Featured

How Much Should You Spend On A Car Payment

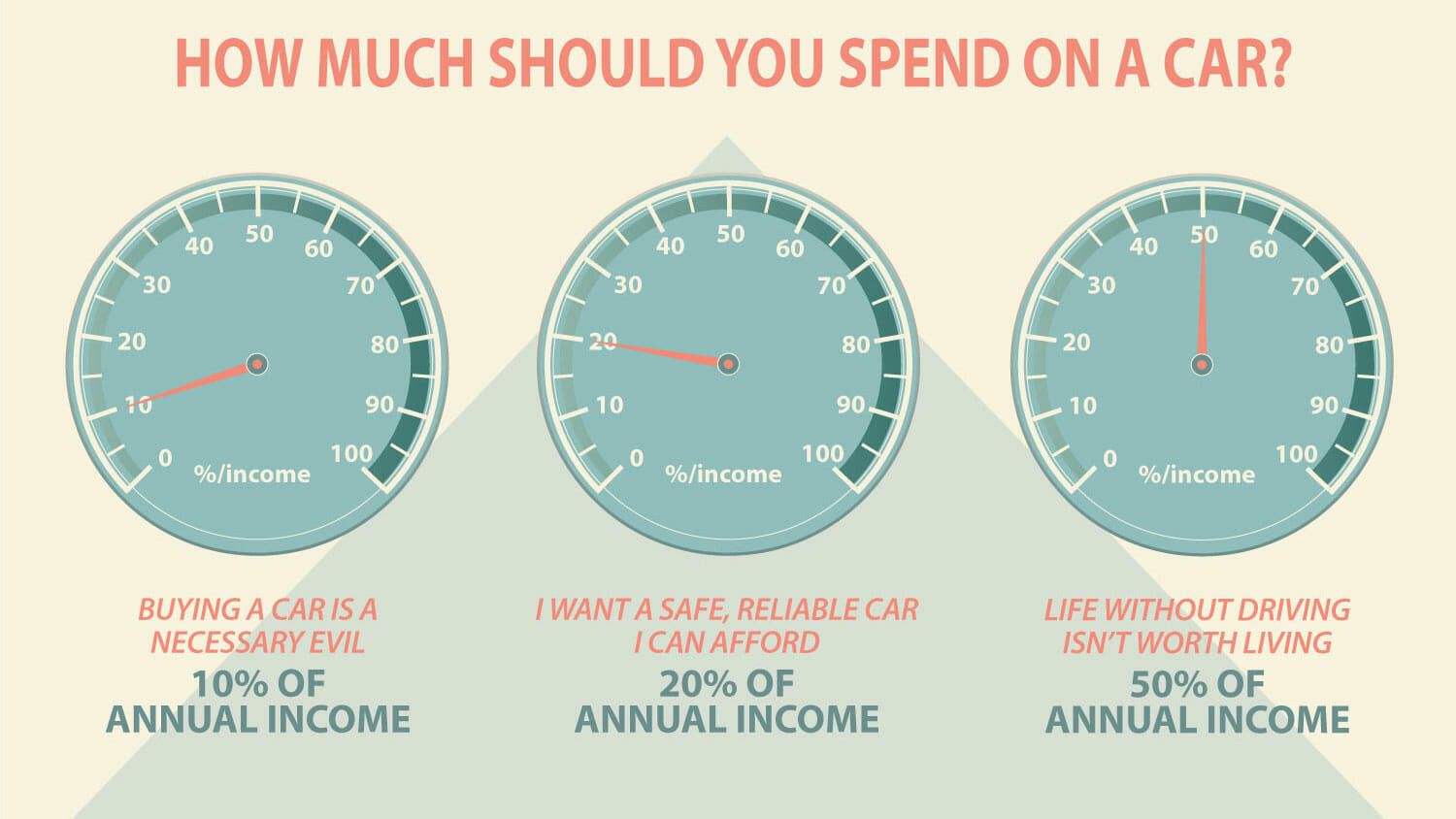

Spend no more than 35 of your pre-tax annual income on a car. If youre not sure where to start weve gathered three different spending rules that can help steer the way as to how much you should spend on your next auto loan.

How Much Should You Spend On A Car Livefrugalee

How Much Should You Spend On A Car Livefrugalee

A third of that is 1155.

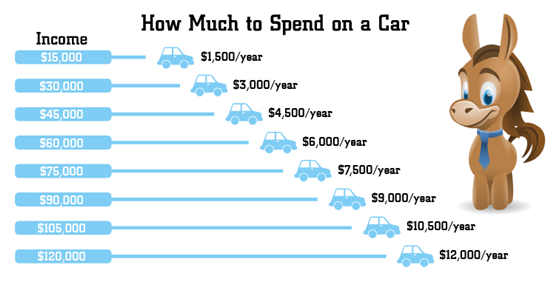

How much should you spend on a car payment. Thats a big range we know so if we had to set a rule it would be this. If you make 3500 spend 700 on a car. Using the average UK salary of 26000 per year this gives you about 6500 to spend on a new car.

For example lets say you take home 3500 per month. Car buyers should spend no more than 10 of their take-home pay on a car loan payment and no more than 20. Why you may regret not following the 110th.

The above methods for determining how much you should spend on a car give us results ranging from 348 to 535 with the same gross salary. Before figuring out just what percentage of your budget can go toward a car payment run the numbers carefully so you know just how much you spend on all essentials. Calculate How Much Down Payment You Can Afford.

For a less expensive vehiclefor example a 10000 oneyou should still have at. And some really frugal ones dont own a car at all. If you have a 700 student loan repayment every month.

That means if your take-home pay is 3000 a month plan to spend no more than 300 on your car payment. Personal finance is personal but everyone wants a rule to follow. Rule of thumb.

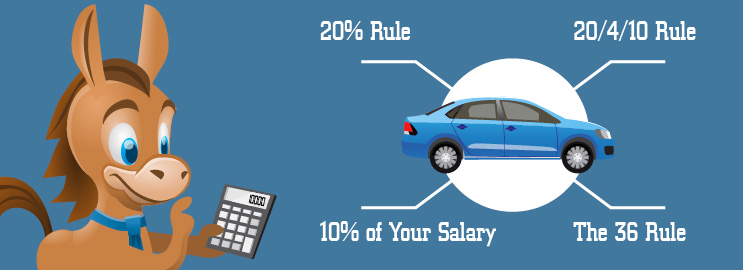

Financial experts answer this question by using a simple rule of thumb. Because the amount you put down will change how much you need to borrow knowing what you can afford to put toward a down payment in advance will help you gauge how much your future car payment. 20 is the recommended down payment amount but some buyers choose to pay as little as 10.

This includes insurance gas repairs and maintenance parking and even tolls. But its a BAD idea. The remainder is how much you can spend on a car payment.

Next do some research to figure out the interest rate youre likely to qualify for. 36 rule The 36 rule states that you shouldnt spend more than 36 of your income on all of your loan payments. So when pressed I would say spend up to 35 of.

So really how much should you spend on a car. You can spend between 10 and 50 of your gross annual income on a car. According to Experian the average monthly car payment is 506 and the average loan period is 68 months.

Lower is better but we recognize personal finance is personal. Spend no more than 20 of your take home pay on a car. As a general rule you should be prepared to pay at least 20 of the vehicles sticker price upfront.

Thats a pretty big difference in. Probably not as much as you might think. Many financial experts recommend keeping total car costs below 15 to 20.

If you make the median household income of about 62000 a year dont spend more than 6200 on a car. A down payment is money you pay toward the vehicle sale price before taking an auto loan. So when you purchase a 15000 car and put 1500 down for example youll need to finance 13500.

Then some frugal personal-finance gurus say you should spend no more than 10-15 of your annual income on a vehicle purchase. How much should you spend on a car. If you dont have the cash for a 20 down payment its wise to wait until youve saved up.

Around this budget youll be able to afford some small city cars such as the Suzuki Alto or the Kia Picanto both of which are available for under 8000. If you take home 2500 spend 500 on a car. Didnt Read While the percent of income you should allocate for your car varies based on several factors the normal range falls between 10 and 15 percent.

For a 30000 vehicle this means you should have at least 6000 saved and ready to spend.

How Much Should You Spend On That Life And My Finances

How Much Should You Spend On That Life And My Finances

Https Www Capitecbank Co Za Bank Better Live Better Articles Buying A Car A Car To Match Your Salary

How Much Should You Spend On A Car

How Much Should You Spend On A Car

How Much Should You Really Spend On A Car

How Much Should You Really Spend On A Car

How Much Should You Spend On A Car Interest Com

How Much Should You Spend On A Car Interest Com

How Much Should You Really Spend On A Car

How Much Should You Really Spend On A Car

How Much Should You Really Spend On A Car

How Much Should You Really Spend On A Car

How Much Should You Spend On A Car Capitalante

How Much Should You Really Spend On A Car

How Much Should You Really Spend On A Car

How Much Should You Spend On Housing Car Groceries And Gifts Pete The Planner

How Much Should You Spend On Housing Car Groceries And Gifts Pete The Planner

How Much Should You Spend On A Car

How Much Should You Spend On A Car

How Much Should You Spend On A Car Young Income

How Much Should You Spend On A Car Young Income

How Much Should Someone Spend On A Car Say As A Of Annual Salary Quora

How Much Should You Spend On Monthly Home Costs Calculate It With This Download Calculators Ideas Of Calcul Buying First Home Home Buying Home Buying Tips

How Much Should You Spend On Monthly Home Costs Calculate It With This Download Calculators Ideas Of Calcul Buying First Home Home Buying Home Buying Tips

Comments

Post a Comment