Featured

- Get link

- X

- Other Apps

Understanding Dividend Yield

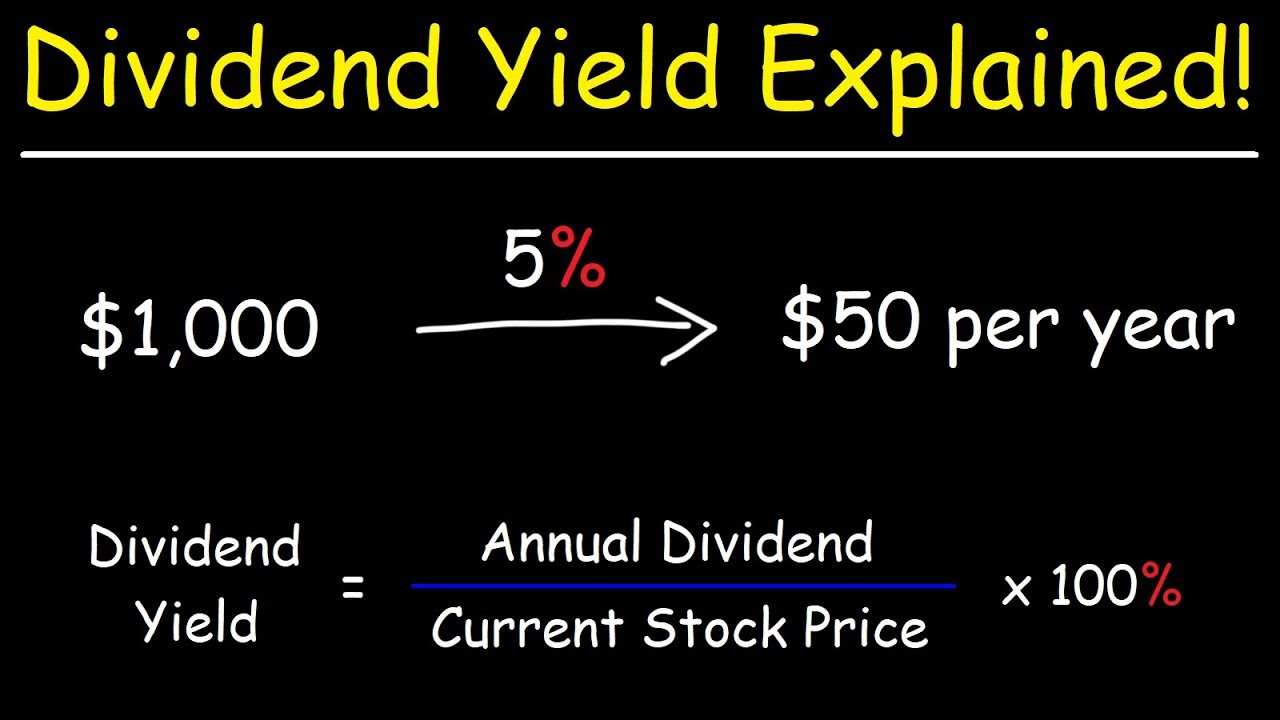

Dividend yield is the dividend relative to the price of the in. Before we get into the nuances of understanding dividend yield lets first define what dividend yield is.

Dividend Yield The 10 Things You Need To Know Dividendinvestor Com

Dividend Yield The 10 Things You Need To Know Dividendinvestor Com

That equates to a dividend yield of 015 at current price levels.

/dotdash_final_How_the_Dividend_Yield_and_Dividend_Payout_Ratio_Differ_Dec_2020-01-f835700d354f452c9ef1c94750ee4962.jpg)

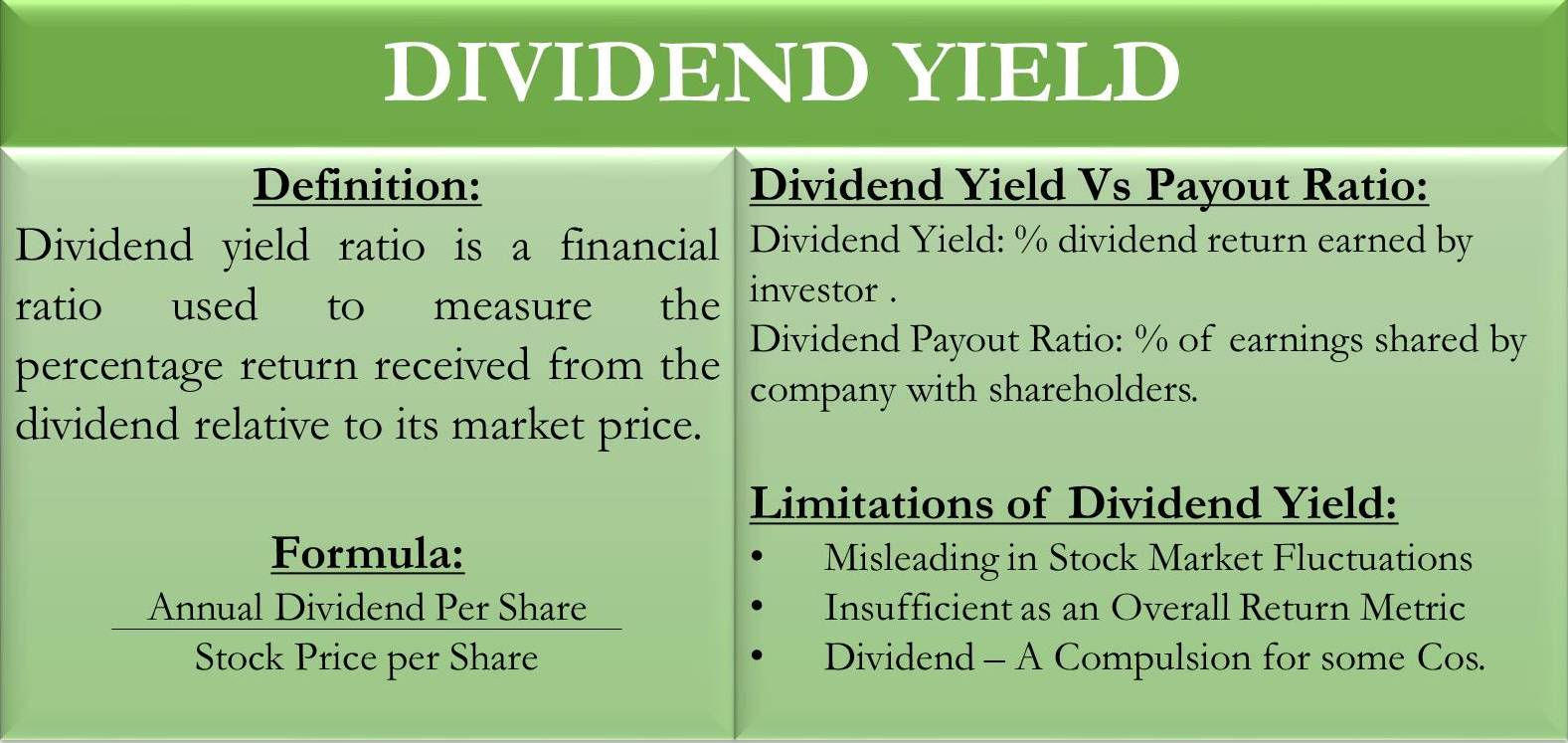

Understanding dividend yield. The dividend yield expressed as a percentage is a financial ratio dividendprice that shows how much a company pays out in dividends each year relative to its stock price. Understanding Dividend Yield. Dividend yield ratio is the ratio between the current dividend of the company and the companys current share price this represents the risk inherently involved in investing in the company.

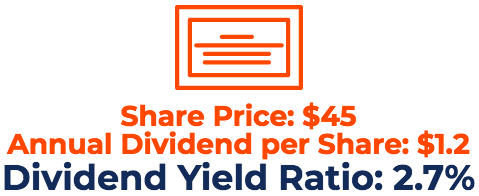

For example a stock trading at 100 per share and paying a. Dividend yield is a method used to measure the amount of cash flow youre getting back for each dollar you invest in an equity position. A dividend is the total income an investor receives from a stock or another dividend-yielding asset during the fiscal year.

What Is Dividend Yield. For example if a companys dividend. The dividend yield is the amount of the annual dividend payment divided by the stock price expressed as a percentage.

Using data from 2002 to 2011 results from a cross sectional multiple regression analysis found a significant negative relationship between dividend yield and share price volatility in Malaysia. The dividend is also. Understanding dividend yield correctly can lead you to make better investments overall.

Yield is the annual percentage return in dividends on your investment. Buying stocks with a high dividend yield can provide a good source of income but if you arent careful it can also get you in trouble. It determines whether you can expect this investment to beat inflation.

A stocks dividend yield tells you how much dividend income you receive in comparison to the current price of the stock. Is a ratio that is calculated by dividing the total annual dividend by the current market price of the stock. It indicates the minimum rate of return you can expect to earn on your shares.

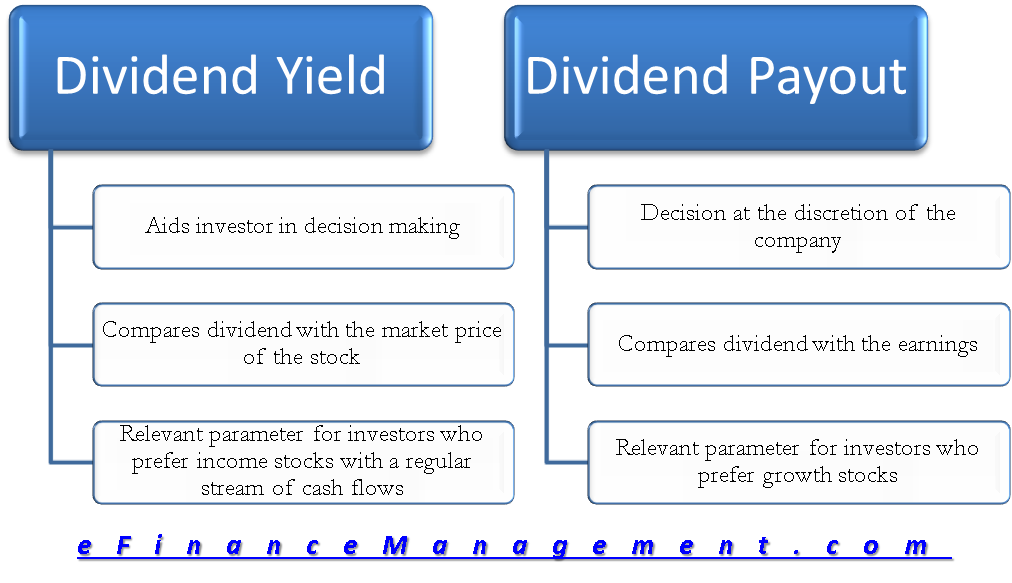

Understanding the definition of the dividend yield is fairly simple understanding what the yield means to the investor is another issue. You calculate the ratio by dividing dividends paid over the past 12 months by a companys current share price and express it as a percentage. A popular yield based measure used to value stocks is the dividend yield.

It allows investors to compare the latest dividend they received with the current market value of the share as an indicator of the return they are earning on their shares. Stocks dividend yield measures the cash flow youre receiving for every dollar invested in an equity position. The dividend yield is equal.

Understanding Ex-Dividend Dates An ex-dividend date signals when a companys shares cease to trade with its current dividend payout. The dividend yield is one of the most important ratios to understand when investing in stocks for income. Yield is a huge consideration for two reasons.

To calculate dividend yield one must know the total of the annual dividend payments made per share. This video provides a basic introduction into the dividend yield. In other words its a measurement of how much bang for your buck youre getting from dividends.

This video will teach you what dividend yield is how to calculate it and why its important. The Dividend Yield - Basic Overview - YouTube. Image via Pixabay by stevepb.

Dividend yield is the percentage a company pays out annually in dividends per dollar you invest. The yield measures how much income investors receive for each dollar invested in the stock. The dividend yield ratio indicates how much a firm is paying out in dividends each year in relation to its market share price.

The reciprocal of the. Some investors use dividend yield the value of a dividend relative to the share price to compare returns on investment. It explains what its used for and how to calculate it.

Essentially dividend stock yield is how much of a return youre getting on for an investment stock without any capital gains. The dividend yield is essentially the return on investment for a stock without any capital gains.

Dividend Yield Efinancemanagement Com

Dividend Yield Efinancemanagement Com

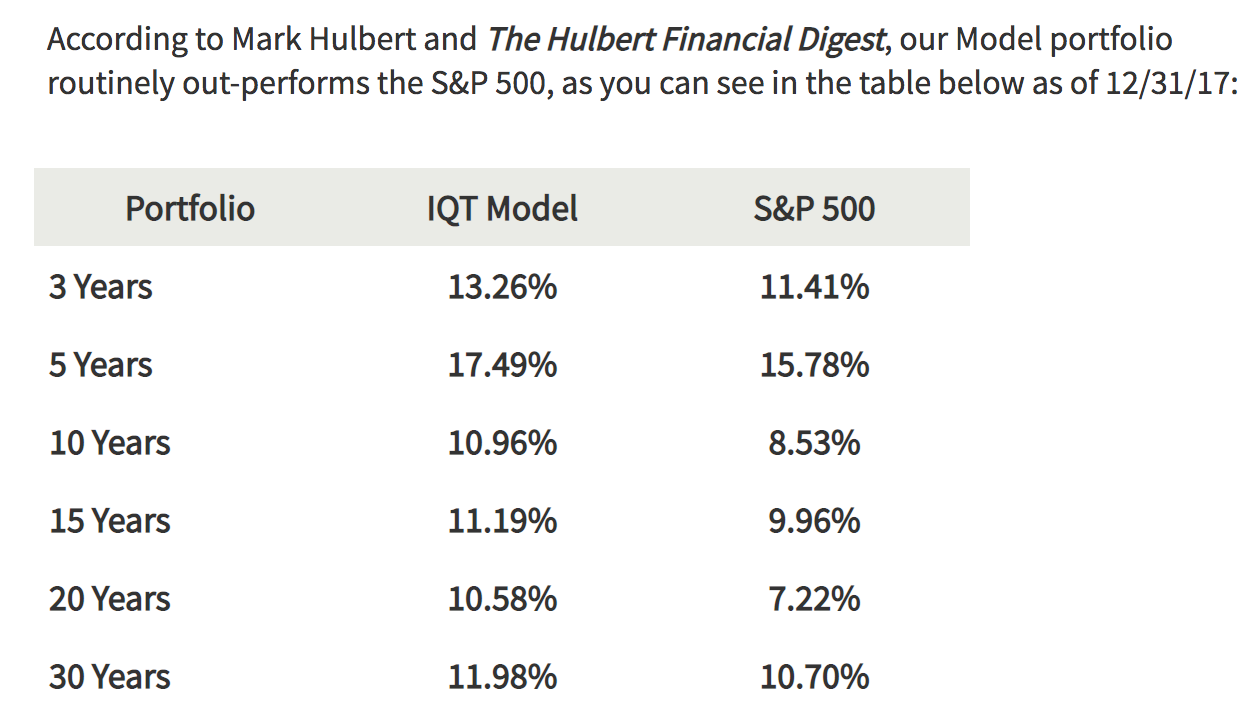

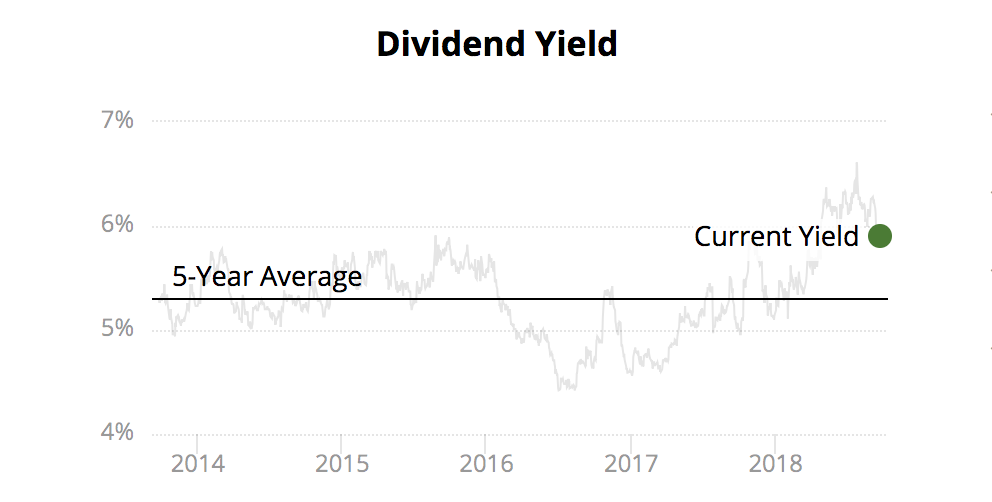

Dividend Yield Theory Explained Intelligent Income By Simply Safe Dividends

Dividend Yield Theory Explained Intelligent Income By Simply Safe Dividends

Dividend Yield Theory Explained Intelligent Income By Simply Safe Dividends

Dividend Yield Theory Explained Intelligent Income By Simply Safe Dividends

Dividend Yield Formula Overview Guide And Examples

Dividend Yield Formula Overview Guide And Examples

/dotdash_Final_Forward_Dividend_Yield_2020-01-167ed1a41c1c48599fa394f4f4faf342.jpg) Forward Dividend Yield Definition

Forward Dividend Yield Definition

The Dividend Yield Basic Overview Youtube

The Dividend Yield Basic Overview Youtube

Dividend Yield Vs Payout Difference Investor Return Vs Profit Share

Dividend Yield Vs Payout Difference Investor Return Vs Profit Share

/dotdash_final_How_the_Dividend_Yield_and_Dividend_Payout_Ratio_Differ_Dec_2020-01-f835700d354f452c9ef1c94750ee4962.jpg) How The Dividend Yield And Dividend Payout Ratio Differ

How The Dividend Yield And Dividend Payout Ratio Differ

/dividendyield-5c67fc5946e0fb00011a0c31.jpg)

Comments

Post a Comment