Featured

Using 401k To Pay Off Mortgage

So if you pull 40000 out to pay a credit card bill 4000 of that. The advantages When you retire you have a few options for your old 401k see them here.

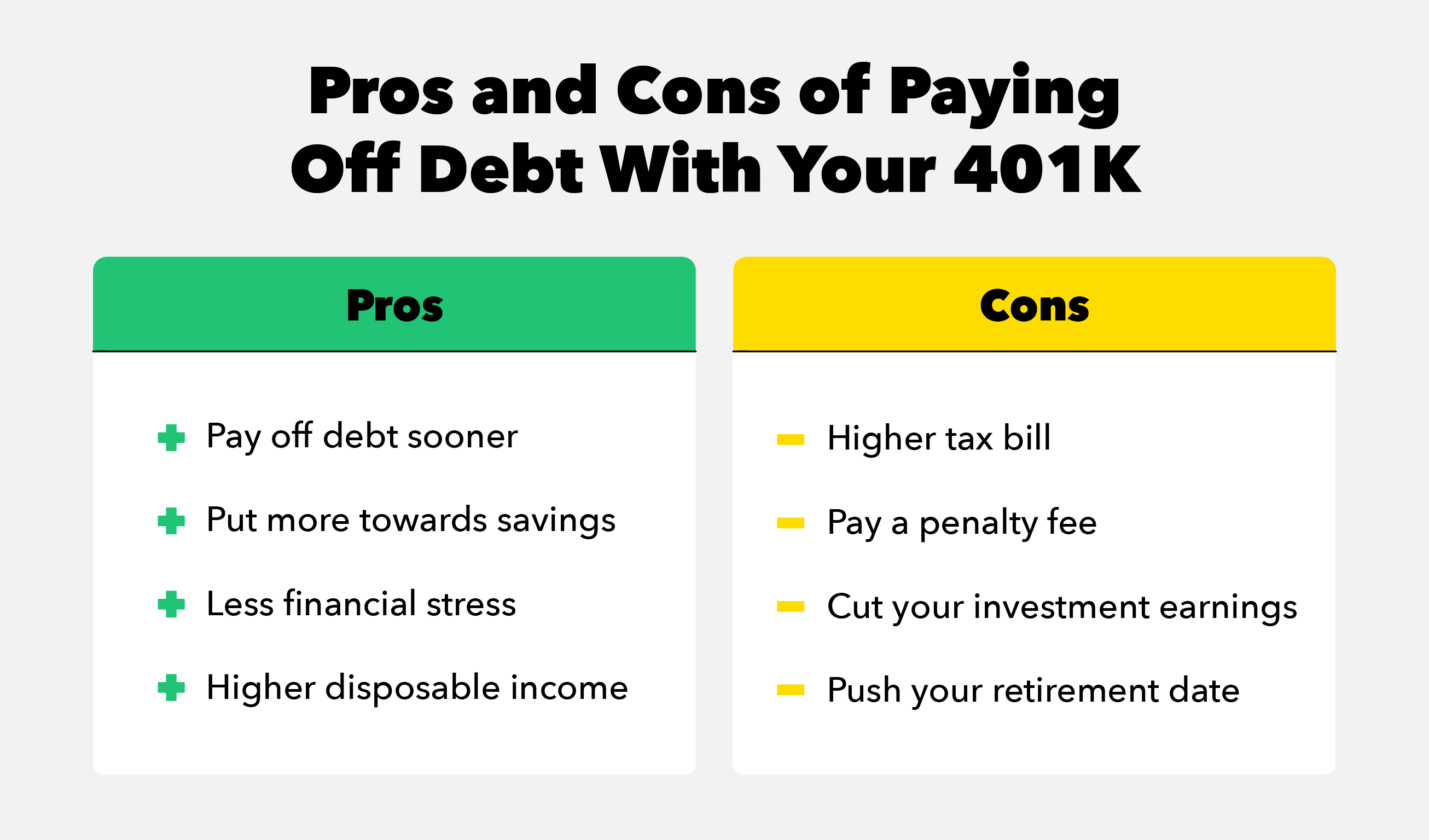

Should I Cash Out My 401k To Pay Off Debt

Should I Cash Out My 401k To Pay Off Debt

If you intend to use retirement funds from traditional 401 ks or IRAs to make another 10 years of mortgage payments in retirement youre going to need to pull out a.

Using 401k to pay off mortgage. For starters youll face a 4500 early withdrawal penalty. This will wipe out the monthly payment but youll still have taxes and insurance to take care of each year. Dangers of using your 401 k to pay off a mortgage The main reason not to use your 401 k to pay off a mortgage is that it takes funds away from your retirement nest egg.

I need 1000 subscribers to unlock many. If youre in the 25 tax bracket youll actually have to withdraw close to 270000 just to net 200000 that you need to pay off your mortgage and thats without accounting for state income taxes. Disbursement help free help.

Not only are you. On top of that youll also owe income tax on the 45000. Annons Non Resident Alien from the US Retirement Withdrawal 401k US.

Paying off the mortgage with a 401k. Using a 401k to pay off a mortgage is possible but it might not be the most prudent decision. Mortgage interest may be tax deductible but it is still an expense many would like to avoid.

So about that possible tax loophole. Pulling money from retirement accounts or IRA to pay down. Heres what Eric Smith a.

With a Roth 401 k your contributions are made after taxes so there are no income taxes due when you withdraw your money. If your investing causes the account to double and you pay the 35 tax on the way out your 65000 doubles to 130000. 401k loans are capped at half of the amount in your account and you must pay them back with.

If the money in your 401k is tax-deferred youre going to be paying income taxes on every dollar you withdraw. Disbursement help free help. Seven months ago before I knew about my termination my wife and I decided to extract 180000 to pay off the mortgage.

It applies to first-time homeowners but not to paying off an existing mortgage. If you decide to take money out of your 401k plan before you are 59 12 years old you will pay a 10 early withdrawal penalty regardless of your contributions or the total amount withdrawn. Suppose you take 45000 from your 401k to pay off debt.

If there were no such things as. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax. Some might decide to cash out a portion of their 401k to pay off the balance of their mortgage.

The IRS has specific rules about how to avoid a penalty for using 401k to pay off house. Finally also keep in mind the low interest rate of 475 percent youre paying on your mortgage compared to the 364 percent rate of return youre say your wife is. Annons Non Resident Alien from the US Retirement Withdrawal 401k US.

I have a 401 k as a retirement fund and accumulated about 300000. Cashing out your 401k and using the proceeds to pay off your mortgage lets you borrow at a low rate and invest at a high rate and do so at no risk. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax.

6 Considerations For Retirees To Pay Off Your Mortgage Early

6 Considerations For Retirees To Pay Off Your Mortgage Early

401 K To Pay Off Mortgage Smart To Invest For Retirement

401 K To Pay Off Mortgage Smart To Invest For Retirement

/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-011-476fff8e835242c39a99ce76c52e8764.jpg) 4 Reasons To Borrow From Your 401 K

4 Reasons To Borrow From Your 401 K

Paying Off Your Mortgage With Your 401k Good Idea Youtube

Paying Off Your Mortgage With Your 401k Good Idea Youtube

Should You Pay Off Your Mortgage With Your 401 K

Should You Pay Off Your Mortgage With Your 401 K

/shutterstock_212927503-5bfc362fc9e77c005145f74a.jpg) Using Your 401 K To Pay Off A Mortgage

Using Your 401 K To Pay Off A Mortgage

/Facts-about-401k-loans-9b8c3bd3d0314c338c0a50bc3c75728c.gif) What You Need To Know About 401 K Loans Before You Take One

What You Need To Know About 401 K Loans Before You Take One

Pay Off Mortgage Early Or Invest The Complete Guide

Pay Off Mortgage Early Or Invest The Complete Guide

Should You Pay Off Your Mortgage Early 6 Pros And Cons

Should You Pay Off Your Mortgage Early 6 Pros And Cons

/dotdash_Final_4_Reasons_to_Borrow_From_Your_401k_Apr_2020-011-476fff8e835242c39a99ce76c52e8764.jpg) 4 Reasons To Borrow From Your 401 K

4 Reasons To Borrow From Your 401 K

The Best Way To Pay Off Your Mortgage A Complete Guide Money Under 30

The Best Way To Pay Off Your Mortgage A Complete Guide Money Under 30

Ask An Ex Banker Mortgages Part Ii Should I Pay My Mortgage Early Bankers Anonymous

Why We Used An Ira Withdrawal To Pay Off The Mortgage

Why We Used An Ira Withdrawal To Pay Off The Mortgage

Given Current Rates Could Cashing Out Your 401 K To Pay Off Your Mortgage Make You A Bundle

Given Current Rates Could Cashing Out Your 401 K To Pay Off Your Mortgage Make You A Bundle

Comments

Post a Comment