Featured

1040 Estimated Tax

Use Form 1040-ES to figure and pay your estimated tax for 2021. Your estimated tax due is 1000 or more.

Enter the amount of estimated tax you paid at each of the quarterly due.

1040 estimated tax. Where to mail 1040-ES estimated payments. If you made estimated tax payments in 2020 towards your federal state or local taxes enter them in the Estimated and Other Income Taxes Paid section. Estimated tax payments are due four times in a tax year.

Use Form 1040-ES to figure and pay your estimated tax. 100 of your 2020 tax liability Farmers and fishermen have different rules. In addition if you do not elect voluntary withholding you should make estimated tax payments on other taxable.

When to file 1040-ES. Form 1040-ES is used to calculate and mail-in estimated tax payments prior to filing your annual 1040 income tax return. Estimated tax is the method used to pay tax on income that is not subject to withholding for example earnings from self-employment interest dividends rents alimony etc.

In addition if you dont elect voluntary withholding you should make estimated tax payments on other. Use this secure service to pay your taxes for Form 1040 series estimated taxes or other associated forms directly from your checking or savings account at no cost to you. IRS Publication 505 and Form 1040-ES provide worksheets to help you calculate what youll likely owe in estimated taxes.

The IRS requires some taxpayers to make estimated quarterly tax payments. Pay electronically using the Electronic Federal Tax Payment System EFTPS. With your return open search for the term estimated tax payments.

Please note this calculator is for the 2021 tax year which is due in April 2022. You must make estimated tax payments and file Form 1040-ES if both of these apply. Schedules forms and records oh my.

The IRS offers five ways to pay your estimated taxes. Divide by the number of quarters or months remaining in the tax year if youre beginning to make estimated payments later in the year. Arkansas Connecticut Delaware District of Columbia Illinois Indiana Iowa Kentucky Maine Maryland Massachusetts Minnesota Missouri New Hampshire New Jersey New York Oklahoma Pennsylvania Rhode.

Choose Start next to the type of estimated tax payment youd like to enter. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS. 1040 Tax Estimation Calculator for 2021 Taxes.

Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self-employment interest dividends rents alimony etc. IRS Estimated Quarterly Tax Payments. For calendar year taxpayers which is most individuals the due dates are April 15 June 15 September 15 of the current year and January 15 of the following year.

Am I required to make quarterly estimated tax payments. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year. To pay your quarterly estimated taxes use the estimated tax worksheet provided by the IRS to figure out how much youll need to pay every quarter.

Each estimated tax payment you make this year will be 108490. Enter your filing status income deductions and credits and we will estimate your total taxes. Form 1040-ES NR US.

1040-ES Guide Dates. Staying on top of your quarterly payments will help ensure you pay no unnecessary penalties at the end of the year for underpayment. Use the Record of Estimated Tax Payments on page 6 to keep track of the payments you have made and the number and amount of.

The total amount of your tax withholding and refundable credits is less than the smaller of. 90 of your 2021 tax liability. The estimated tax worksheet on page 4 will help you figure the correct amount to pay.

Individuals including sole proprietors partners and S corporation shareholders generally use Form 1040-ES to figure estimated tax. Use IRS Direct Pay for free online transfers from your checking or savings account. Any income you earn that is not subject to federal withholding tax might require that you submit quarterly estimated tax payments.

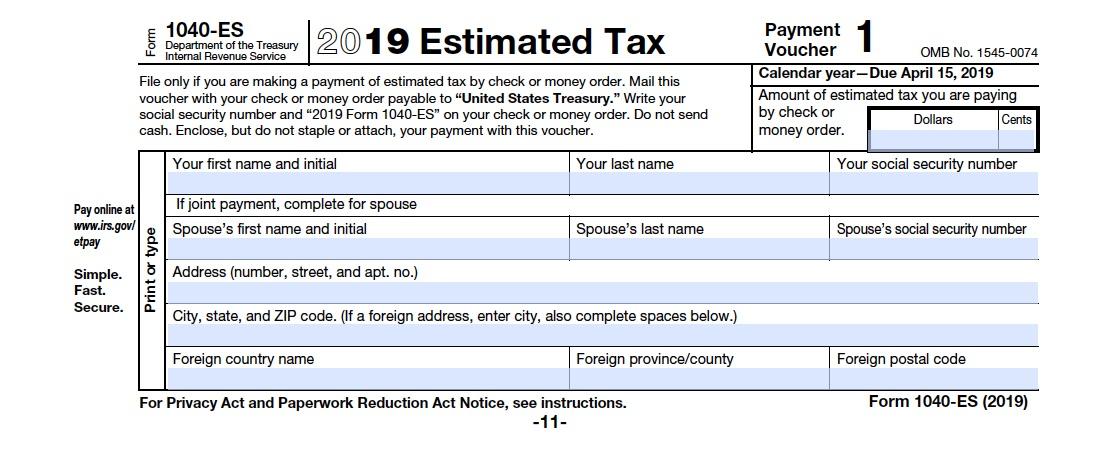

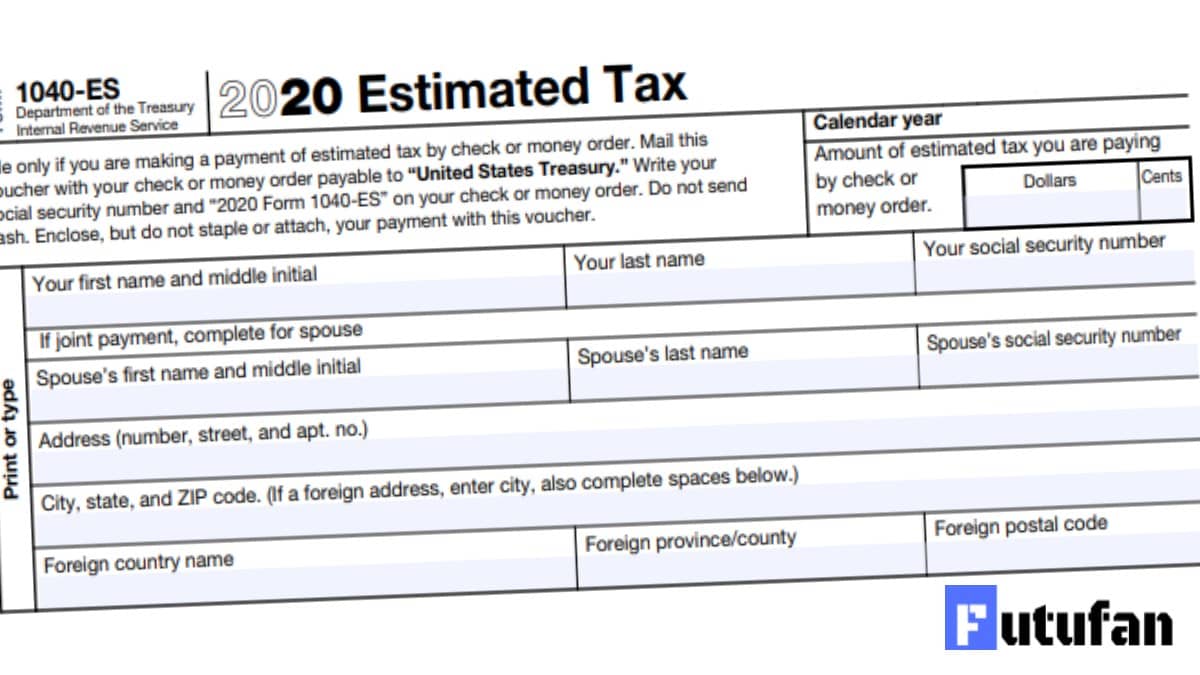

The payment vouchers in this package are for crediting your estimated tax payments to your account correctly. You can easily keep track of your payment by signing up for email notifications about. The first line of the address should be Internal Revenue Service Center.

Send in your payment by check or money order with the corresponding payment voucher from Form 1040-ES. If You Live In. And thats the amount youll enter on slips one through four of Form 1040-ES.

Estimated Tax for Nonresident Alien Individuals. Once your estimated tax payment has been calculated the current payment voucher must be sent to the correct IRS address based on the state where you liveThe 1040-ES worksheet does not need to be sent to the IRS instead it should be kept with your tax records for the year. Once you know the amount to pay you can either send a check with the payment vouchers in the worksheet to the Department of the Treasury or you can pay your taxes online on the IRSgov payments page.

Select the Jump to link. When to File Form 1040-ES. Form 1040-ES PR Estimated Federal Tax on Self Employment Income and on Household Employees Residents of Puerto Rico.

How To Make The 2 Estimated Tax Payments Also Due July 15 Don T Mess With Taxes

What You Need To Know About The Estimated Tax Payment Due June 15 2018 C Brian Streig Cpa

What You Need To Know About The Estimated Tax Payment Due June 15 2018 C Brian Streig Cpa

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

How To Make The 2 Estimated Tax Payments Also Due July 15 Don T Mess With Taxes

What Is Form 1040 Es When Are Estimated Tax Payments Due Ask Gusto

What Is Form 1040 Es When Are Estimated Tax Payments Due Ask Gusto

How To Make The 2 Estimated Tax Payments Also Due July 15 Don T Mess With Taxes

Estimated Tax Payments Deadline June 17 Cpa Practice Advisor

Estimated Tax Payments Deadline June 17 Cpa Practice Advisor

Https Www Irs Gov Pub Irs Pdf F1040es Pdf

1040 Es 2020 First Quarter Estimated Tax Voucher

1040 Es 2020 First Quarter Estimated Tax Voucher

Where To Mail Your Estimated Tax 1040 Es Form Don T Mess With Taxes

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Learn How To Fill The Form 1040 Es Estimated Tax For Individuals Youtube

Learn How To Fill The Form 1040 Es Estimated Tax For Individuals Youtube

Comments

Post a Comment