Featured

Does The President Pay Taxes

The figures below drawn from the New York Timess own analysis of Trumps tax-return data for 2017 show that Trump paid 7435857 in taxes in 2017. But getting no help from the IRS the president was forced to improvise.

How Much Do Us Presidents Pay In Taxes The Fiscal Times

How Much Do Us Presidents Pay In Taxes The Fiscal Times

Yes even current Presidents pay taxes.

Does the president pay taxes. Code also grants a 100000 non-taxable travel account. Congress added the expense account in 1949. The president of the United States is the highest political office title one can have in America.

His returns which include his official salary can be found on the Presidential Tax Returns website. Roosevelt however paid income taxes throughout his presidency. Under the Former Presidents Act each former president is paid a lifetime taxable pension that is equal to the annual rate of basic pay for the head of an executive federal department201700 in 2015the same annual salary paid to secretaries of the Cabinet agencies.

US law requires the president of the United States to be paid a salary while in office. While in office the US. A trip aboard Air Force One to meet with the English prime minister for instance would be government funded as would a state dinner.

Last week President Donald Trump issued a memorandum that would defer the payment of payroll taxes for most military members effective Sept. Presidents have to buy their own groceries. President receives a salary of 400000 a year and a 50000 expense account.

The Founding Fathers did not want the US to be a place where you got breaks just because who you are. Here we take a look at seven of them. According to Title 3 of the US code a president earns a 400000 salary and is.

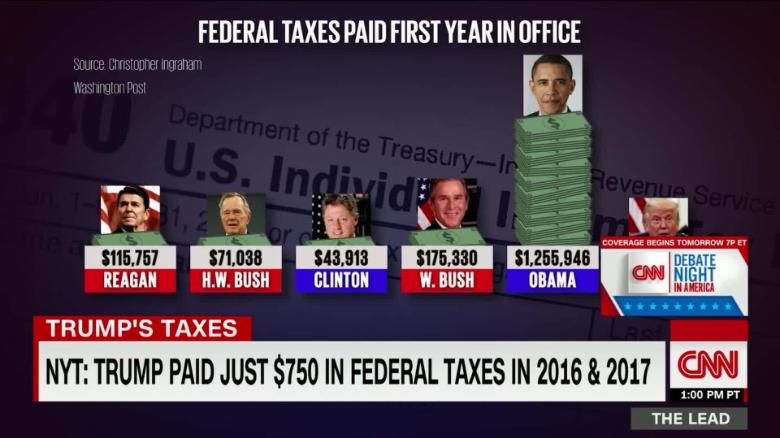

1 2020 through Dec. Additionally the salaries of personnel responsible for supporting and protecting the president or for maintaining the operations of. The New York Times claim that President Donald Trump paid just 750 in federal income taxes in 2016 and 2017 is wrong based on a flawed understanding of how taxes are paid.

When a President is no longer President they are just an average citizen like you. So can those of. Carter in other words had searched long and hard for some way to pay taxes in 1977.

Although the president is permitted a 100000 stipend to redecorate parts of the White House anything beyond that is something they have to pay for themselves. Yes the president does have to pay taxes. On Sunday the New York Times reported President Trump paid 750 in federal income tax his first year in office the lowest first-year tax payment of any president since at least Carter and in raw.

Yes he would pay more taxes unless the increased tax level was offset by having more deductions to offset the. Presidents are governed by the same laws and regulations to which all taxpayers are subject Sometimes presidents overpay and get refunds or. President Donald Trump paid just 750 in income taxes during his first year in office an exclusive report from The New York Times found a stark difference compared to what his recent.

Believing as I do that people in my. 1 Title 3 of the US. As a rule of thumb taxpayers are directly responsible for any presidential expense occurred in the course of official government business.

They do however have a taxpayer-provided chef which is a benefit of living in the White House. Yes the President pays taxes on his earned income just like any other citizen does. This pays for the presidents personal expenses such as food and dry cleaning.

But how much does the president makeYou may be surprised by the number. The presidents tax returns show he paid just 750 in federal income taxes each year in 2016 and 2017 and paid nothing at all for many years before. The president has to look presentable when in the public.

The billionaire president paid just 750 in federal income taxes in 2016 the year he won the presidency and 750 in 2017 the Times found in examining the presidents tax documents. While Barack Obama once paid 18 million in federal income taxes Donald Trump paid only 750 twice. However there are several surprising things that the president has to pay for out of pocket as Readers Digest noted in a recent report.

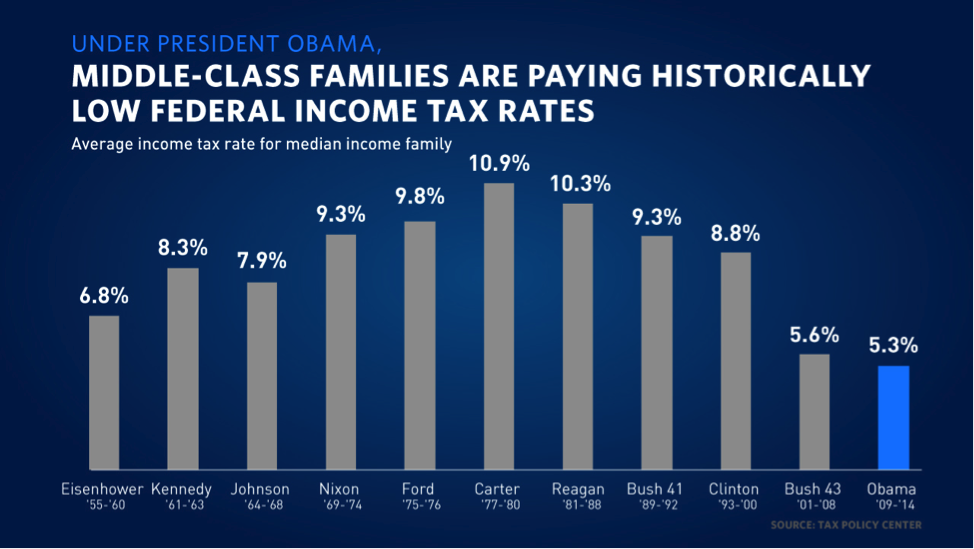

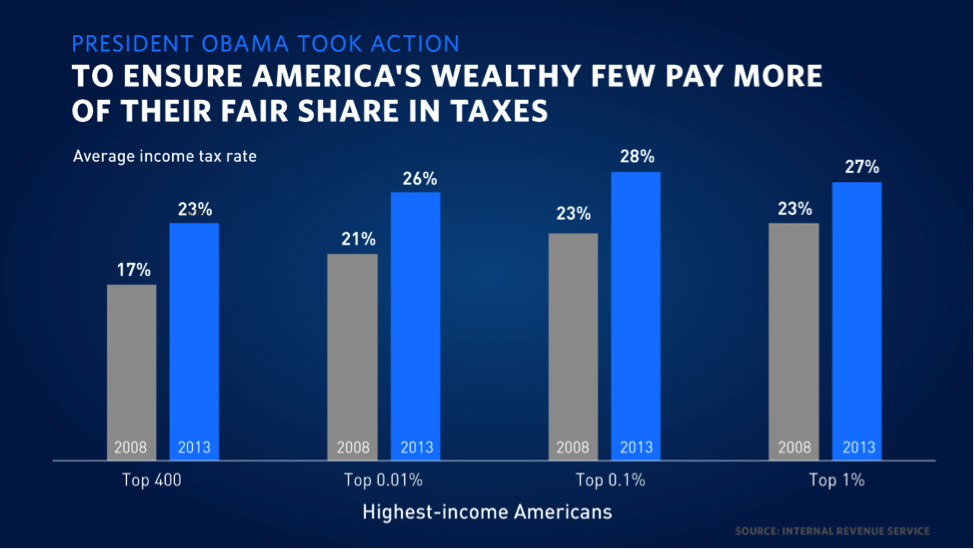

How Obama S Tax Hikes Would Hit The Rich And Middle Class

How Obama S Tax Hikes Would Hit The Rich And Middle Class

Do Presidents Pay Taxes The Official Blog Of Taxslayer

Do Presidents Pay Taxes The Official Blog Of Taxslayer

How Can President Trump Pay Less Tax Than You Npr

How Can President Trump Pay Less Tax Than You Npr

Kings Or Presidents Who Pay More Tax No More Tax

Kings Or Presidents Who Pay More Tax No More Tax

Trump S Taxes What You Need To Know Bbc News

Trump S Taxes What You Need To Know Bbc News

Chart How Trump S Taxes Compare To Other Presidents Statista

Opinion Trump Doesn T Pay Taxes That S Old News The Real Story Is The President S Personal Debts Coming Due Marketwatch

Opinion Trump Doesn T Pay Taxes That S Old News The Real Story Is The President S Personal Debts Coming Due Marketwatch

How Does Us Tax Law Allow Billionaires Not To Pay Read This And Try To Understand Cnnpolitics

How Does Us Tax Law Allow Billionaires Not To Pay Read This And Try To Understand Cnnpolitics

How Donald Trump S Taxes Compare To Those Of Other U S Presidents The Washington Post

How Donald Trump S Taxes Compare To Those Of Other U S Presidents The Washington Post

Trump S Taxes Show Chronic Losses And Years Of Income Tax Avoidance The New York Times

Trump S Taxes Show Chronic Losses And Years Of Income Tax Avoidance The New York Times

/presidents-salary-593414238d464e39b2a3157f24e40e6a.png)

/presidents-salary-593414238d464e39b2a3157f24e40e6a.png)

Comments

Post a Comment