Featured

Tennessee State Income Tax

For the 2018 tax year your S corporation had Tennessee net earnings of 500000. Deduct the amount of tax paid from the tax calculation to provide an illustration of your 20212022 tax.

Historical Tennessee Tax Policy Information Ballotpedia

Historical Tennessee Tax Policy Information Ballotpedia

The Tennessee income tax has one tax bracket with a maximum marginal income tax of 100 as of 2021.

Tennessee state income tax. AFP-TN State Director Tori Venable issued the following statement. It was enacted in 1929 and was originally called the Hall income tax for the senator who sponsored the legislation. 9 Zeilen Tennessee Income Taxes.

The corporation will owe excise tax in the amount of 32500 65 of 500000. Sean Pavone Shutterstock Party-loving Tennessee residents pay among the highest sin taxes in the country. However the state does collect taxes on interest and dividends earned on investments a form of income tax known as the Hall tax Enacted in 1929 the Hall tax was previously a 6 tax levied on interest earned on bonds and notes and dividends from stock.

Detailed Tennessee state income tax rates and brackets are available on this page. However the state does collect taxes on interest and dividends earned on investments a form of income tax known as the Hall tax Enacted in 1929 the Hall tax was previously a 6 tax levied on interest earned on bonds and notes and dividends from stock. Qualifying deductions might include an itemized deduction the Tennessee standard deduction exemptions for dependants business expenses etc.

When calculating your Tennessee income tax keep in mind that the Tennessee state income tax brackets are only applied to your adjusted gross income AGI after you have made any qualifying deductions. Tennessee doesnt tax wages but like New Hampshire it does tax interest and dividend income. Donation pages on its site note that donations to TTR are not tax-deductible.

Find your gross income. A 2016 law has begun phasing out the investment income tax and it will disappear in 2020. Within each tax type you will find the definition of the tax tax rates and due dates for returns.

Check the 2021 Tennessee state tax rate and the rules to calculate state income tax. How to Calculate 2021 Tennessee State Income Tax by Using State Income Tax Table. The Hall income tax was a Tennessee state tax on interest and dividend income from investments.

Also the net worth of your corporation which is greater than the value of its real and tangible property is 600000. Tennessee is one of nine states that does not collect a general income tax. It does have however a flat 1 to 2 tax rate that applies to income earned from interest and dividends.

But not for too much longer. The organization was incorporated as a public benefit corporation of Tennessee on October 22 2001. In nearly all appearances in the media and speaking engagements TTR is represented by its spokesman.

Whats the Tennessee Income Tax Rate. Our state is now officially income-tax free helping attract more businesses jobs and retirees. This includes Social Security and income from retirement accounts.

Additionally property taxes in Tennessee are quite low with an average effective rate of just 064. Is an American anti-tax political advocacy group active in the state of Tennessee. It was the only tax on personal income in Tennessee which did not levy a general state income taxThe tax rate prior to 2016 was 6 percent applied to all taxable interest and dividend income over 1250 per person 2500 for married couples filing jointly.

There is no income tax on wages in this state. As Tennessee does not have a standard income tax all forms of retirement income are untaxed at the state level. The Hall income tax is imposed only on individuals and other entities receiving interest from bonds and notes and dividends from stock.

The Hall Income Tax instituted a six percent tax on interest and dividend income for individuals living in Tennessee. The state levies a single-rate income tax on individuals. Calculate your total tax due using the tax calculator update to include the 20212022 tax brackets.

20212022 Tennessee State State Tax Refund Calculator. The Tennessee State State Tax calculator is updated to include the latest State tax rates for 20212022 tax year and will be update to the 20222023 State Tax Tables once fully published as published by the various States. The Center Square The top marginal income tax rate for residents of Tennessee stands at 1 percent according to a new study of state individual income tax rates by the Tax Foundation.

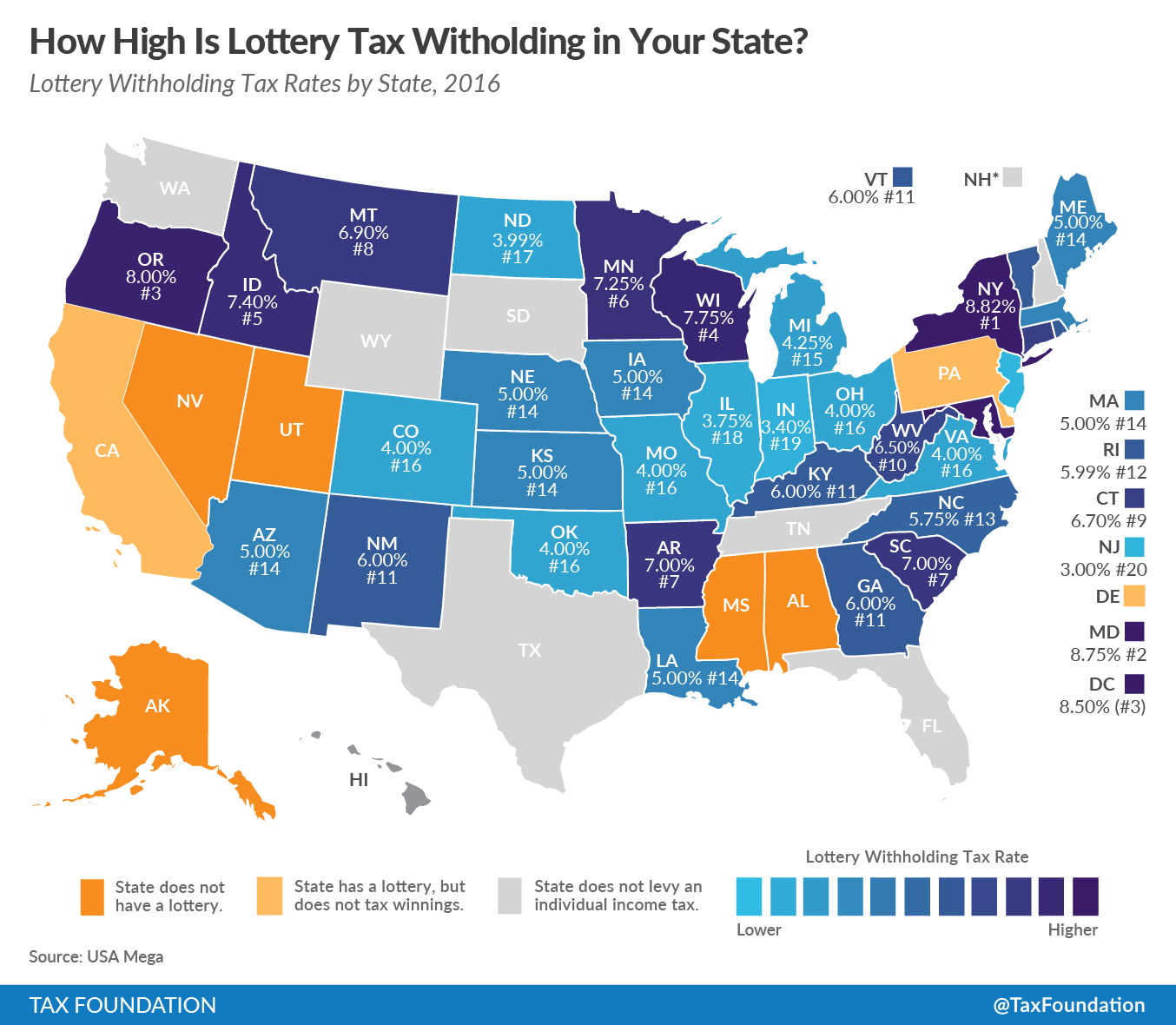

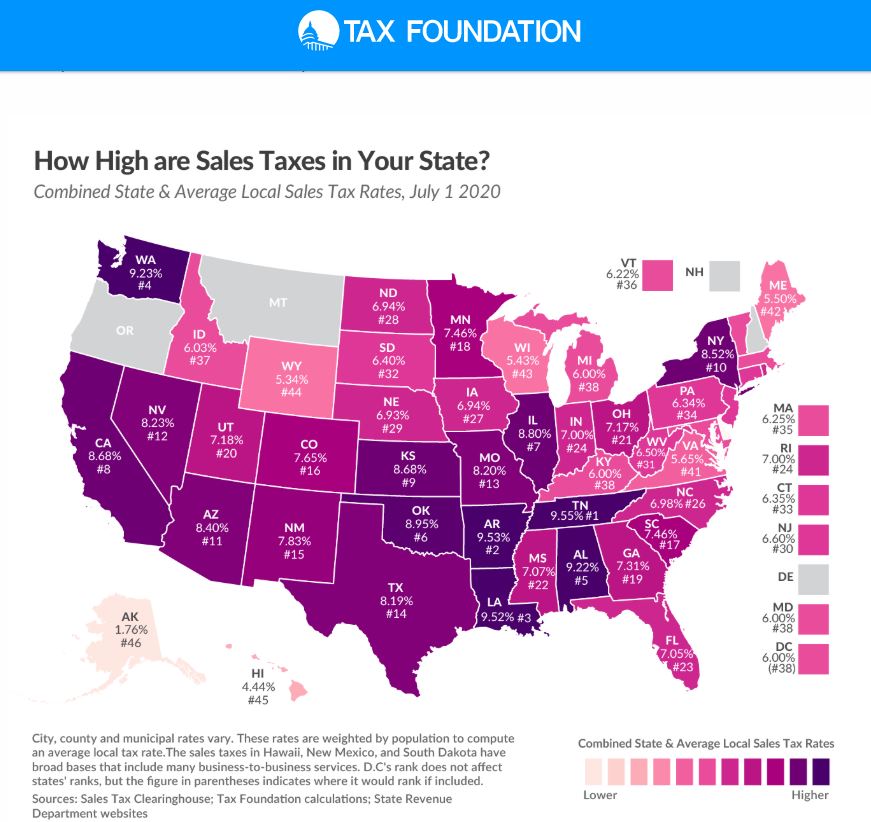

To make up the revenue difference Tennessee charges the third-highest. Eliminating the Hall Tax is a great way to start off the New Year for Tennesseans. Tennessee Tax Revolt Inc.

Therefore the Tennessee income tax rate is 0. Tennessee has no state income tax on salaries wages bonuses. For too long the Hall Tax punished seniors.

Find your pretax deductions including 401K flexible account contributions. Find your income exemptions. The department also assists with the collection of certain local taxes.

The Department of Revenue is responsible for the administration of state tax laws established by the legislature and the collection of taxes and fees associated with those laws. Tennessee is one of nine states that does not collect a general income tax. Information about those taxes is available as well as forms needed.

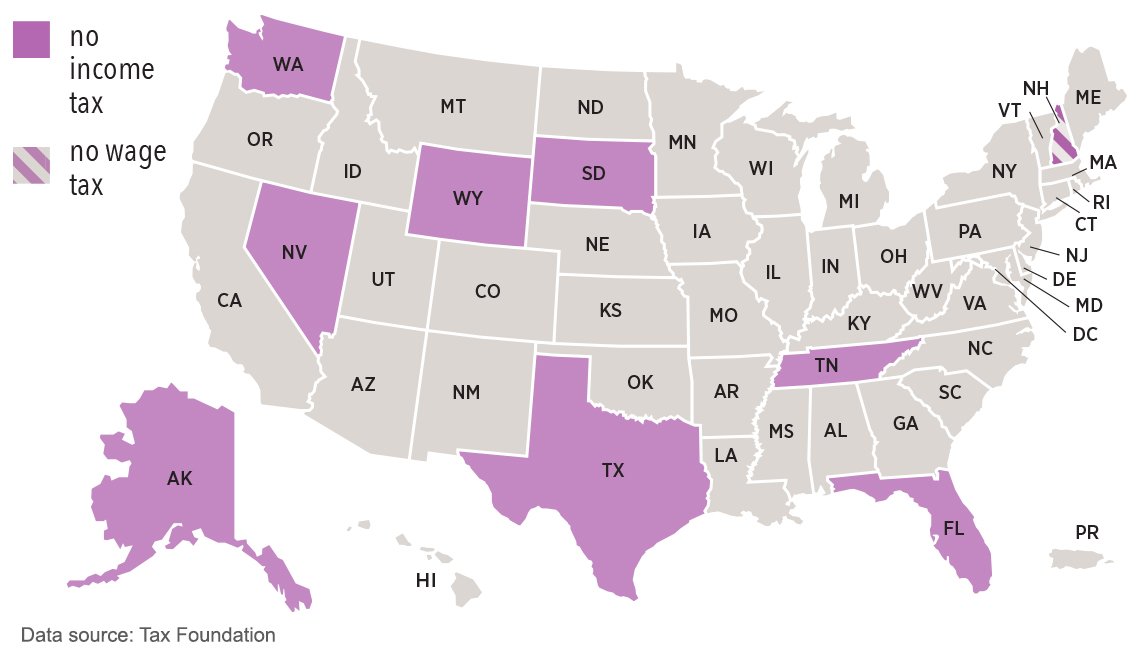

Income Tax Free Tennessee Means That Someone Won The Lottery Twice Tax Foundation

Income Tax Free Tennessee Means That Someone Won The Lottery Twice Tax Foundation

/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png) The Best And Worst States For Sales Taxes

The Best And Worst States For Sales Taxes

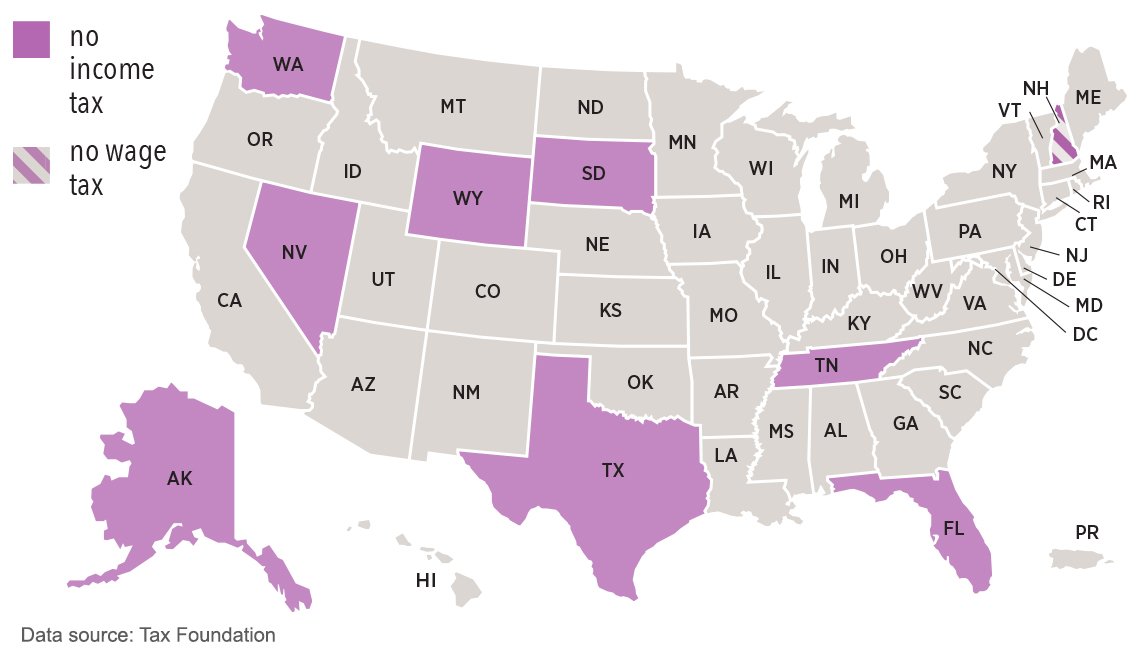

2020 State Individual Income Tax Rates And Brackets Tax Foundation

2020 State Individual Income Tax Rates And Brackets Tax Foundation

Success Tennessee To Phase Out The Hall Tax Tax Foundation

Success Tennessee To Phase Out The Hall Tax Tax Foundation

Tennessee Now Has Highest Sales Tax Nationwide

Tennessee Now Has Highest Sales Tax Nationwide

Kansas Has 9th Highest State And Local Sales Tax Rate The Sentinel

Kansas Has 9th Highest State And Local Sales Tax Rate The Sentinel

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

9 States That Don T Have An Income Tax

9 States That Don T Have An Income Tax

Why Are Tennesseans So Afraid Of An Income Tax Memphis Daily News

Tennessee Income Tax Calculator Smartasset

Tennessee Income Tax Calculator Smartasset

Success Tennessee To Phase Out The Hall Tax Tax Foundation

Success Tennessee To Phase Out The Hall Tax Tax Foundation

7 States Without Income Tax Mintlife Blog

7 States Without Income Tax Mintlife Blog

Tennessee Considers Eliminating Hall Tax American Legislative Exchange Council

Tennessee Considers Eliminating Hall Tax American Legislative Exchange Council

Comments

Post a Comment