Featured

- Get link

- X

- Other Apps

How Do I Start A 401k

Outline who can contribute when they can enroll and how much the employer contributions will be. If youve saved for retirement with a 401k understand when you can start taking distributions your withdrawal options and what you should know about early distributions.

/what-age-can-funds-be-withdrawn-from-401k-abd801d6dbd343309cf738f1fa2c621c.png) At What Age Can I Withdraw Funds From My 401 K Plan

At What Age Can I Withdraw Funds From My 401 K Plan

What to Know About Starting a 401k Plan for Your Small Business.

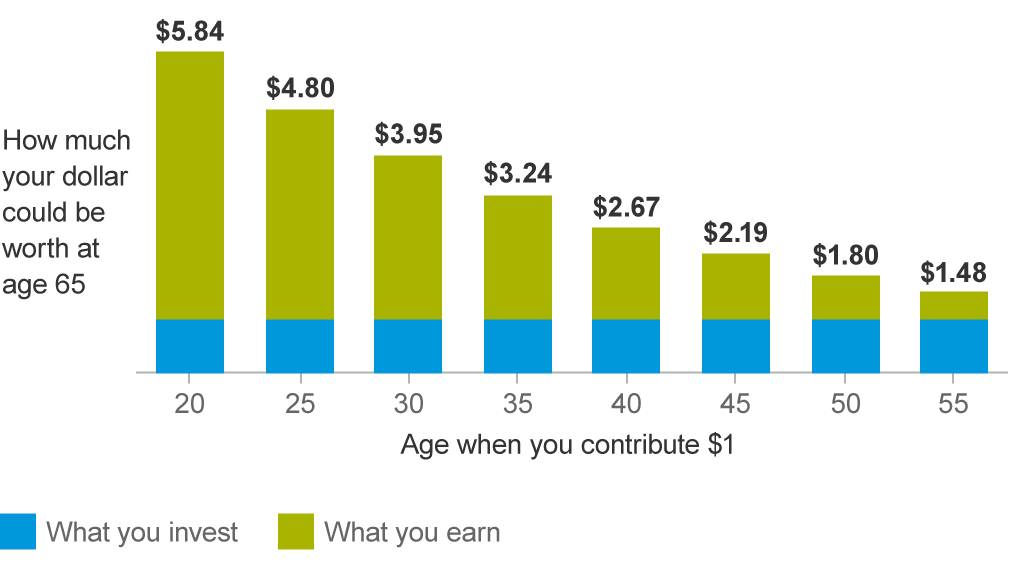

How do i start a 401k. Realize theres variety in your 401 k. The value of your 401k at retirement is a function of how much you contribute the matching provided by your employer and the appreciation of your 401k assets. One of the best things you can do for your kids is get them to start saving money early in life.

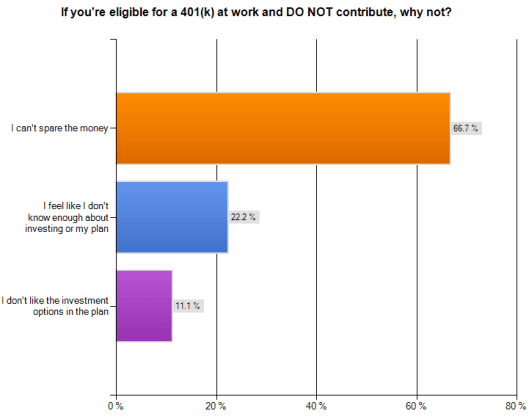

There are thousands of different kinds of mutual funds each one with different goals risks diversification fees etc. You can start withdrawing funds from a 401 k or IRA without penalty after age 595 but you dont have to start taking required minimum distributions RMDs from tax-deferred retirement accounts until age 72 705 if you reached age 705 before Jan. If you start saving in a 401 k early in your career the money will.

Assume you make 50000 a year and decide to contribute 5 of your pay or 2500 a year to your 401 k plan. Not all employers do but their numbers are growing especially among large companies. There are numerous types of 401 ks but in general most employers offer either a traditional 401 k plan or a safe harbor 401 k plan.

When you want to set up a retirement plan for your employees you can either roll out a SEP-IRA SIMPLE-IRA or a traditional 401 k. The route you take will depend on your situation. You set aside a certain amount of money each month from your paycheck and use it to.

Do the following to open your 401k. To put it in really general terms a 401 k is a retirement savings account offered through your employer. Most employers who are looking for top-quality employees offer a 401k as a benefit which helps them to retain talent.

Most 401k plans are made up of something called mutual funds. In a traditional plan you contribute a percentage of income to each employee or match the amount your employees decide to put into their account. To learn how to get this plan started follow the brief guide below.

Im doing what I can with a self-fashioned family 401k where I match my kids summer earnings. If you have less than 100 employees youll be able to choose from a SEP-IRA a SIMPLE. A Roth IRA works differently.

Figure out if youre eligible. Participating in a 401 k account might also qualify you for employer contributions that will help you to build wealth faster. In case youve not familiar them a mutual fund is really nothing more than a collection of investments such as stocks bonds cash and other assets.

An employer self-employed individual or benefits manager who wants to set up a. How do you open a 401k. Announce the introduction of the 401k policy to your staff.

Utilizing a 401k is a great way to jump-start your savings. Companies that are powered by fewer than 100 employees are in the best position to adopt a 401k plan for their business starting now. Getting Started Follow these step-by-step instructions to set up your Self-Employed 401k or call us at 800-544-5373 for guidance throughout the entire process.

If your employer matches your contributions or some percentage of. If you dont have retirement accounts available its time to start your own 401k or similar retirement savings program. Heres how they break down.

Check with your HR department to see if you can sign up right away or if you must wait. Those who take advantage of the current opportunities will not only experience a surge in company morale given the improved. If you get paid twice a month then youll have 10417 taken out of each paycheck before taxes have been applied and put into your 401 k plan.

Make Your 401k Policy Put it in writing. To calculate your 401k at retirement we look at both your existing 401k balance and your anticipated future contributions and then apply a rate of return to estimate how your. Participating in a 401k plan through your employer is usually the easiest way to get started putting money away for the long term.

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png) How To Take Money Out Of A 401 K Plan

How To Take Money Out Of A 401 K Plan

How Much Should Be In Your 401 K At 30

How Much Should Be In Your 401 K At 30

/how-much-should-i-put-in-my-401k-410a513b95894b9db05bb2897cec881e.png) How Much Should I Put Aside For Retirement

How Much Should I Put Aside For Retirement

What S The Difference Between A 401k And Ira And Which Should You Invest In Money Under 30

What S The Difference Between A 401k And Ira And Which Should You Invest In Money Under 30

Your 401 K Benefits Of Starting Early

How To Use A 401 K To Start Or Buy A Business

How To Use A 401 K To Start Or Buy A Business

/how-much-should-i-put-in-my-401k-410a513b95894b9db05bb2897cec881e.png) How Much Should I Put Aside For Retirement

How Much Should I Put Aside For Retirement

Solo 401k My Solo 401k Financial

Solo 401k My Solo 401k Financial

/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png) What Is A 401 K Plan And How Do They Work

What Is A 401 K Plan And How Do They Work

%20Decision%20Chart%20New.png) Ira Basics How To Use An Ira And Start Investing Soonira Basics How To Use An Ira And Start Investing Soon

Ira Basics How To Use An Ira And Start Investing Soonira Basics How To Use An Ira And Start Investing Soon

401 K Or Ira How To Choose Where To Put Your Money Ellevest

401 K Or Ira How To Choose Where To Put Your Money Ellevest

When To Start Saving For Retirement Vanguard

When To Start Saving For Retirement Vanguard

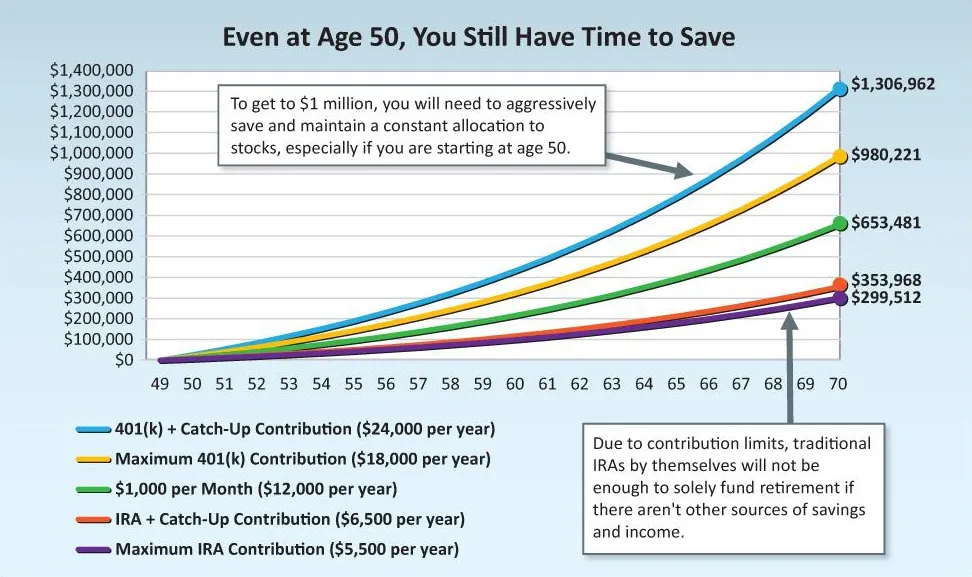

Retirement You Can Save 1 Million Even Starting At Age 50 Money

Retirement You Can Save 1 Million Even Starting At Age 50 Money

Open A Solo 401k Account My Solo 401k Financial

Open A Solo 401k Account My Solo 401k Financial

Comments

Post a Comment