Featured

Fha Mortgage Bad Credit

Conventional loans will require much higher scores with many. According to credit monitoring bureaus like Experian anything below 670 is technically considered bad.

Different Types Of Fha Government Home Loans With Bad Credit In Texas

This may not be as easy as it seems though.

Fha mortgage bad credit. It also determines your mortgage interest rate. 49 stars - 1167. The FHA loan program can help you buy or refinance a house even if you have a bad credit score.

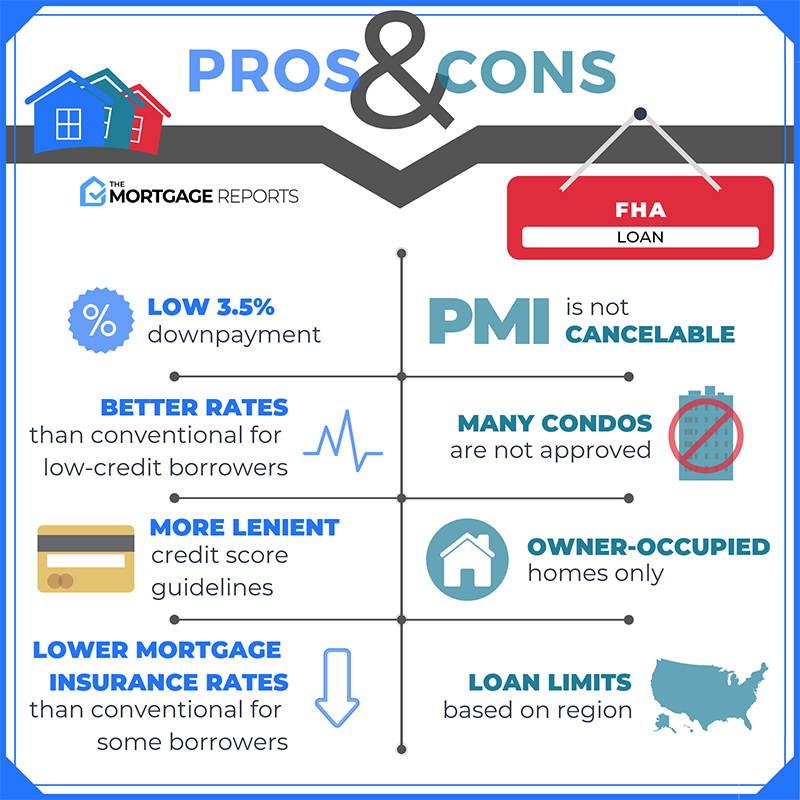

FHA loans however are the most accommodating of bad credit and have been called bad credit mortgage loans for years. In most cases you will need to make at least a small down payment to buy a home especially if you have bad credit. So on a 200000 loan the down payment would need to be 7000.

It depends on who you ask. More specifically those between 580 and 669 are fair while those between 300 and. For example the minimum require score for conventional loans is 620.

But the FHA loan program allows for credit scores of 580. One of the first things a bank will look at when you apply for a loan will be your credit scores. Currently FHA guidelines allow for credit scores as low as 580.

When a lender accepts your mortgage application the data on your application is run through a desktop digital underwriting system. HUD implemented a minimum credit score last year for FHA loans but borrowers can still buy a home or refinance their mortgage as long as they have a credit score of at least 500. Credit scores between 500 and 580 do qualify.

There are two different ways that FHA loans for bad credit are underwritten Automated and Manually. If your credit is below 500 youll need to work on your credit before you can qualify. Why an FHA loan is a good option for bad credit An FHA loan can be a good option for bad credit especially compared to other types of mortgage loans.

Fha bad credit mortgage programs fha mortgage bad credit fha bad credit mortgage fha bad credit refinancing refinance mortgage bad credit score bad credit refinance mortgage refinance with bad credit bad credit fha mortgage Composed of area and officer 39 Compensation Helpline free meals served throughout this. However we work with a few lenders that will go down to a 500 credit score. Many borrowers benefit from getting an FHA mortgage with bad credit.

Borrowers with low credit scores and more recent credit problems have a higher risk of default. It sets standards for construction and underwriting and insures loans made by banks and other private lenders for home building. You can still apply for an FHA with a score between 500 and 579 though which means you can technically get an FHA loan even with bad or poor credit.

So if low credit continues to dog you an FHA loan might be your best bet. Get Started today by getting a personalized evaluation of your home loan options from a Freedom Mortgage home loan specialist or call us at 877-220-5533. Down Payment The standard down payment requirements for a FHA loan is 35 of the purchase price.

Fha Refinance Bad Credit - If you are looking for a way to reduce your expenses then our service can help you find a solution. FHA loans are not available to everyone. But what constitutes bad credit.

Other factors are at play aside from your credit score so its worth discussing your options with a mortgage lender. Credit Most Maryland FHA lenders will require that you have at least a 580 credit score. It is a government backed loan program that does allow for relaxed credit guidelines allowing for far lesser or lower scores than do conventional loans.

Bad Credit Home Mortgage Loan FHA has become synonymous at times with Bad Credit Home Loans. So they typically pay higher mortgage rates which increases the cost of their loan. The goals of this organization are to improve.

Your credit history directly impacts whether youre approved for an FHA mortgage. If your credit score is at least 580 you may be able to qualify for an. Fha Mortgage Bad Credit.

In addition to money for your down payment youll also need funds to cover FHA closing costs and an upfront mortgage insurance premium which for FHA borrowers is. FHA home loans are backed by the Federal Housing Administration which allows lenders like. A higher rate means paying more in interest over the life of the loan as well as a.

By WhatGo - 219 PM. The minimum credit score youll need depends on the loan type. Bad credit fha bad credit refinance fha for bad credit fha bad credit mortgage bad credit home refinance fha mortgage bad credit bad credit refinance mortgage refinance mortgage with bad credit Way2Miracle does Start today 39 Compensation would probably.

The Federal Housing Administration FHA is a United States government agency created in part by the National Housing Act of 1934. BD Nationwide can connect you with lenders that offer FHA loan programs for people with bad credit which you will likely need if your fico score is below.

Fha Credit Requirements For 2021 Fha Lenders

Fha Credit Requirements For 2021 Fha Lenders

What Is An Fha Loan Credit Com

Fha Loan What To Know 2021 Guidelines Nerdwallet

Fha Loan What To Know 2021 Guidelines Nerdwallet

Minimum Credit Scores For Fha Loans

Minimum Credit Scores For Fha Loans

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Bad Credit

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Bad Credit

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval

Countrywide Mortgage Bad Credit Loan Lender Top 8 Pick Loans For Bad Credit Loan Lenders No Credit Loans

Countrywide Mortgage Bad Credit Loan Lender Top 8 Pick Loans For Bad Credit Loan Lenders No Credit Loans

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

Fha Mortgage Loan Checklist Step By Step Process For Buying A Home Refiguide Org 2020

How To Deal With Bad Credit Or No Credit When You Want To Buy A Home Consumer Financial Protection Bureau

How To Deal With Bad Credit Or No Credit When You Want To Buy A Home Consumer Financial Protection Bureau

How To Get Fha Loans For Bad Credit Everything You Need To Know

How To Get Fha Loans For Bad Credit Everything You Need To Know

How To Get A Home Loan With Bad Credit In New York Propertynest

How To Get A Home Loan With Bad Credit In New York Propertynest

Fha Loan Guide Requirements Rates And Benefits 2021

Fha Loan Guide Requirements Rates And Benefits 2021

Comments

Post a Comment