Featured

Starting 401k At 40

Just like the title says Ive started to contribute to my 401k at the age of 40. The value of your 401k at retirement is a function of how much you contribute the matching provided by your employer and the appreciation of your 401k assets.

Why The Median 401 K Retirement Balance By Age Is Dangerously Low

Why The Median 401 K Retirement Balance By Age Is Dangerously Low

At your age in 2021 as in 2020 youre legally allowed to save 19500 in a 401k retirement plan.

Starting 401k at 40. Be confident about your retirement. You are not likely to have more kids at age of 40. The maximum total amount that can be contributed by you and your employee is 49000.

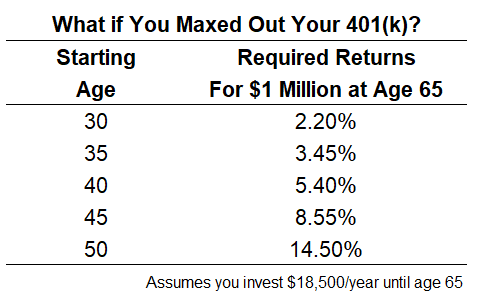

How to Start a 401 k Plan With No Retirement Savings Over 40 Step 1. I feel so stupid that Ive wasted all this timeIts been almost a whole year since Ive started. For example a 40-year-old who wants 1 million by the time shes 67 must save 10000 a year for the next 27 years and earn 9 percent a year to reach that goal.

By your mid-40s you should have two to three times your annual salary saved. The heavier costs of pregnancy to toddler years are over. By adding an IRA you can invest an additional 6000 a year and at 50 that goes up to 7000.

Now we only have one contributing to a 401k. Here are the details from the IRS website about contribution limits. Plan to hold off until thenor at least till youre 68 or 69to claim benefits if your financial situation and health allow it.

The IRS allows. Payments rise about 8 for each year you defer claiming Social Security past your full retirement age 67 for a present-day 40-year-old until the maximum retirement age of 70. The safe harbor plan is pretty close to the traditional 401 k with a few differences.

Make your investment choices. Find an investing pro in your area today. A 401k is the simplest way to double your money quickly with the company match and deferred taxes.

For 2015 annual plan contributions for a SEP-IRA is up to 52000 SIMPLE IRA is up to 12500 plus an employer contribution of 3 of income and the Solo 401 k is up to 53000. By this age a few things would have been in place and stabilised. We didnt always contribute the max but did in later years.

Im contributing 4 pre tax wi. To calculate your 401k at retirement we look at both your existing 401k balance and your anticipated future contributions and then apply a rate of return to estimate how your. Now run your numbers through the AARPs.

Assume youre 40 years old with 0 in retirement savings. So if youre over 50 try to hit those targets as much as possible. The 401k contribution limit is 17500 per year and if youre over 50 you can add another 5500 to that as a catch up contribution.

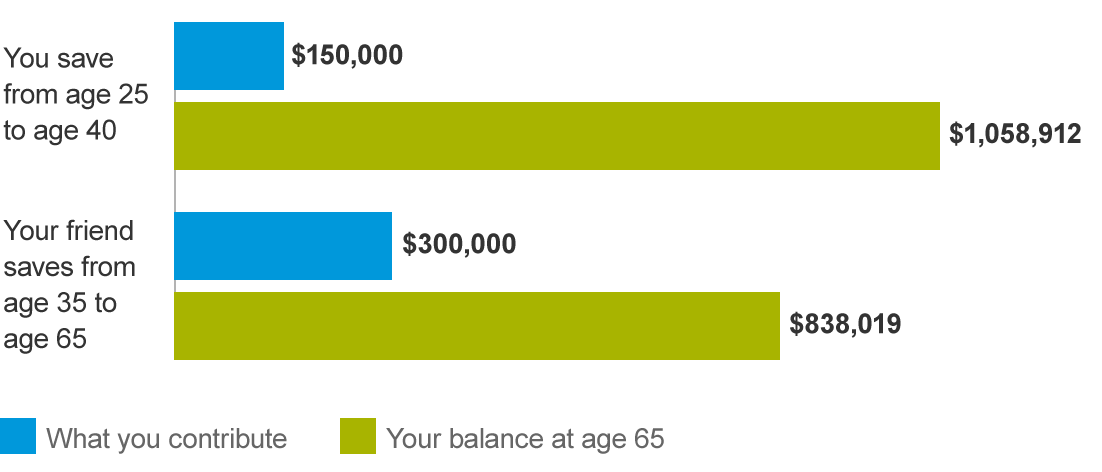

Utilizing a 401k is a great way to jump-start your savings. Its 26000 if youre 50 or over Those are the maximums set by the Internal Revenue Service IRS for the 2020 and 2021 tax years. Your friend starts saving at age 35 and saves the same 10000 a year for the next 30 years until you both retire.

The limits on 401k contributions are even better. Use a Calculator You dont have to be amazing at math to figure out what you need. Its a nice cushion but seems so far into the future that we will.

You dont have to tell me. At ages 40 and 41 just last month our 401ks just crossed the 1 million mark. For example a 40-year-old earning 50000 a year can expect benefits of 1517 per month if she retires at age 65 or 1766 if she waits until age 67.

And yes thats two to three times your current salary not your starting salary. We had two family members contributing to 401ks. By 50 years old you should have at least five years worth of income in your 401k.

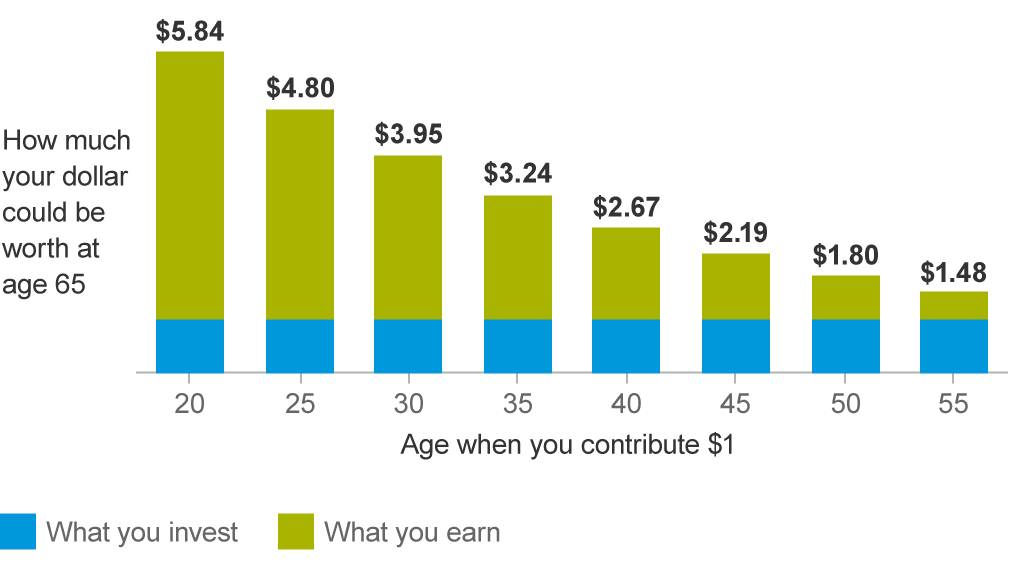

The selection varies by employer but at age 40 you might want to avoid. But at age 40 you need to stop saving for some reason. At that point all else equal youll have more money than your friend despite having put away only half as much.

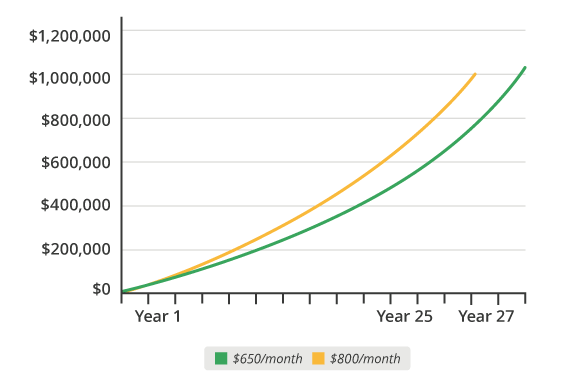

That means if you were making 80000 by the time you turned 40 you should have at least 240000 saved in your 401k. Pick up the necessary forms from the human resources department or benefits administrator of your employer or. In order to retire with 1 million in 25 years a 40-year-old just getting started would need to invest 800 a montha little less than 20 of the average 50000 income.

Keep in mind many 401k plans allow contributions to be matched up to a certain percentage so its wise to take advantage of these offers. Before the age 40 you have many other possible cost to prioritise over your own retirement. For instance under most of these safe harbor plans mandatory employer contributions must be fully vested when theyre made.

By 40 years old you should have at least three years worth of income in your 401k.

401k Savings By Age How Much Should You Save For Retirement

401k Savings By Age How Much Should You Save For Retirement

401k Savings By Age How Much Should You Save For Retirement

401k Savings By Age How Much Should You Save For Retirement

When To Start Saving For Retirement Vanguard

When To Start Saving For Retirement Vanguard

40 With No Savings How To Retire A Millionaire Ramseysolutions Com

40 With No Savings How To Retire A Millionaire Ramseysolutions Com

The Difference In Retirement Savings If You Start At 25 Vs 35

How Much Should I Have In My 401k During My 20 S 30 S 40 S And 50 S

How Much Should I Have In My 401k During My 20 S 30 S 40 S And 50 S

401k Savings By Age How Much Should You Save For Retirement

401k Savings By Age How Much Should You Save For Retirement

How Hard Is It To Become A 401 K Millionaire

How Hard Is It To Become A 401 K Millionaire

How Much Should I Have In My 401k At 40 Financial Samurai

How Much Should I Have In My 401k At 40 Financial Samurai

/how-much-should-i-put-in-my-401k-410a513b95894b9db05bb2897cec881e.png) How Much Should I Put Aside For Retirement

How Much Should I Put Aside For Retirement

/saving-for-retirement-with-a-late-start-38e3bb030ef242649b53f1ad16826b10.png) 7 Tips For Saving For Retirement If You Started Late

7 Tips For Saving For Retirement If You Started Late

/dotdash_final_6-Late-Stage-Retirement-Catch-Up-Tactics_Feb_2020-4c3d3dd8ab49428bb2f04afdb7b72948.jpg) 6 Late Stage Retirement Catch Up Tactics

6 Late Stage Retirement Catch Up Tactics

Why Now Is A Good Time To Invest For Retirement

Why Now Is A Good Time To Invest For Retirement

When To Start Saving For Retirement Vanguard

When To Start Saving For Retirement Vanguard

Comments

Post a Comment