Featured

1099 R Form Turbotax

Youll get a 1099-R if you received 10 or more from a retirement plan. For Privacy Act and Paperwork Reduction Act Notice see the.

Select Delete next to the unwanted 1099-R and then answer Yes on the following screen.

1099 r form turbotax. Turbotax 1099 Misc Forms. Some of the items included on the form are the gross distribution the amount of the. Usually the 1099-R will show the taxable amount of the distribution on the form itself and will report the amount of federal tax that was withheld.

In this video I show you how to add a 1099-R into taxslayer. Inside TurboTax search for 1099-R and select the Jump to link in the search results. Answer Yes on the Did you get a.

Turbotax Form 1099 B. Income listed on a 1099-R form can be taxable or tax-free and if you have withdrawn money before retirement age may be subject to early. Open continue return if you dont already have it open.

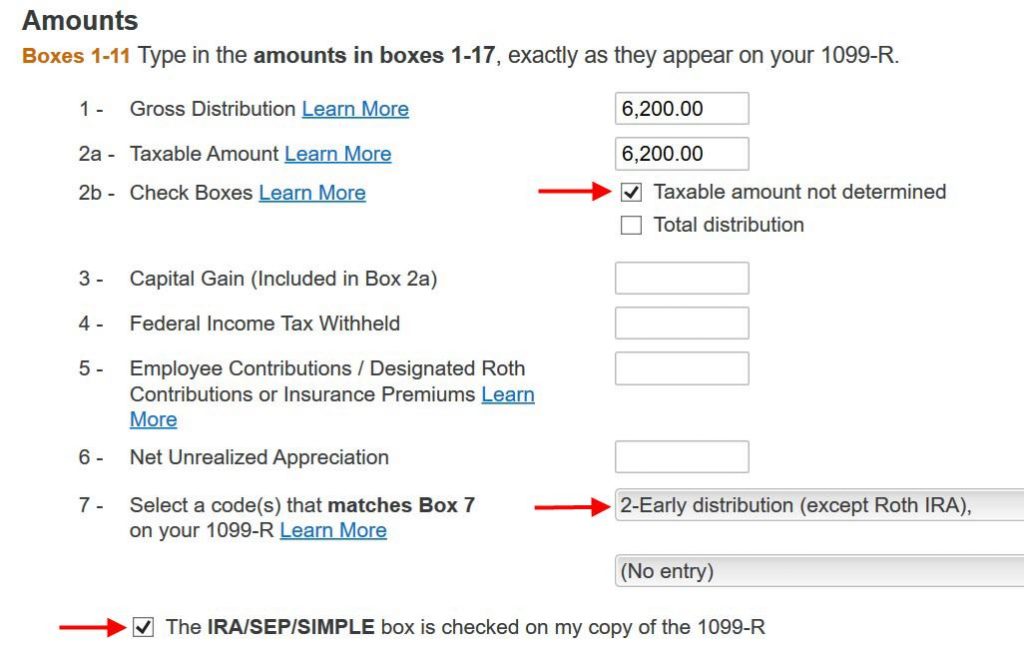

When you come to the Retirement Income section answer Yes because you received a 1099-R from your 401 k plan. Be sure to enter all the information on your 1099-R into TurboTax. Skip this section and wait until the next year.

This will take you to the Your 1099-R Entries screen. Turbotax Form 1099 Int. Heres how to enter your 1099-R in TurboTax.

Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. 24 posts related to Turbotax 1099 R Forms. I have received 2 1099-R from my employer a large company for rollover funds from 401K and Pension Plan because I retired in 2020.

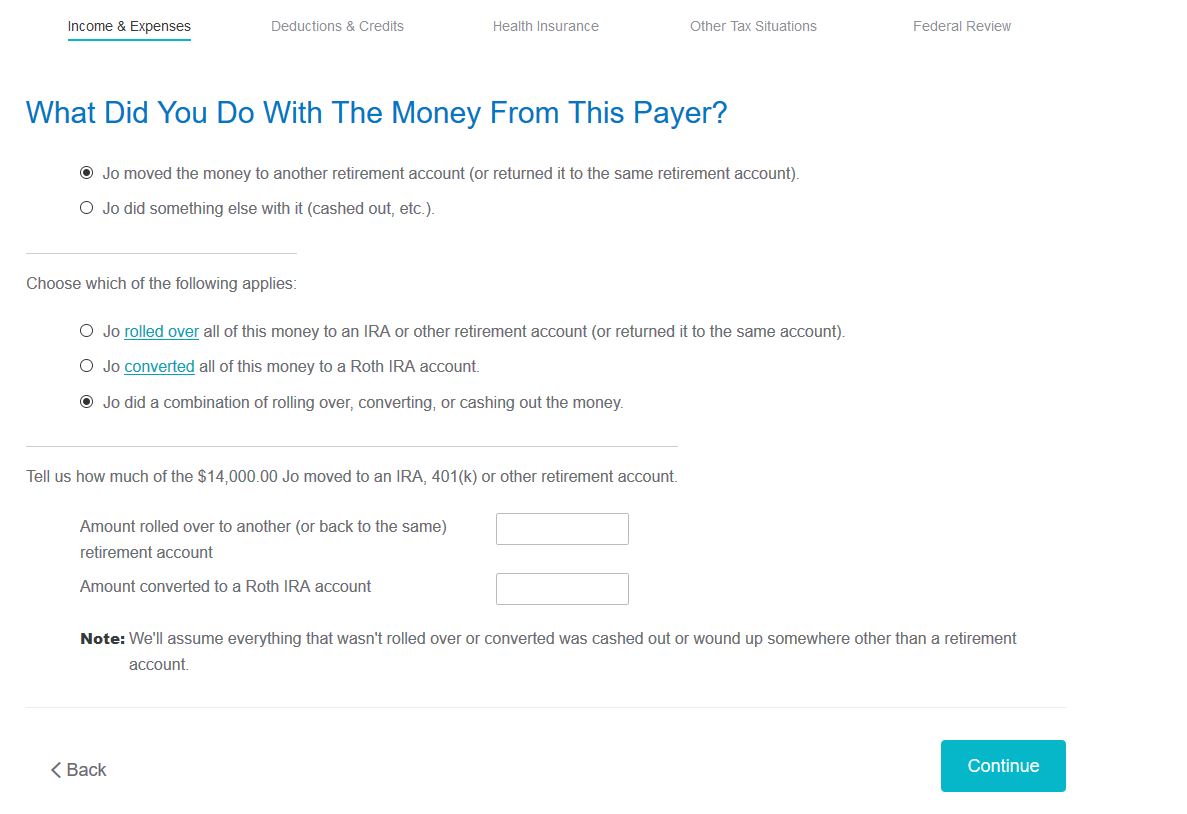

In the United States Form 1099-R is a variant of Form 1099 used for reporting on distributions from pensions annuities retirement or profit sharing plans IRAs charitable gift annuities and Insurance Contracts. Available in mobile app only. When you convert from Traditional IRA to Roth you will receive a 1099-R form.

1099-NEC Snap and Autofill. Or do you need to obtain copies of olde. The form also covers other types of distributions you receive from pension plans annuities and profit-sharing plans.

Turbotax Form 1099 K. How to Recover Your 1099 Form - TurboTax Tax Tip Video - YouTube. Complete this section only if you converted during the year for which you are doing the tax return.

If you only converted during the following year you wont have a 1099-R until next January. Open continue your return if you dont already have it open. File with Form 1096.

Yes you received a 1099-R form. The current version supports the 1099-R in the interview. Turbotax 1099 Quick Employer Forms.

Turbotax Form 1099 G. Turbotax Form 1099 Q. If the IRASIMPLE check box on the Form 1099-R Box 7 you received is not checked verify that it is not checked on the 1099-R entry screen in your tax return in the TurboTax program.

Receiving a Form 1099 can be unpleasant because unlike a Form W-2 it likely reports income that hasnt already been taxed in the form of any withholding. This form is used by numerous different companies and itll help figure out if the company is really a rip-off or not. Go to Federal Taxes - Wages Income - IRA 401 k Pension Plan Withdrawals 1099-R.

Turbotax Form 1099 S. Its easy to see IRS Form 1099 as representing a big liability since it reports income that hasnt already been taxed in the form of withholding. Available in TurboTax Self-Employed and TurboTax Live Self-Employed starting 1252021.

Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income. Code listed in box 7 is G which is correct however the small box in box 7 is not checked in either of them. Both were direct rollover to a managed IRA account.

Copy A For Internal Revenue Service Center. Line 16a or line 16b on Form 1040 is overridden or both are overridden All or a portion of the distribution has been rolled over but it is being taxed To resolve this issue you can try the following. Inside TurboTax search for 1099-R and select the Jump to link in the search results.

Department of the Treasury - Internal Revenue Service OMB No. 1099 R Form On Turbotax Whenever a individual is searching to rent a new occupation the simplest way to discover if theyre employing the proper individual would be to consider the time to complete an IRS 1099 Form. Turbotax Home And Business 2014 And Best Of Turbotax 1099 Forms.

Form 1099-R is filed for each person who has received a distribution of 10 or more from any of the above. Now the entries into TurboTax. A 1099-R form records distributions you received during the year from certain retirement accounts including 401 k 403 b and IRA accounts.

You will receive a Form 1099-R that reports your total withdrawals for the year. The form mode enter will void the TurboTax accuracy guarantee is does not do the same error.

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

How Do I Enter Or Delete 1099 R In Turbotax Turbotax Help

How Do I Enter Or Delete 1099 R In Turbotax Turbotax Help

What To Do Since My 1099 R Form Has States Tax Wit

What To Do Since My 1099 R Form Has States Tax Wit

Solved Where Do I Enter The Information From My 1099 R In Turbotax

Solved Where Do I Enter The Information From My 1099 R In Turbotax

What Does Fatca Mean And Where Is It On My 1099r F

What Does Fatca Mean And Where Is It On My 1099r F

Turbotax Home And Business 2014 And Best Of Turbotax 1099 Forms Vincegray2014

Turbotax Home And Business 2014 And Best Of Turbotax 1099 Forms Vincegray2014

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman

Got Two 1099r From Two Different Tin Numbers Due T

Got Two 1099r From Two Different Tin Numbers Due T

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

How To Report Backdoor Roth In Turbotax A Walkthrough

How To Report Backdoor Roth In Turbotax A Walkthrough

Comments

Post a Comment