Featured

Can The Irs Take Money Out Of Your Bank Account

But in reality the IRS rarely digs deeper into your bank and financial accounts unless youre being audited or the IRS is collecting back taxes from you. The IRS can levy your bank account after certain statutory requirements are met but this doesnt freeze the account.

Can The Irs Take Money From Your Bank Account

Can The Irs Take Money From Your Bank Account

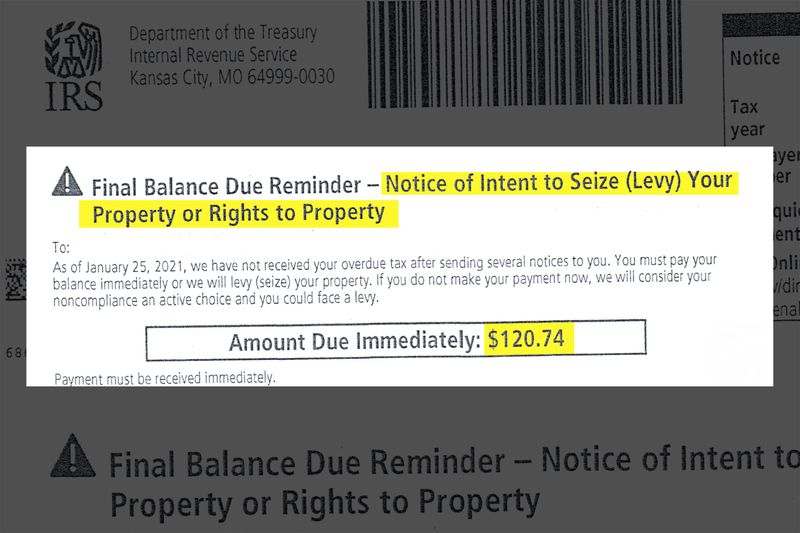

If the IRS has sent repeated notices demanding payment and you havent paid or tried to set up other arrangements the IRS may issue a bank levy.

Can the irs take money out of your bank account. It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real estate and other personal property. Thank you If you set-up a payment for your income tax payment using TurboTax and you did not specify a payment date for the withdrawal TurboTaxs default payment date. States will send a notice that the garnishment will be taking place in addition to any other late notices youve received.

When money is taken from your bank account you usually will know. If so your bank account may be subject to an IRS bank levy. If you didnt in the next couple of days youll have to log on to the link I already provided and input your banking info.

When the IRS serves the levy to the bank the bank places a hold on the funds in the bank account up to the dollar amount on the levy. The bank is required to hold those funds for 21 days and then remit them to the IRS. Department of the Treasury not the IRS requires banks to report deposits and withdrawals of 10000 or more from any savings account.

An IRS bank account levy is when the IRS seizes money from your bank account to cover your tax debt. However it is a legal and sometimes necessary procedure that the government uses to collect owed tax dollars. Generally IRS levies are delivered via the.

This is done in order to seize the funds in your bank account to pay off back taxes that you owe. If you put your checking account on your tax return in 2018 or 2019 you dont have to do anything. An IRS bank levy is typically issued for a one time pull from your bank account but the bank holds those funds for 21 days before forwarding them to the IRS.

When the levy is on a bank account the Internal Revenue Code IRC provides a 21-day waiting period for complying with the levy. When will the IRS take money out of my bank account for the tax that is due. The IRS has loads of information on taxpayers.

The IRS cannot take a stimulus check to pay past due taxes. The procedure is to take the money and have the account-holder fight to get it back. Many people find it shocking that the Internal Revenue Service IRS can take money directly from their bank account.

If you receive an IRS bill titled Final Notice of Intent to Levy and Notice of Your Right to A Hearing contact us right away. The waiting period is intended to allow you time to contact the IRS and arrange to pay the tax or notify the IRS of errors in the levy. The IRS probably already knows about many of your financial accounts and the IRS can get information on how much is there.

If you selected debit from your bank account that information is passed on to the state and IRS and they will do the debit when they process your return information -- usually 1-3 weeks for e-file and 3-4 weeks if mailed in. This is called an IRS bank levy.

Bank Levy Release How To Release An Irs Bank Levy Community Tax

Bank Levy Release How To Release An Irs Bank Levy Community Tax

Can The Irs Take Money From My Bank Account Manassas Law

Can The Irs Take Money From My Bank Account Manassas Law

Bank Levy Release How To Release An Irs Bank Levy Community Tax

Bank Levy Release How To Release An Irs Bank Levy Community Tax

Coronavirus Stimulus Checks Pending How To Make Sure You Get Yours Gv Wire

Coronavirus Stimulus Checks Pending How To Make Sure You Get Yours Gv Wire

Pay Taxes When You Efile Via Direct Debit Or Check On Efile Com

Pay Taxes When You Efile Via Direct Debit Or Check On Efile Com

Irs Notice Cp57 Insufficient Funds Penalty H R Block

Irs Notice Cp57 Insufficient Funds Penalty H R Block

/bank-levy-basics-315527_FINAL-5788135a0c274ffc81b9d8d53e44a1bb.gif) What A Bank Levy Is And How It Works

What A Bank Levy Is And How It Works

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Irs Levy On Business Bank Account What To Do When Business Levied

Irs Levy On Business Bank Account What To Do When Business Levied

:max_bytes(150000):strip_icc()/federal-tax-liens-3193403_final-ae94abda07d54e318b9b6388610fee1f.gif) How A Tax Levy Works And What You Can Do To Stop One

How A Tax Levy Works And What You Can Do To Stop One

Irs Bank Account Levy Can They Really Take All The Money In My Acco

Irs Bank Account Levy Can They Really Take All The Money In My Acco

3rd Stimulus Check Update Irs Updates Get My Payment Tool See When You Ll Get Paid Syracuse Com

3rd Stimulus Check Update Irs Updates Get My Payment Tool See When You Ll Get Paid Syracuse Com

My Stimulus Check Payment Went To The Wrong Or Closed Bank Account Aving To Invest

My Stimulus Check Payment Went To The Wrong Or Closed Bank Account Aving To Invest

Irs Get My Payment Page Status Not Available Error Meaning Usa

Irs Get My Payment Page Status Not Available Error Meaning Usa

Comments

Post a Comment