Featured

- Get link

- X

- Other Apps

Can I Get An Fha Loan With Bad Credit

The good news is that you should be eligible for an FHA streamline refinance. It also depends on how you handle your finances before you apply for the loan.

Minimum Credit Scores For Fha Loans

Minimum Credit Scores For Fha Loans

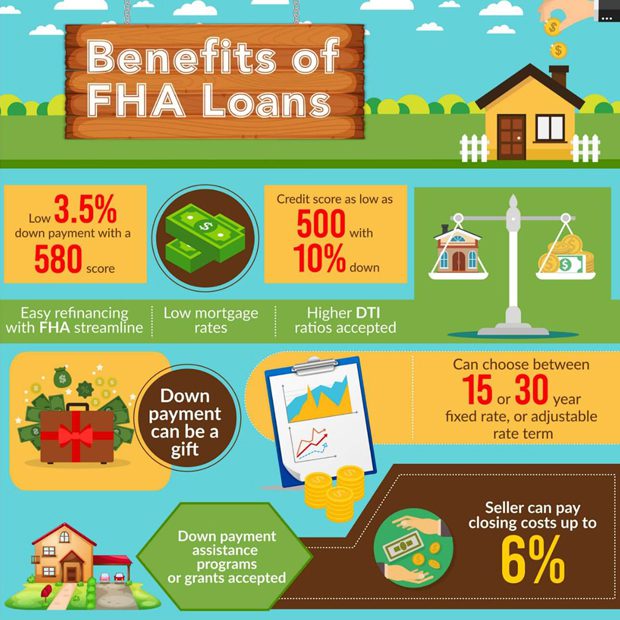

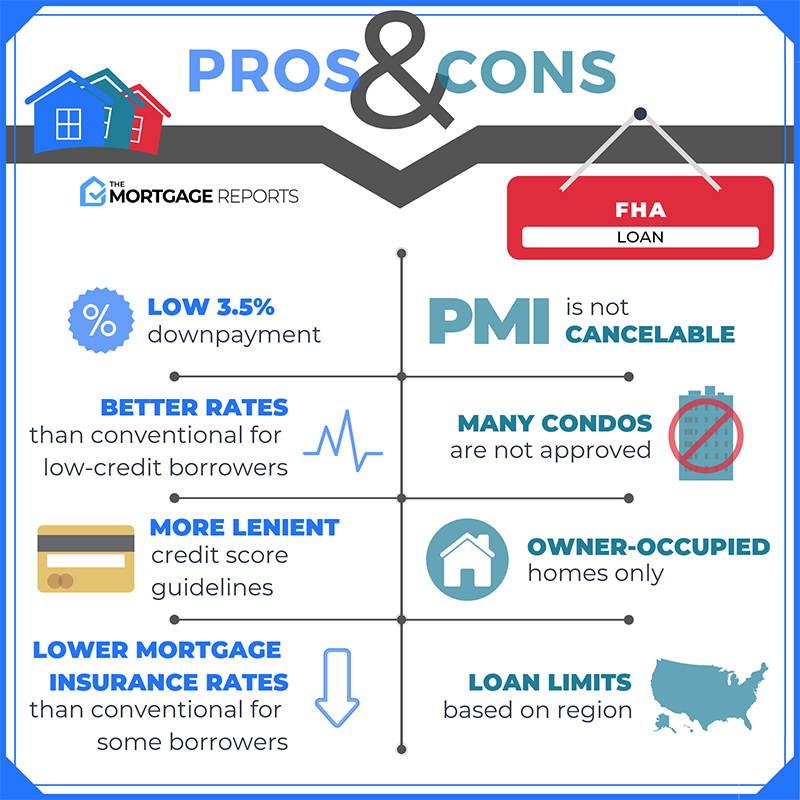

For borrowers with a credit score between 500-579 you may still qualify for an FHA loan but will be required to put 10 down.

Can i get an fha loan with bad credit. Borrowers who are in the process of fixing bad credit catching up on their payments or trying to improve their overall credit situation have enough to manage without the added complication of trying to repair or salvage a home damaged in a. The FHA requires that borrowers have a credit score above 500 to qualify for an FHA-backed loan and a score of 580 or higher to qualify for the lowest down payment amount. Keep in mind that in order to qualify for a 35 down payment you must have at least a 580 credit score.

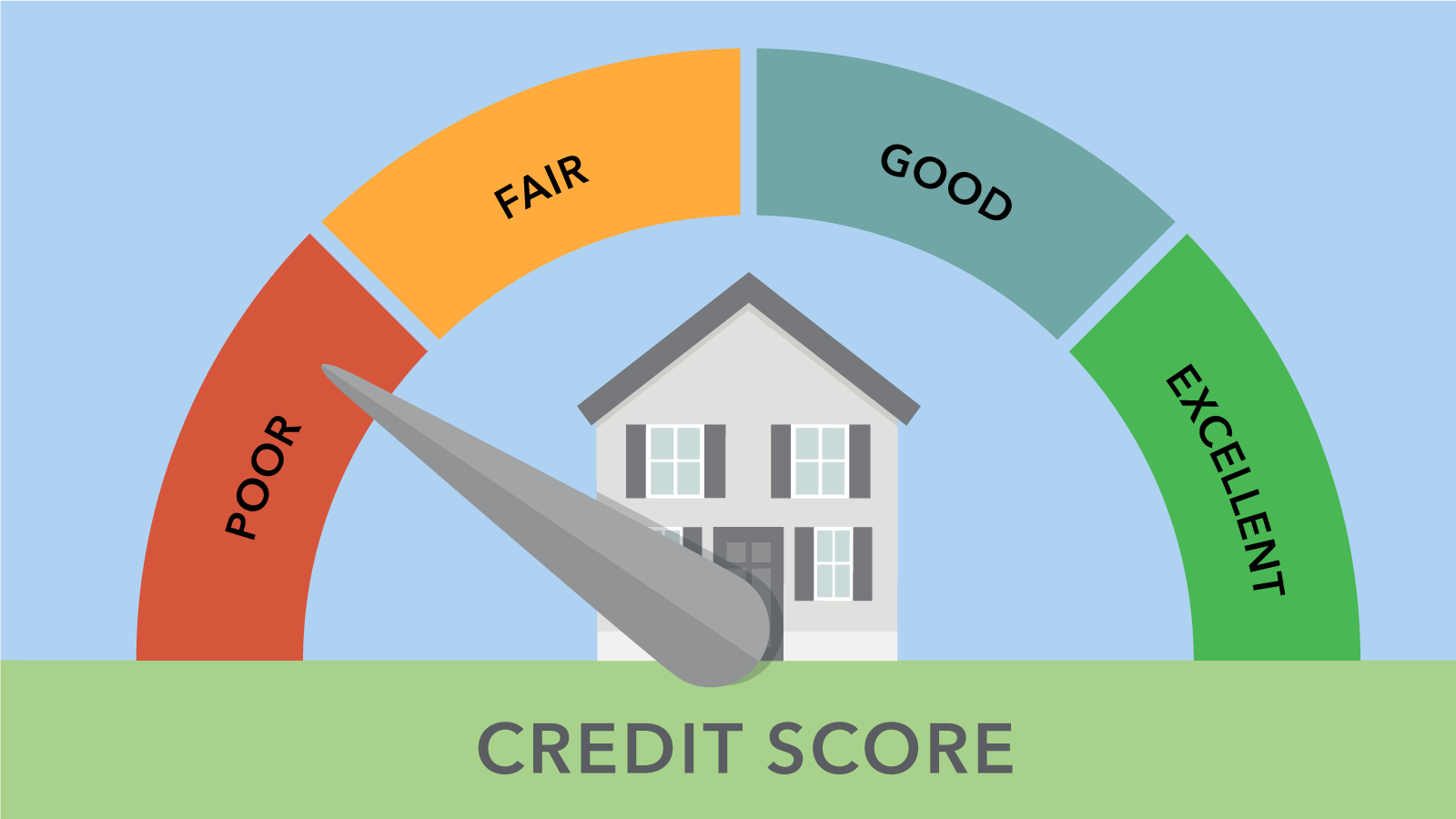

You have to maintain a good credit history and a credit score above 620 to get a conventional loan. THe FICO score ranges mentioned above are the specific credit score numbers required for an FHA mortgage loan with the lowest down payment or an adjusted down payment based on the lenders assessment of you as a credit risk as related to your credit. If your credit score is below 580 however you arent necessarily excluded from FHA loan eligibility.

However the pandemic has made lenders tighten their credit score requirements and it will be very challenging to qualify for an FHA loan with a credit score below 580. Can I get an FHA loan with a 550 credit score. There are several pieces of your financial health that a lender will look at but there are options for those with credit challenges.

Technically speaking the FHA loan program does not have a bad credit loan provision. In fact the down payment you put down isnt even required to be your own money it can also be a gift or loan. But the Federal Housing Administration comes with program to help individuals that have bad credit get authorized for home financing loan.

For those interested in applying for an FHA loan applicants are now required to have a minimum FICO score of 580 to qualify for the low down payment advantage which is currently at around 35 percent. If your score falls between 500 and 579 you can still qualify for an FHA loan but youll need to make a. The minimum credit score for an FHA loan is 500.

Technically the FHA will guarantee a mortgage for borrowers with at least a 500 credit score with a 10 down payment. If your credit is below 500 youll need to work on your credit before you can qualify. An FHA loan is a great option for buyers who have less-than-perfect credit scores or dont have enough money for a traditional 20 down payment.

The reality is the fact that conventional mortgage brokers generally stay away from bad credit. HUD requires no credit check and no appraisal is required on the property being refinanced and depending on how old your loan is the lender may not even require income or employment verification. The bottom line is that you can get an FHA loan with bad credit.

You can easily qualify for the FHA loan with a credit score as low as 500 with a down payment of 10. Yes it is possible to get approved for FHA loans for bad credit even if your middle credit score is 500. Conventional loans are difficult to qualify for with a credit score lower than 620.

0 votes I know my credit is not what it should be but Id really like to get out of renting sooner or later been in rentals for like 8 years now. FHA Loans for Borrowers with a 570 Credit Score. The most common type of loan available to borrowers with a 570 credit score is an FHA loan.

Can I get a loan with a 500 credit score. Can I get an FHA loan with a 500 credit score. You have to make your financial situation look as attractive as possible.

Furthermore can I get an FHA loan with poor credit. Credit scores between 500 and 580 do qualify. If youre thinking about applying for an FHA loan heres what you need to know.

That question is a serious one in the wake of natural disasters such as Hurricane Harvey and Hurricane Irma. It just depends on the lender you use. If you have a steady income that allows you to make a monthly mortgage payment you may be able to get an FHA home loan even with bad credit.

But if you are below 550 credit score it can become a bit more challenging. FHA loans can be a good option for borrowers with low credit scores and limited money available for a down payment. Can I get an FHA 203h rehab loan with bad credit.

The maximum DTI to qualify for an FHA mortgage is 31. The Federal Housing Administration FHA provides mortgage insurance for loans through FHA-approved lenders known as FHA loans. However many lenders will prefer a credit score above 620.

ItвЂs important to know that the FHA loan is not actually the FHA financing you money to get a property. No matter how bad your credit is in the past you have to show that you overcame that. However the FHA requires a 10 percent down payment.

Could An Fha Loan Be The Loan For You Michigan Mortgage

Could An Fha Loan Be The Loan For You Michigan Mortgage

Fha Loans 2021 Loan Requirements Guidelines How To Qualify

Fha Loans 2021 Loan Requirements Guidelines How To Qualify

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

How To Get An Fha Loan With Bad Credit In 2021 The Lenders Network

How To Get An Fha Loan With Bad Credit In 2021 The Lenders Network

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Vs Conventional Which Low Down Payment Loan Is Best

Fha Vs Conventional Which Low Down Payment Loan Is Best

What Is An Fha Loan Credit Com

Fha Credit Requirements For 2021 Fha Lenders

Fha Credit Requirements For 2021 Fha Lenders

Fha Loan What To Know 2021 Guidelines Nerdwallet

Fha Loan What To Know 2021 Guidelines Nerdwallet

How To Deal With Bad Credit Or No Credit When You Want To Buy A Home Consumer Financial Protection Bureau

How To Deal With Bad Credit Or No Credit When You Want To Buy A Home Consumer Financial Protection Bureau

How To Get Fha Loans For Bad Credit Everything You Need To Know

How To Get Fha Loans For Bad Credit Everything You Need To Know

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval

Fha Criteria For 2012 Borrowers Can Expect More Of The Same

Fha Loan Guide Requirements Rates And Benefits 2021

Fha Loan Guide Requirements Rates And Benefits 2021

Comments

Post a Comment