Featured

- Get link

- X

- Other Apps

How Much Money Do I Need To Retire At 40

Required Income Future Dollars. 70000 as your monthly expenses when you reach 40Assuming the inflation rate around 5 you would require a retirement corpus of over Rs.

How Much Money Do You Need To Retire The Money Ways

Their financial experts say you need savings of around 25 times your annual salary to retire in your 40s.

How much money do i need to retire at 40. Number of Years After Retiring. British people need at least 260000 to retire without money worries say experts. Using a withdrawal rate of 4 you should have a minimum of 1 million in retirement savings before you retire.

It is really easy to calculate the amount of money you need to retire using this online calculator. On top of that the 2019 Retirement Confidence Survey showed that one-third of Americans assume theyll need at least 1 million to live a happy retirement life. And this corpus rises if you are planning to retire at 40.

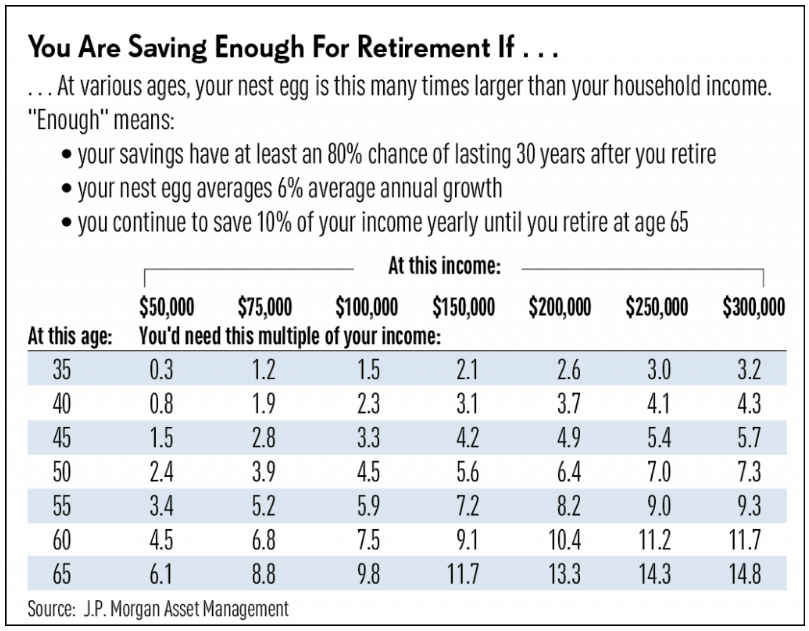

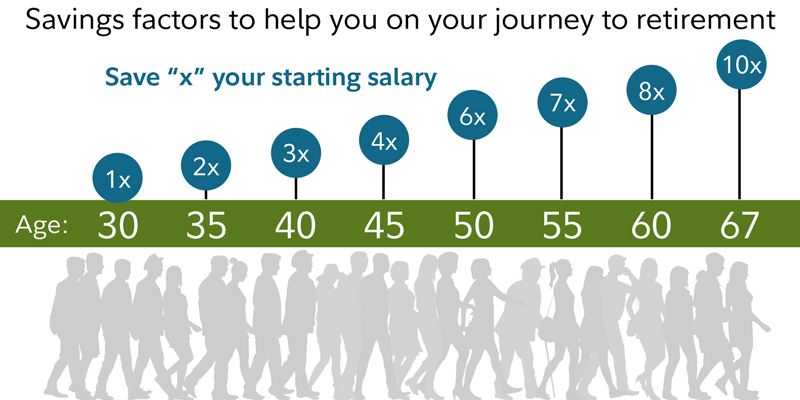

At least 1x your salary at 30 3x at 40 6x at 50 8x at 60 and 10x at 67. If you wait until you are 40 to begin saving for the future youll need to contribute 384 per month to achieve a comfortable retirement by the time you reach state pension age. Heres a simple rule of thumb for calculating how much money you need to retire.

5 crores to sustain a lifetime. The TV programme meets people who prove that you dont have to earn ludicrous amounts of. The figure rises to 1030 per month if you are aiming for a luxurious lifestyle.

For example if you plan to spend 50000 per year in retirement and want to withdraw 2 percent youd need 50000 divided by 002 or 25 million to. Around 40 per cent of millennials are now renting in their thirties double the rate of the previous. Going by the second rule using a median individual income of about 35000 you arrive at just over 600000 need for retirement 70 percent X 35000 25 years.

For instance currently your monthly expenditure at the age of 25 is Rs. Annual Yield of Balance. For example say you have figured out that you need 40000 per year in retirement.

And if your goal is to retire by 40 youll need more than the median household income because of the extended retirement period. If its 50000 a good rule-of-thumb is to multiply that by 25 to see how much youll need to save to comfortably retire for 25 years 125M. As you start withdrawing 45000 40000 and 5000 in todays dollars from Taxable and Tax Free sources respectively your nest egg starts depleting.

If you save half of your income each month 2083 you could have about 660000 when you retire at 40. If you want to retire at the age of 40 or thereabout then all your retirement savings and investments should be aimed at accumulating not less than 1 million dollars. A 2017 Merrill Lynch s study showed that the average retirement costs around 740000.

Start by making a copy of the sheet and saving it in your own google drive. By age 64 your retirement nest egg Sheltered Taxable Tax Free will have grown to 192938. To meet this goal you would need to save approximately 1 million at your desired age of retirement.

Think about how much money you need to comfortably live for a year. That could translate into about 1222 a. Number of Years Until Retiring.

Lets assume your retirement income goal is to generate 40000 of investment income per year. According to the principles of Fire the target is a pot of money worth 25 times your annual spending not salary. 40000 4 1000000.

Following the first rule if you spend 20000 a year youll need about 500000 to retire comfortably a number that seems a lot more attainable than the 1 million mark. How much do I need to save into a pension at different ages. So how much do you need to be retirement-ready.

35000 and you calculate Rs. Here is a brief example of the 4 withdrawal guideline in action. Annual inflation on Required Income.

So if you can get by on 10000. How to Use The Online Retirement Calculator. Fill in your personal information Name current age retirement age and retirement years.

This will be enough to fund your retirement lifestyle assuming you live till 80-85 years old. How much money do you need to retire at 40.

If I Want To Retire With A Monthly Income Of 6 000 Per Month How Much Money Should I Have Saved To Last Me 40 Years Quora

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much Money Do I Need To Save To Retire At 62 Goodlife

How Much You Should Have Saved For Retirement Right Now

How Much You Should Have Saved For Retirement Right Now

Here S How Much Money You Need To Have Saved Up To Retire By Age 40

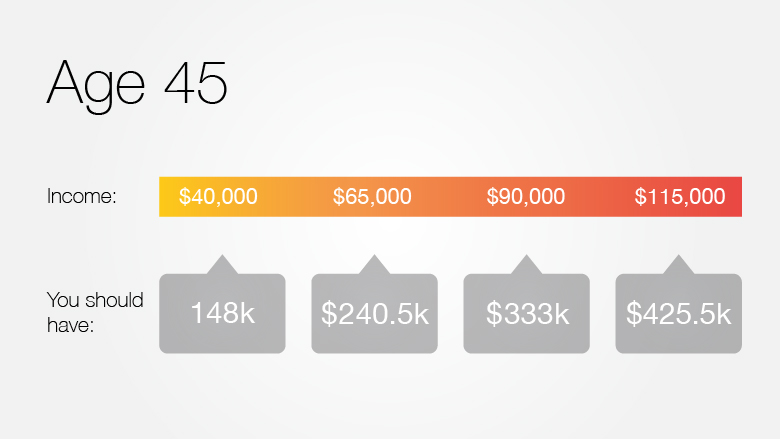

How Much Should We Have Saved For Retirement By Age 45 Quora

How Much Money Do You Need To Retire

How Much Money Do You Need To Retire

Suze Orman Is Right You Need 5 Million Or More To Retire Early

Suze Orman Is Right You Need 5 Million Or More To Retire Early

How Much Money You Need To Retire At 45 And Live On Investment Income

How Much Do I Need To Retire Fidelity

How Much Do I Need To Retire Fidelity

How Much Money Do You Need To Retire I M Gonna Be Your Friend

How Much Money Do I Need To Retire Nasdaq

How Much Money Do You Really Need To Retire Paradigmlife Net Blog

How Much Money Do You Really Need To Retire Paradigmlife Net Blog

In Your 40s How Much You Should Have Saved For Retirement Right Now Cnnmoney

In Your 40s How Much You Should Have Saved For Retirement Right Now Cnnmoney

If You Start Investing Today How Much Will You Have For Retirement This Table Shows You All You Need To Know

If You Start Investing Today How Much Will You Have For Retirement This Table Shows You All You Need To Know

Comments

Post a Comment