calculator Bogleheads

Social Security Tax Impact Calculator Bogleheads

Social Security Tax Impact Calculator Bogleheads

Taxable Social Security Calculator

Taxable Social Security Calculator

Social Security Tax Impact Calculator Bogleheads

Social Security Tax Impact Calculator Bogleheads

Comments

Post a Comment