Featured

Money Market Account Taxes

Put that same amount in. If you hold some or all of your qualified retirement plan funds in a money market account you dont pay any taxes on the interest until you take withdrawals because theyre all tax-sheltered.

What Are The Taxes On Money Market Accounts Gobankingrates

What Are The Taxes On Money Market Accounts Gobankingrates

Money market accounts come in two forms.

Money market account taxes. Our Mega Money Market Accounts require an opening deposit of 150000. If you earn interest throughout the year from a high-yield savings account CD or money-market account totaling more than 10 each bank will send you Form 1099-INT to include with your tax. Personalized check order charges including tax and shipping and handling are debited from your account when your order is placed.

The average money market rate is less than a tenth of a percent. Some brokerages also offer similar funds called money market funds and you generally must pay tax on dividends paid by those funds as you earn them unless theyre held in a tax-deferred. This is a key benefit of a money market account because when tax time comes you can simply write a check when the IRS wants the money Becker says.

If that money was in a taxable brokerage account youd owe 15 percent in capital gains tax or 15000. Review money market account disclosures for Texas here. To open a Mega Money Market or speak to an account specialist visit the nearest branch location or call us at 972-263-9497.

Access your money whenever you need it and pay no monthly fee each month you maintain the minimum balance. Tax-free money market accounts. You use the 1099-INT form to complete your taxes.

Both money market deposit accounts and money market mutual funds charge fees. A federally insured savings account that requires you to keep a minimum balance limits the number of monthly transactions and for which interest rates are based on market interest rates. Theyre also a great place to build your emergency fund.

Collection Items all fees are per item. The basic definition of money market account MMA. If youre buying a taxable fund any returns from the fund are generally subject to regular state and federal taxes.

After a year your balance would earn less than ten bucks. The national average interest rate for savings accounts under 100000 as reported by the FDIC is currently just 006 while money market accounts sit at 009. Say you save 10000 in such an account.

You must keep 150000 minimum balance in order to earn dividends. So for example if you put 10000 into an MMA with an APY of 029 on January 1 and dont add any more money by the end of the year youll have 10029. A money market account is a specific type of bank account that often pays higher interest rates than other bank products.

You want to keep this money somewhere separate from your regular spending account so you arent tempted to use it. Many people put their money into them as a way of increasing their investment income. Money market mutual funds and money market deposit accounts.

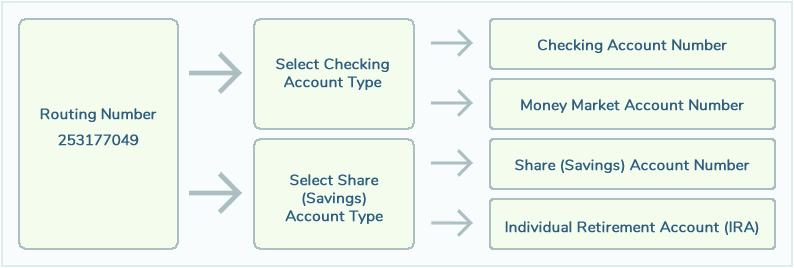

Mega Money Market Accounts. Money market deposit accounts are a type of savings account offered by banks and credit unions. Qualified plans include 401ks 403bs and individual retirement accounts.

The Internal Revenue Service requires account holders to pay tax on interest earned on money market accounts and other types of interest-paying deposit accounts. However when you take that money out of an IRA youll pay your full ordinary income tax. Since they generate income however they can and will be taxed - but not always.

If you have a Roth plan or IRA you get the interest out tax-free if the account has been open for at least five tax years and youre 59 12. The institution holding the deposit should send you a 1099-INT form that details the amount of interest you earn each year. 1000 monthly fee on balances that fall.

They offer higher interest rates than savings accounts. Money market mutual funds contain low-risk securities such as short-term treasury bonds. This makes money market accounts great for large and infrequent expenses like tax payments college tuition and vacations.

To ease this potentially painful encounter with the tax man Becker says the seller can proactively estimate any capital gains taxes on the sale and park that amount in a money market account where it will earn interest. Money market funds are divided into two categories. Interest earned on balances over 100000.

Check order charges vary. If you regularly maintain a higher balance and want to get a higher rate of interest on it our Money Market Account is just what youre looking for. Money market accounts a special kind of account offered by many banks and other financial institutions are a sort of hybrid between checking accounts and savings accounts.

Shareholders receive regular interest payments while the price of a share generally remains steady at 1. Your account terms will also explain your annual percentage yield APY which is the rate at which your MMA will earn compounding interest over the course of a year. Money market deposit accounts work similarly except that these deposit accounts.

You generally must pay tax on the interest you receive from a money market account. An MMA will help it grow faster. However you can cash in either of these account types at any time.

In a money market mutual fund the main fee is the expense ratio.

State Employees Credit Union Tax Refund Information

State Employees Credit Union Tax Refund Information

German Tax System Taxes In Germany

German Tax System Taxes In Germany

Financial Transaction Taxes Harm Small Investors And The Economy

Financial Transaction Taxes Harm Small Investors And The Economy

4 Benefits Of A Money Market Account Discover

4 Benefits Of A Money Market Account Discover

Why You Should Dump Your Tax Free Money Market Fund Money

Why You Should Dump Your Tax Free Money Market Fund Money

How Brokerage Accounts Are Taxed In 2021 A Guide

How Brokerage Accounts Are Taxed In 2021 A Guide

Fair Taxation Of The Digital Economy Taxation And Customs Union

Fair Taxation Of The Digital Economy Taxation And Customs Union

How Do Taxes Work On High Yield Savings And Cd Interest Business Insider

How Do Taxes Work On High Yield Savings And Cd Interest Business Insider

Proud To Pay Taxes How Corporations Can Take Sustainability More Seriously

Proud To Pay Taxes How Corporations Can Take Sustainability More Seriously

Money Market Accounts Vs Savings Accounts Ally

Money Market Accounts Vs Savings Accounts Ally

What Is A Money Market Account Nerdwallet

What Is A Money Market Account Nerdwallet

Germany A Surprising Bitcoin Tax Haven No More Tax

Germany A Surprising Bitcoin Tax Haven No More Tax

What Are The Taxes On Money Market Accounts Gobankingrates

What Are The Taxes On Money Market Accounts Gobankingrates

/GettyImages-1026036218-b6cd4a72f005410eb149bf00093ce1ed.jpg)

Comments

Post a Comment