Featured

Snowball Debt Payoff

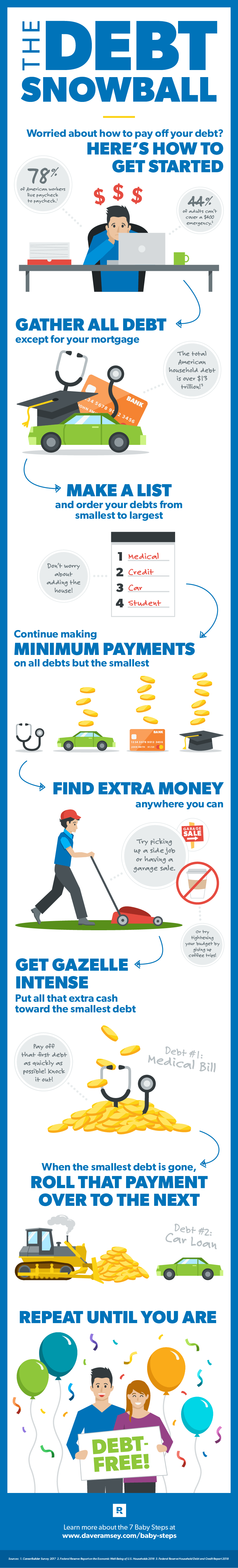

The debt snowball method is a debt reduction strategy in which you pay off bills in order of smallest to largest regardless of interest rate. The debt snowball plan is a strategy to pay off debts in order one by one by rolling your payments over like a snowball from one debt to the next.

My 2019 Debt Pay Off Plan Debt Snowball Method Romina Vasquez Youtube

My 2019 Debt Pay Off Plan Debt Snowball Method Romina Vasquez Youtube

The reason for this is that often times people have a lot of little debts lying around.

Snowball debt payoff. 1000 50 minimum payment 740 PAID OFF. According to Dave momentum is the key to reducing and eliminating debt. Use the Snowball Technique.

The snowball technique works great if you have several loans that you are trying to pay off. It is also incredibly easy to use thanks to the brilliant software Microsoft Excel. What Is The Snowball Debt Payoff Method.

Next enter a monthly dollar amount you could add to your accelerated debt payoff plan. Now we are able to see the finish line of our debt that seems never-ending and I wanted to share with you the total truth about how I really feel about debt payoff after 3 intentional years. Then click the Calculate Results button.

Lots of minimum payments to pay and it gets overwhelming. The debt snowball is designed to help you change how you behave with money so. Using the Dave Ramsey Debt Snowball we paid off 6000 in 6 months.

How Does the Debt Snowball Method Work. Any place you can save is money you can put toward the debt payoff. Hopefully you can find places to trim monthly spending to pay off your debt.

Debt Snowball A debt consolidation loan typically has a 5-year payoff period at a fixed interest rate. Debt snowball plans and debt avalanche plans only work when you have extra cash to put toward the top priority account. Although I may make a commission all.

This post may contain affiliate links. Debt A- 5k at 12 Debt B-. Ordered from smallest balance to highest balance enter the name current balance interest rate and minimum payment amount for all of your debts up to a maximum of 10 debts.

In this video I show you how to pay off debt using the Debt Snowball or the Debt Avalanche method. If you dont have a budget this is a good time to start. However the debt would be paid off in five fewer months at a total cost of 3428113.

With the debt snowball method you pay off your debts from smallest balance to largest balance regardless of interest rates. If the borrower got the loan at 18 APR the monthly payments would be 57135 or about 6 a month more than the snowball method. However youd now be paying the freed up money from debt 1 to debt 2 in addition to the minimum payment.

By month two you would have paid off debt 1. List your debts from smallest to largest regardless of interest rate. Debt Snowball Calculator The Power of Rollover Payments This calculator uses rollover payments to accelerate your payoff plan to get you debt free as soon as possible.

You can order your list of debts by interest rate or balance the choice is yours. The debt snowball method. This technique made popular by financial guru Dave Ramsey is an especially great technique to try if you are having trouble getting motivated to pay off your debt.

He used the snowball method to pay off roughly 100000 worth of debt including his mortgage. Pay as much as possible on your smallest debt. Billys Debt Snowball Calculator Begin the process of paying off your debts faster by entering your debts below.

There are two fundamental differences between the Debt Sno. It will allow you to forecast exactly how much longer it will take for you to achieve your goals. Debts 3 and 4 would still only receive the minimum payment.

When using this technique to pay off your debt quickly the trick is to pay off the loan with the lowest balance first. In this article we will discuss an effective debt reduction technique the Snowball Method. The snowball method was made popular by Dave Ramsey author and radio talk show host.

But its more than a method for paying off bills. The strategy worked so well for Sall that he decided to share his spreadsheet for paying back debt. Order the debts starting with the fewest months you have until paid off with a minimum payment NOT by the highest interest or largest balance.

The Debt Snowball Method is a five-step approach to debt reduction. If you do have a budget take this opportunity to give it a fresh look. Make minimum payments on all your debts except the smallest.

Debt Consolidation Loan vs. Lots of statements coming every month. She will focus on paying Debt A first then move on to Debt B.

Lets get straight into it. Sallie decides to try the snowball method she organizes her debts from lowest to highest balance below. Repeat until each debt is paid in full.

Snowball Debt Payoff Spreadsheet excel will allow you to easily calculate and determine exactly how much you need to pay on which debt and when. The way it works is that you throw everything you have at the first debt in line to be paid off.

Spreadsheet For Using Snowball Method To Pay Off Debt

Debt Snowball Can Pay Off 6 000 In 6 Months Here S How

Debt Snowball Can Pay Off 6 000 In 6 Months Here S How

How The Debt Snowball Method Works Ramseysolutions Com

How The Debt Snowball Method Works Ramseysolutions Com

It S Easy To Pay Off Debt Quickly With Dave Ramsey S Debt Snowball Method Track Your Monthly Payme Debt Payoff Worksheet Debt Snowball Debt Snowball Worksheet

It S Easy To Pay Off Debt Quickly With Dave Ramsey S Debt Snowball Method Track Your Monthly Payme Debt Payoff Worksheet Debt Snowball Debt Snowball Worksheet

![]() Debt Payoff Charts And Trackers

Debt Payoff Charts And Trackers

Free Printable Debt Snowball Worksheet Pay Down Your Debt

Free Printable Debt Snowball Worksheet Pay Down Your Debt

Debt Snowball Worksheet Free Printable Debt Snowball Worksheet Budgeting Budgeting Money

Debt Snowball Worksheet Free Printable Debt Snowball Worksheet Budgeting Budgeting Money

Free Debt Snowball Printable Worksheet Track Your Debt Payoff

Free Debt Snowball Printable Worksheet Track Your Debt Payoff

It S Easy To Pay Off Debt Quickly With Dave Ramsey S Debt Snowball Method Track Your Monthly Pay Debt Snowball Printable Debt Snowball Debt Snowball Worksheet

It S Easy To Pay Off Debt Quickly With Dave Ramsey S Debt Snowball Method Track Your Monthly Pay Debt Snowball Printable Debt Snowball Debt Snowball Worksheet

How To Create A Debt Payoff Plan Lauren Greutman

How To Create A Debt Payoff Plan Lauren Greutman

Debt Payoff Plan Chart Debt Snowball Method Printable At Printable Planning For Only 5 00

Debt Snowball Vs Debt Avalanche Which Is The Best Debt Payoff Strategy Youtube

Debt Snowball Vs Debt Avalanche Which Is The Best Debt Payoff Strategy Youtube

Free Printable Debt Snowball Worksheet Pay Down Your Debt Debt Snowball Worksheet Debt Snowball Free Budget Printables

Free Printable Debt Snowball Worksheet Pay Down Your Debt Debt Snowball Worksheet Debt Snowball Free Budget Printables

Snowball Vs Avalanche What S The Best Way To Pay Off Debt

Snowball Vs Avalanche What S The Best Way To Pay Off Debt

Comments

Post a Comment